Federal tax authorities have recovered 27.83 billion pesos (US $1.3 billion) from corporate tax evaders this year.

Among the companies that have paid debts to the Federal Tax Administration (SAT) are América Móvil, a telecommunications corporation owned by billionaire businessman Carlos Slim, Walmart, IBM and Femsa, the world’s largest Coca-Cola bottler and the operator of the OXXO convenience store chain.

América Movil paid 8.29 billion pesos in tax debt racked up between 2016 and 2019, while Walmart coughed up 8.08 billion pesos it owed in relation to the sale of restaurant chain Vips.

Femsa settled a tax bill for 8.79 billion pesos while IBM reached an agreement with the SAT to pay back 669 million pesos.

Another 2 billion flowed into government coffers from smaller, lesser known companies that are not listed on the Mexican Stock Exchange. As part of the agreements they reached with federal authorities, the companies were required to announce publicly that they were guilty of tax evasion, the newspaper El Universal reported.

Simec Inernational, a steelmaker, admitted its guilt in a notice published at the start of the year in a national newspaper. It also urged other companies to comply with their tax obligations and to approach authorities to clear up any doubts they might have.

Among the other companies that did the same are the steelmakers Orege and Siderúrgicos Noroeste and the manufacturing firm Sigosa.

President López Obrador last week claimed credit for recouping tax debts owed by large companies.

“The [economic] model we’re applying is yielding results and is for the benefit of all people,” he said.

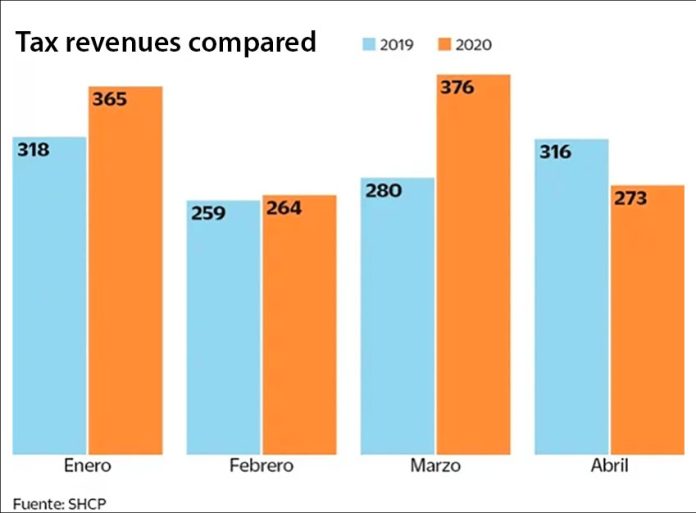

Data from the Finance Ministry shows that the government’s tax income was above 2019 levels in January, February and March.

However, it dipped below 2019 takings in April, the first full month of federally mandated social distancing to limit the spread of the coronavirus.

Source: El Universal (sp)