The Mexican peso continued its upward streak against the US dollar on Thursday morning, strengthening yet again after the U.S. published encouraging inflation data that could mean a Federal Reserve rate cut is on the horizon.

According to Bloomberg data, the peso was trading at 17.73 to the U.S. dollar early on Thursday morning. By 6:40 p.m. EDT, however, Bloomberg reported that it had weakened slightly to 17.75 to the dollar.

This upward trend shows Mexico’s peso appearing to recover after the currency’s volatility in the aftermath of the June 2 presidential elections. The peso’s strengthening this week puts it at its best performance against the U.S. dollar since June 5, when it traded at 17.53.

Thursday marked the seventh consecutive day of gains against the U.S. dollar, making it the peso’s longest winning streak since mid-March.

U.S. inflation in June continues downward trend

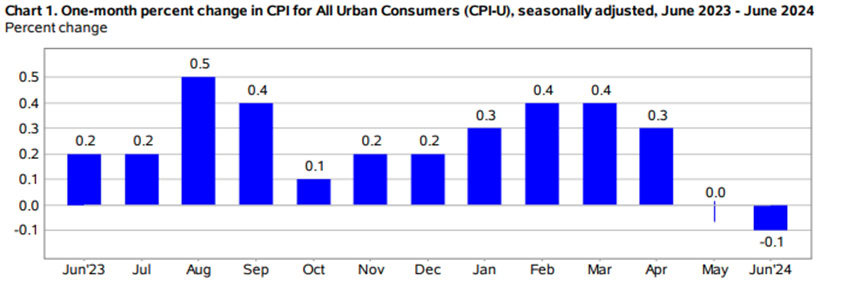

U.S. consumer prices fell more than expected in June, according to government data published on Thursday.

Last month, the US Consumer Price Index (CPI) decreased by 0.1% after remaining unaltered in May. Over the 12 months leading up to June, the CPI increased to 3%. Economists surveyed by Reuters had anticipated a 0.1% increase and a 3.1% year-on-year rise.

According to Bloomberg, these figures show U.S. inflation has resumed its downward trend after a rebound at the beginning of 2024. While U.S. inflation has been overall declining, the annual headline inflation rate in Mexico has been rising for four straight months.

Janneth Quiroz, director of economic analysis at Monex, explained that inflation data in the U.S. supports investors’ bets on a continuing downward trend toward the Federal Reserve’s target of 2%. However, in his most recent appearance before Congress, the head of the Federal Reserve Jerome Powell refrained from giving further details as to when any rate cuts would take place.

Bank of Mexico policy meeting indicates a divided board

The minutes from the most recent monetary policy meeting of Mexico’s central bank were also published on Thursday, revealing a split board vote on lowering the interest rate. Three members of the governing board are open to resuming the discussion of interest rate cuts in upcoming monetary policy meetings.

The current interest rate is 11%, the rate it has been since March, when the board voted to cut the rate from a record-high rate of 11.25%.

The Banxico minutes reveal that central bankers discussed the post-election volatility in the local market as being due to idiosyncratic factors. Bloomberg said these factors, which the bank does not mention, include Morena’s supermajority in Congress after Claudia Sheinbaum won the presidential election.

With reports from La Jornada, El Financiero, Bloomberg Línea, El Financiero and Forbes