Mexico is on track to record its best year ever for exports after the value of shipments sent abroad in October increased 5.6% compared to the same month of 2022.

Mexican exports were worth US $51.97 billion in October, the national statistics agency INEGI reported Monday, lifting the cumulative total for 2023 to $493.51 billion.

The figure for the first 10 months of the year is a record high and an improvement of 3% compared to the same period of 2022.

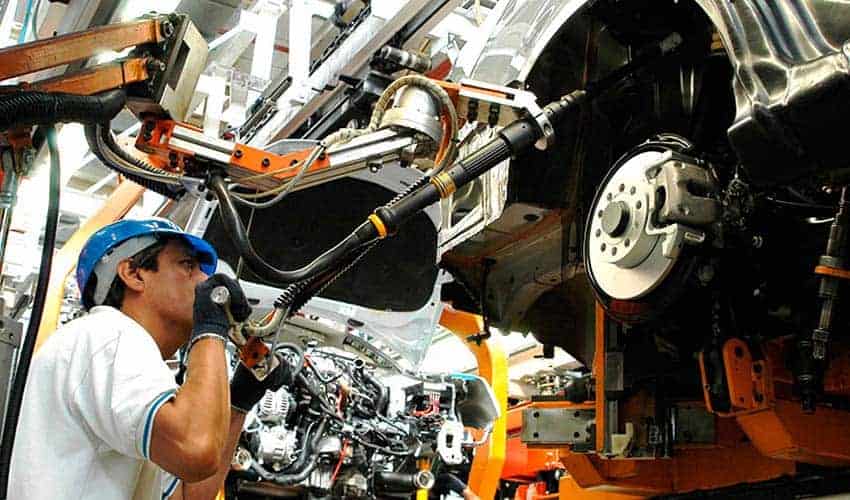

Auto sector drives export growth in October

INEGI data shows that oil exports increased 14.1% annually in October to $3.19 billion, while non-oil exports rose 5.1% to $48.77 billion. The latter contributed to around 94% of Mexico’s export total last month.

Manufacturing exports increased 5.3% in October to $46.37 billion, equivalent to 89% of the total and 95% of the non-oil total.

Within that category, auto exports surged 20.9% to $17.66 billion while non-auto exports fell 2.5% to $28.7 billion.

Gabriela Siller, director of economic analysis at Banco Base, said that the auto sector export growth could have been higher if auto workers in the U.S. hadn’t gone on strike between mid September and late October.

“It was a good month, but it could have been better,” she said.

Agricultural exports spiked 12.3% to $1.71 billion in October, while mining exports decreased 15.1% to $698.8 million.

INEGI noted that avocado exports were up 37.6% compared to October 2022, while shipments of citrus fruits and tomatoes increased 32.4% and 20.9%, respectively.

In contrast, exports of raw coffee beans and frozen shrimp both declined by over 60% on an annual basis.

A good year for Mexico’s automotive industry

Non-oil exports contributed to 94% of the $493.51 billion in export revenue in the first 10 months of the year. They increased 4.5% to $465.33 billion, while oil exports declined 16.3% to $28.17 billion.

Manufacturing exports increased 4.5% to reach $439.44 billion. Auto exports also drove the export growth recorded between January and October, increasing 15.2% to $156.61 billion. Non-auto manufacturing exports fell 0.6% to $282.83 billion.

Mexico’s agricultural exports increased 4.3% to $18.08 billion, while mining exports rose by the same percentage to reach $7.8 billion.

Most Mexican exports go to the US

INEGI data shows that just over 83% of Mexico’s export income is derived from shipments sent to the United States. Just under 17% comes from exports sent to the rest of the world, including Canada, China, Germany and South Korea.

Imports up in October, but down so far this year

The value of imports to Mexico rose 1.8% annually in October to $52.22 billion. The import of intermediate goods – inputs used in the production of other goods – contributed to about three-quarters of that amount, while consumer goods accounted for around 15%.

The value of imports between January and October was $503.84 billion, a 0.6% decline compared to the same period of 2022. The contributions of intermediate goods and consumer goods to the total was very similar to that seen in October.

Fuel imports declined 29.3% to $45.57 billion in the first 10 months of the year, allowing Mexico to record a slight decrease in its overall spending on foreign goods. President López Obrador is aiming to make Mexico self-sufficient for fuel, but the data shows there is still some way to go.

Non-oil imports – made more accessible to Mexican consumers due to the appreciation of the peso this year – increased 3.6% between January and October.

A declining trade deficit

Mexico recorded a trade deficit of $10.33 billion between January and October, a reduction of 62.7% compared to that recorded for the same period of 2022.

The deficit in October was $252.5 million, a drop of 87.9% compared to a year earlier.

Mexico News Daily

I’ve read one article and hit my limit. Please unsubscribe me.

I have been a subscriber for a few years, always get blocked. Check your records. Carlos baires …..c1b2@sbcglobal.net

This is bullshit. Ive signed on three times and can’t get to the news articles

Finally go signed on. Took way too long. Someone needs to streamline this process. The articles are good. It’s a shame it takes so long to access them.

I see the accompanying photo for this article showing a worker sorting avocados. I just read that the native forests in the avocado growing regions of Mexico are being devastated by illegal logging and immense water use because of the expansion of avocado orchards. Cartels, lax and/or corrupt government, and corporations looking the other way are all involved, as usual. How about an article in MND that explores this environmental disaster? There will always be markets for certain products, like avocados, and it is the duty of the government to regulate and enforce laws so the environment and citizens are protected from rampant exploitation. MND has new ownership, and stated they want to be shed a more positive light on Mexico, but not it seems this publication is more of a cheerleader for development and real estate than doing investigative journalism or in depth reporting on pressing issues of the day. Development and growth is not always good.

Thanks for your feedback. We read that avocado article as well. As we continue to grow and have more resources, we will have more perspective and opinion pieces. Concerns of Chinese investment in Mexico, concerns about environmental issues with the Maya Train, and water related/drought issues are all recent examples of our recent coverage. We are working hard to bring more complete content and perspectives. As you say, not all development is good. But we also think not all development is bad. We aim to cover both sides, with necessary due diligence. Reader feedback is very important to us, thank you.

Comments are closed.