Mexico and the United States have agreed to cooperate on foreign investment screening as a measure to better protect the national security of both countries.

The plan, set out in a Memorandum of Intent (MOI) signed in Mexico City on Thursday, appears to be motivated to a large degree by a desire to stop problematic Chinese investment in Mexico, although United States Secretary of the Treasury Janet Yellen said that her investment screening talks with Mexican Finance Minister Rogelio Ramírez de la O were “not just China-focused.”

Yellen and Ramírez signed the MOI “to affirm the importance of foreign investment screening in protecting national security and express their desire to establish a bilateral working group for regular exchanges of information about how investment screening can best protect national security,” the U.S. Department of the Treasury said in a statement.

“The MOI recognizes the importance of the U.S.-Mexico economic relationship, the benefits of maintaining an open investment climate, and the critical role of effective investment review mechanisms in addressing national security risks that can arise from certain foreign investment, particularly in certain technologies, critical infrastructure, and sensitive data.”

Yellen told a press conference that cooperation with Mexico will allow a revision of potential foreign investment to take place that is similar to that carried out by the Committee on Foreign Investment in the United States (CFIUS), which includes officials from 16 U.S. departments and agencies.

“Like our own investment screening regime, CFIUS, increased engagement with Mexico will help maintain an open investment climate while monitoring and addressing security risks, making both our countries safer,” she said.

Reuters reported that “CFIUS’ increased scrutiny in recent years has sharply reduced Chinese investment in the United States.”

But Yellen, after noting that her investment screening talks with Mexico were “not just China-focused,” said that the United States didn’t have a problem with the East Asian nation investing in Mexico to supply the U.S. as long as its investments were able to pass national security screenings and complied with new U.S. rules on electric vehicle batteries.

“If Chinese involvement triggered those rules, which are meant to avoid undue dependence on China, then that’s a no,” she said.

Asked whether Mexico was concerned that increased foreign investment screening cooperation with the United States would hurt its burgeoning relationship with China, Ramírez said that the country’s trade relationship with the U.S. was “overwhelmingly dominant” and given higher priority than those with other countries.

China didn’t appear among the top 10 foreign investors in Mexico in the first nine months of 2023, but it ranks second behind the U.S. for the combined value of investment announcements made between January and November. The more than US $12 billion in investments announced by China this year is expected to flow into Mexico in the next two to three years.

Cross-border payment systems

Yellen said Thursday that U.S. and Mexican officials had met earlier in the day “to discuss cross-border payments, including the possibility of more deeply integrating our payments systems.”

“I see real potential here and welcome further exploration of the possibility of interlinkage and other ways to improve connectivity between the U.S. and Mexican payment systems,” she said.

The secretary said that possible deeper integration of U.S. and Mexican payment systems (such as the Bank of Mexico’s SPEI system) was “not about China.”

Ramírez said that the cost of sending money between the two countries could be reduced. Mexicans living and working in the United States send tens of billions of dollars annually to Mexico in remittances.

The finance minister also said that Mexico and the United States agreed to “strengthen the exchange of confidential information and intelligence about the two financial systems, with the aim of strengthening the fight against drug trafficking, … corruption and money laundering.”

Greater economic integration

Yellen said that the U.S. and Mexican economies are already “deeply intertwined,” but asserted that greater integration is possible.

“Yesterday, I met with Mexican private sector leaders to hear firsthand about the opportunities they see for greater integration,” she said.

“… The United States continues to pursue what I’ve called friendshoring: seeking to strengthen our economic resilience through diversifying our supply chains across a wide range of trusted allies and partners. Mexico has a natural advantage, given its proximity and the frequent interaction between American and Mexican businesses that create jobs on both sides of our shared border,” Yellen said.

She also said that “greater coordination on financial and regulatory policy can further increase trade and investment and the benefits they bring.”

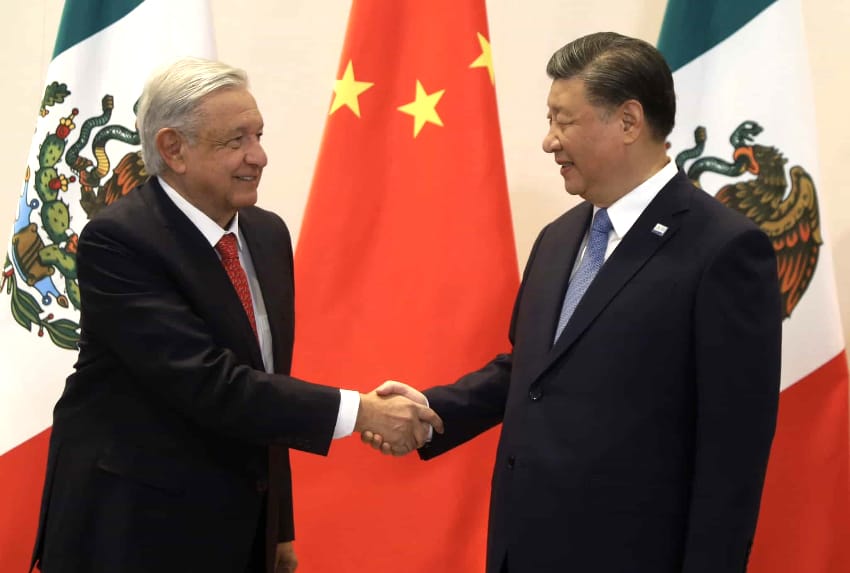

Yellen, who spent three days in Mexico this week and announced U.S. sanctions against 15 alleged Mexican cartel members while in the country, also met with President López Obrador on Thursday.

A brief statement issued by the Department of the Treasury after that meeting said that they discussed “key aspects of the U.S.-Mexico economic relationship, including how both countries can take advantage of stronger economic integration.”

López Obrador said on social media that his meeting with Yellen was “very productive and pleasant.”

In the same post, he said that “the policy of good neighborliness between the people and governments of Mexico and the United States is a reality,” adding that the bilateral relationship covers “all aspects, from friendship to cooperation in economic and financial affairs.”

With reports from Reuters and El Economista