General Motors (GM) has overtaken Nissan to retake the title of No. 1 auto maker in Mexico after an eight-year hiatus.

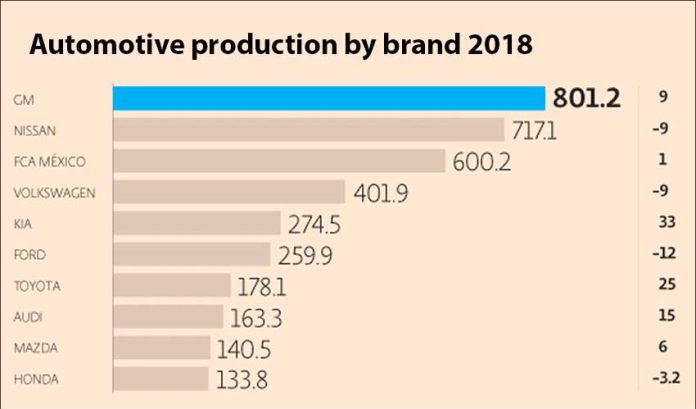

The United States manufacturer made 801,163 light vehicles in Mexico to the end of November last year, a 9% increase on 2017 numbers.

It was also the top auto exporter from Mexico, with over 775,000 of its new vehicles shipped out of the country.

Japanese auto maker Nissan, which was Mexico’s largest between 2011 and 2017, made 717,108 vehicles in the first 11 months of 2018, a 9% decline on the previous year.

While December figures have not yet been released there is no chance that Nissan will make up the ground to pass GM.

The numbers are a reflection of GM’s renewed manufacturing focus in Mexico and the difficulties faced by Nissan due to a contraction of the Mexican auto market, the newspaper El Economista said.

By increasing its production capacity in Mexico in the past two years, GM defied calls from United States President Donald Trump for American auto makers not to expand their presence in Mexico but rather keep jobs in the U.S.

The Detroit-based manufacturer has also announced that it plans to manufacture new models in Mexico including the Chevrolet Equinox SUV, the GMC Terrain and the Chevrolet Blazer.

Six of the eight models GM currently makes in Mexico are SUVs and the category accounts for 95% of the company’s entire Mexico production.

“Our Silao [Guanajuato] complex is producing the new generation of large pick-ups while in Ramos Arizpe [Coahuila] we will produce the new Blazer,” GM México CEO Ernesto Hernández said.

“We will continue with our projects and we’re very happy to maintain our manufacturing footprint in Mexico,” he added.

Fiat Chrysler, Volkswagen and Kia were the third, fourth and fifth biggest auto makers in Mexico last year.

The new trade agreement reached late last year between Mexico, the United States and Canada will bring changes to the North American auto sector and push up manufacturing costs in Mexico but according to El Economista, GM and other U.S. manufacturers are well prepared.

Among the changes agreed to in the new pact, known as USMCA, are an increase to regional content levels to 75% from 62.5% in order for a car to be given tariff-free status and a requirement for 40% of content to come from high-wage areas where workers earn at least US $16 per hour.

The trade agreement, which will replace the 25-year-old NAFTA, is expected to take effect at the start of 2020.

Source: El Economista (sp)