The Chinese firm Shandong Golden Empire (GEB) announced Friday plans to invest US $165 million in the state of San Luis Potosí.

GEB will construct a plant in Mexico’s biggest industrial park, Parque Logistik III, located in Villa de Reyes, just south of the city of San Luis Potosí.

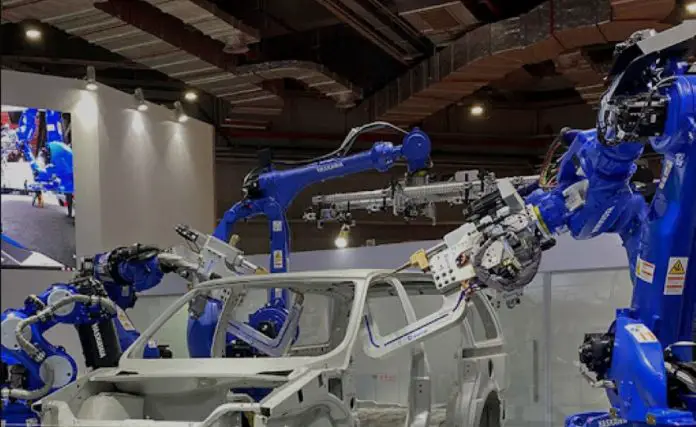

GEB’s plant will produce equipment and components for the automobile, urban train, robotics, wind turbine and aerospace industries, and aims to enhance industrial and technological development in the state. The investment is part of GEB’s plan for strategic expansion in key sectors, the state Economic Development Ministry said.

GEB’s is one of 10 investment commitments already made in the state in the last year by Chinese companies, totaling $1.17 billion, according to San Luis Potosi’s Economic Development Minister Jesus Salvador González Martínez, who also announced that the ministry is currently wooing six more Chinese companies to invest in the state, primarily in the automobile and manufacturing sector.

“Tomorrow, the Minister of Economic Development Minister, Jesús Salvador González Martínez, will meet with the Ambassador of China, Zhang Run, who will visit [San Luis Potosí’s] industrial zone to explore potential investment opportunities. We will strengthen ties, and we expect growth!” the ministry posted on the X social media platform Monday.

San Luis Potosi is part of the central Mexico Bajío region, where several major automakers have longstanding operations, including Toyota, Honda and General Motors (GM). The region benefits from its strategic location in Mexico’s center, as well as from the USMCA free-trade agreement between the U.S. Mexico and Canada, which facilitates exports to the North American market.

San Luis Potosí state is home to more than 300 auto manufacturing businesses alone, both foreign and Mexican.

In recent years, Chinese companies have sought to build manufacturing or assembly facilities in Mexico in order to benefit from the USMCA free trade zone, although the U.S. has been making moves to prevent Chinese companies from getting around heavy U.S. tariffs on Chinese goods by producing them in Mexico.

In March, Minth México, a subsidiary of the Chinese auto parts company Minth Group, announced plans to build two new plants in the central state of Aguascalientes — also part of the Bajío region — with a combined cost of $173.5 million. This followed news last December that Chinese Tier 1 supplier Xinquan Automotive planned to invest $100 million in its Aguascalientes plant.

In the past, González said, the state government had offered companies free land to attract big investors like BMW and GM. However, improved financial incentives, a favorable business environment and straightforward administrative processes have helped attract higher levels of investment to the region in recent years without having to do that, he said.

With reports from Cluster Industrial and El Economista