Three technology companies will establish electronic semiconductor chip manufacturing plants in Jalisco and Baja California to meet worldwide demand, according to the head of the National Auto Parts Industry (INA) business chamber, Alberto Bustamante.

While Bustamante didn’t specify a location in Jalisco, he mentioned Mexicali as the location for a Baja California plant on Tuesday.

During the announcement of the International Technology and Manufacturing Fair (FITMA), which will take place in June at the Citibanamex Center in Mexico City, Bustamante said that at least 200,000 units have been affected in Mexico by the semiconductor shortage.

“This doesn’t mean that the manufacturing of such cars came to a halt,” he said, “but that these units are finished and have not yet left the yards of automakers because they are waiting for the semiconductors.”

Since 2020, the disruption caused by COVID-19 lockdowns created a scenario where demand outstripped supply, causing automakers to fall behind in production.

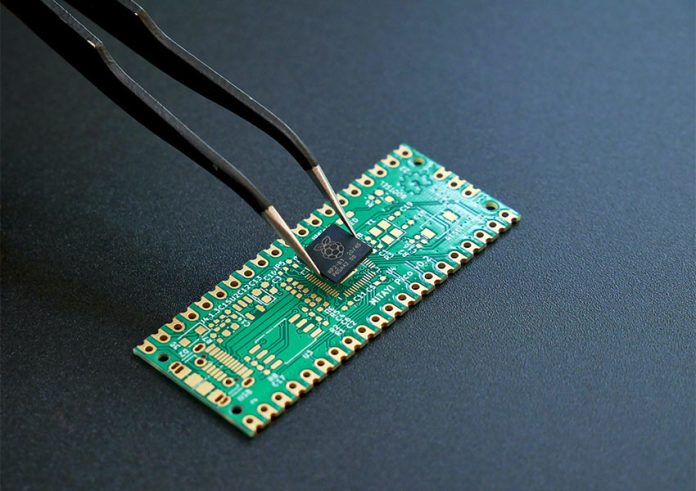

Semiconductors, commonly called chips, are a central component in the manufacturing of consumer electronics such as smartphones, cameras, computers and cars. They are especially important for electric vehicles, which require more chips than gasoline-powered cars.

At the peak of the chip shortage in 2021, global auto production plummeted 26% during the first nine months of the year. Automakers built 3.23 million fewer vehicles than expected in North America in 2021.

Supply chain issues began to resolve in 2022, and J.P. Morgan has predicted a continued steady recovery in 2023.

“We’re nearing the end of the supply crunch after more semiconductor capacity came online in 2022. Looking ahead, we don’t predict any major constraints,” said Sandeep Deshpande, head of European Technology Research at J.P. Morgan.

As part of its promotion of strategic sectors in North America, Bustamante said, the U.S. government is pushing the installation of two semiconductor plants in that country to be ready by the end of this year, or the beginning of 2024.

Once these two plants open, chip shortages will no longer be an issue for the Mexican automotive industry, Bustamante stressed. The INA chief anticipates that semiconductor production would normalize “within the first six months of next year.”

“We are getting closer. As you would say: we already see the light at the end of the tunnel.”

With reports from JP Morgan, Business Insider, Forbes En Línea and Aristegui Noticias