Mexico could get a reprieve from the United States’ 50% tariffs on steel imports, but only on exports up to a certain limit, according to the Bloomberg news agency.

The United States imposed 25% tariffs on all steel and aluminum imports in March, and doubled the rate to 50% this month.

Bloomberg reported on Tuesday that trade negotiations between the United States and Mexico are “homing in on a possible quota system to reduce tariffs on a certain volume of steel imports.”

Citing unnamed “people familiar with the talks,” the news agency said that “the developing framework” would “alleviate crushing duties for some of the Mexican steel imports that U.S. automakers and other industries have described as essential.”

Citing two sources, Bloomberg said that a “tariff-free steel quota” could be established based on Mexico’s export volumes between 2015 and 2017.

“That would predate a surge in imports as well as a slowdown tied to the pandemic,” the news agency said.

A quota based on 2015-2017 volumes would equate to about 2.79 million metric tonnes of steel per year, according to data from the United States Department of Commerce.

Citing its sources, Bloomberg said that steel imports from Mexico “under any threshold specified under the deal would avoid the 50% tariff but are still expected to be hit with a 10% baseline charge.”

“… Amounts above it would be subjected to the full [50%] duty, said people familiar with the matter.”

A “tariff-free” or “tariff-reduced” quota of 2.79 million tonnes of steel per year would represent about 88% of Mexico’s steel exports to the United States last year, which totaled 3.19 million metric tonnes.

“Setting the threshold below current demand would ensure a domestic market for American steel while providing some relief to U.S. consumers of the metal,” Bloomberg said.

“At the same time, it would allow the [Trump] administration to provide some reprieve to a U.S. partner,” the news agency said.

“… Tariff-rate quotas have a long history in the U.S., having been imposed to regulate trade in everything from sugar to solar cells,” it noted.

Bloomberg did not report on any negotiations between the United States and Mexico related to the 50% tariff on aluminum.

Despite tariffs, Mexico maintains significant trade surplus with the US

Mexico is the third-largest exporter of steel to the United States, but it imports more of that metal, and aluminum, from the U.S. than it sends to its northern neighbor.

The Mexican government has repeatedly emphasized that Mexico has a deficit with the United States on the trade of the metals, and has thus argued that tariffs on Mexican steel and aluminum are unwarranted.

“It doesn’t make sense to put a tariff on a product you have a surplus in,” Economy Minister Marcelo Ebrard said earlier this month.

Ebrard has traveled to Washington, D.C. on several occasions to hold trade talks with U.S. officials, including Commerce Secretary Howard Lutnick. He is aiming to negotiate exemptions, or at least reductions, of U.S. tariffs on steel, aluminum and vehicles made in Mexico.

On June 4 — the date the 50% tariff on steel and aluminum exports to the U.S. took effect — President Claudia Sheinbaum said:

“In the case of Mexico, firstly, it’s unjust … because as we have said several times, Mexico imports more [from the United States] than it exports in steel and aluminum. Formally, a tariff is imposed when there is a deficit. … Secondly, from our perspective, it has no legal basis because there is a trade agreement.”

The trade agreement she was referring to is the USMCA, which is supposed to guarantee tariff-free trade for most of the goods Mexico, the United States and Canada import from each other.

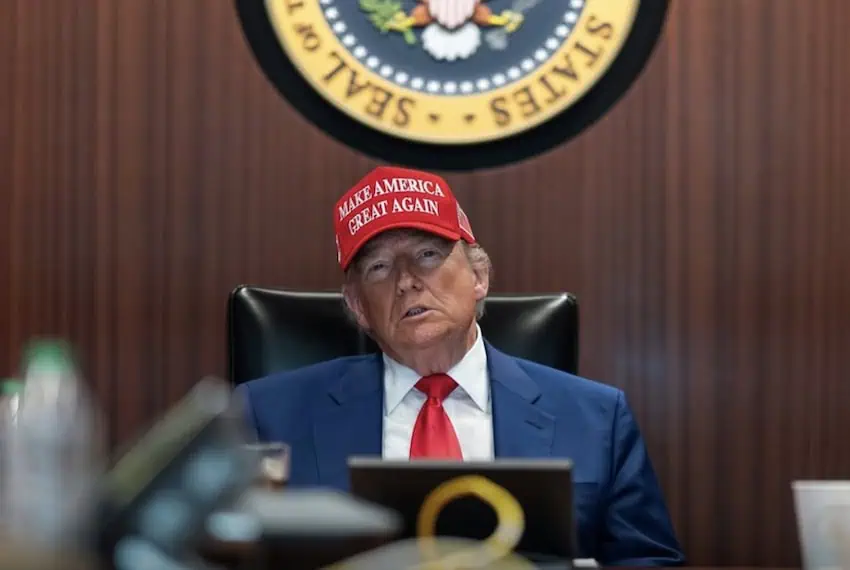

Sheinbaum said last Wednesday that in a telephone call with U.S. President Donald Trump she proposed a separate “general agreement” between Mexico and the United States covering security, migration and trade.

“I suggested this general agreement and he agreed,” she said.

Sheinbaum said last Thursday that the Mexican government’s “objective” was for the agreement to be signed “very soon.”

With reports from Bloomberg