All foreign residents in Mexico will soon be required to have a tax number due to a recent tax reform.

Temporary and permanent residents aged 18 or over or anyone with a CURP identity number must have an RFC number by July 1 whether they earn income in Mexico or not.

RFC stands for Registro Federal de Contribuyentes, or Federal Taxpayers Registry. RFC numbers are used by the federal government for a range of purposes, among which are to track income and detect potential cases of money laundering.

An application for an RFC number must be lodged in person at an office of the federal tax agency SAT. The first step in the process is to make an appointment at your nearest SAT office via the agency’s online portal (Spanish only)

If you don’t understand Spanish you can use Google Translate to convert the text to English.

After requesting an appointment (registrar cita) and choosing the option for an individual taxpayer (persona física) you will be required to enter your CURP number, which appears on residency cards, as well as your full name and email address.

You will then be directed to a new page, where you will need to select the service for which you’d like to make an appointment, the state in which you live and the office at which you would like to lodge your application.

After you have done that, you will either be able to schedule an appointment on the page’s virtual calendar or be told that no appointments are available and given the option to join a fila virtual or virtual line. By entering your email address you will be sent a “token” – an alphanumeric code – that can be used to join the virtual line.

You will then receive an email confirming you are in the virtual line and advising you to monitor your email for an appointment date and time. On the day of your appointment, you will need to take a variety of documents to the SAT office.

According to the SAT website, foreigners applying for a RFC number themselves need:

- A valid migration document, i.e. a residency card.

- Proof of address, such as a bank statement, electricity bill or rental contract.

- A passport.

Paul Kurtzweil from the YouTube channel Two Expats in Mexico said in a video about the RFC application process that foreigners should also take a printout of their CURP – available here – and a thumb drive with them when applying for their tax number.

“They’re going to be putting some things on there for you, so don’t forget that item,” he said.

Trisha Velarmino, who provides a detailed account of her experience applying for an RFC number on the Mexico Insider website, said that SAT places a taxpayer’s firma digital or digital signature on his or her USB stick.

During the application process, SAT will collect biometric data from applicants, including facial photographs and fingerprints. There is no cost involved in applying for an RFC number, and the application process in a SAT office shouldn’t take longer than 40 minutes.

Kurtzweil said in his RFC video that it’s increasingly difficult to get things done in Mexico due to recent legislative and rule changes. He said that people have been unable to open bank accounts and buy cars because they didn’t have a RFC number.

Lakeside News, an English-language news outlet that publishes on the Semanario Laguna website, said that without an RFC number on your electricity bill, you won’t be able to sell your house or buy a car. It also noted that in some places, an RFC number is needed to open a bank account or contract internet service.

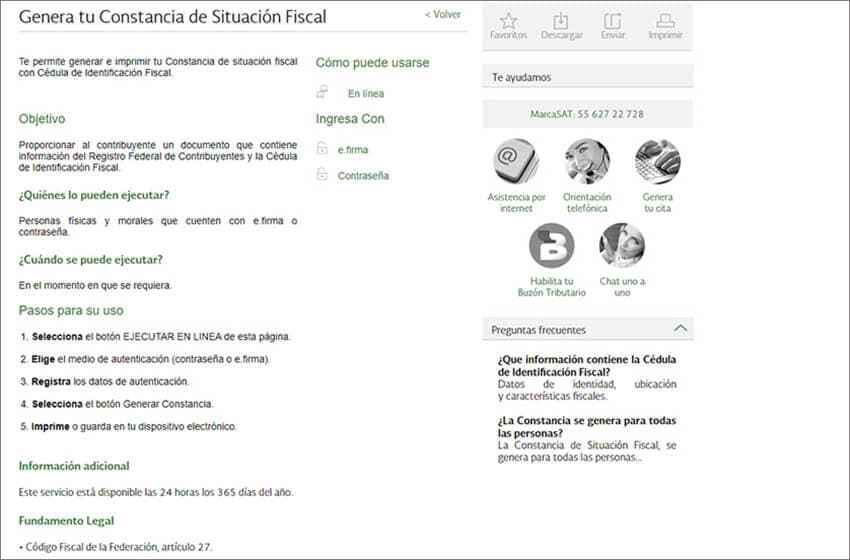

Another bureaucratic requirement of foreigners once they have an RFC number is to obtain a document called Constancia de Situación Fiscal (Proof of Fiscal/Tax Situation). That document will be required by any foreigners doing business in Mexico, even if that business is simply being an electricity, water or internet customer.

According to Lakeside News, companies will soon be asking foreigners for their Constancia de Situación Fiscal if they are not doing so already.

The document can be obtained via the SAT website. Two Expats in Mexico has a video detailing how to get a Constancia de Situación Fiscal online.

With reports from Semanario Laguna/Lakeside News