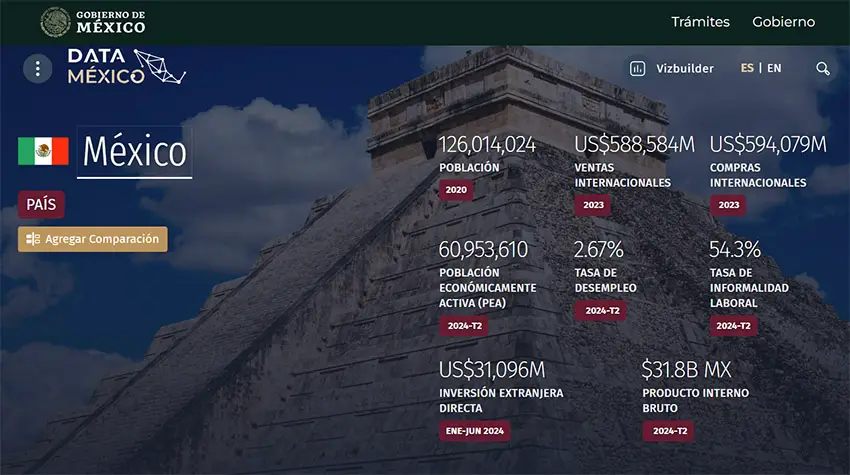

Mexico’s Economy Ministry (SE) this week launched a new section in its DataMéxico platform designed to highlight private investment trends, allowing private sector interests to consult disaggregated lists of public investment announcements.

Users of the platform can find data arranged in a variety of categories, including country of origin of the companies announcing investments, the Mexican state in which the investment is to be made and the economic sector within which the investment is being made.

The data is also broken down by date so that potential investors can conduct detailed analysis of the timing and context of the proposed investments. The new section can be found at economia.gob.mx/datamexico/.

In a social media post, the SE said the new Public Announcements of Foreign Investment section “aims to recognize the private sector’s interest in investing” in Mexico, citing the nearshoring phenomenon and the growing need for companies to increase efficiency in their production chains.

In an attached press bulletin, the SE said it remains committed to providing educational tools that the public can rely on, supplying timely information in a transparent manner as the government strives to consolidate international best practices in Mexico.

On the same day they unveiled the new tool, the SE announced that since January 2023 the private sector has issued 575 investment announcements featuring a sum total of US $170.6 billion.

During the first seven months of this year, the SE reported US $48.3 billion in announced investments from foreign and domestic companies.

According to the newspaper La Jornada, Economy Minister Rachel Buenrostro said these announcements reflect investor confidence in Mexico’s economy and its capacity to augment industry at both the local and global levels.

Mexico’s manufacturing sector has attracted the most planned investment (US $86.3 billion), followed by the energy sector (US $24.9 billion) and the transportation sector (US $22.5 billion). These three sectors comprise 78% of the total prospective investments since January 2023.

The data show that U.S. companies lead the way in investing in Mexico, with proposed investments exceeding US $68.5 billion.

In addition, investment announcements from companies in China (US $16.8 billion), Germany (US $12.2 billion), Argentina (US $10.7 billion), Denmark (US $10.2 billion) and France (US $8 billion) represent for Mexico a desirable diversification in the origin of these investments.

Of equal importance is the distribution of the target location of these investments. Although the industrialized northern and central regions of Mexico are the primary destinations for these funds, companies in the west and south are expecting to receive new investments to the tune of US $39 billion.

While projecting that these proposed investments could generate more than 331,000 new jobs, the SE said the above illustrates the confidence in the economic development of previously overlooked regions of Mexico and the talent of its workforce.

These figures bode well for the country’s future as Claudia Sheinbaum prepares to take office on Oct. 1 as Mexico’s next president. Vidal Llerenas, tapped to be Sheinbaum’s deputy economy minister for industry and commerce, said last week that foreign direct investment could increase by US $3-4 billion each year during Sheinbaum’s six-year term.

With reports from La Jornada and El Economista