Authorities in the United States have announced new sanctions against Mexican individuals and companies allegedly involved in cartel-backed timeshare fraud schemes in Mexico that have cost thousands of U.S. citizens hundreds of millions of dollars.

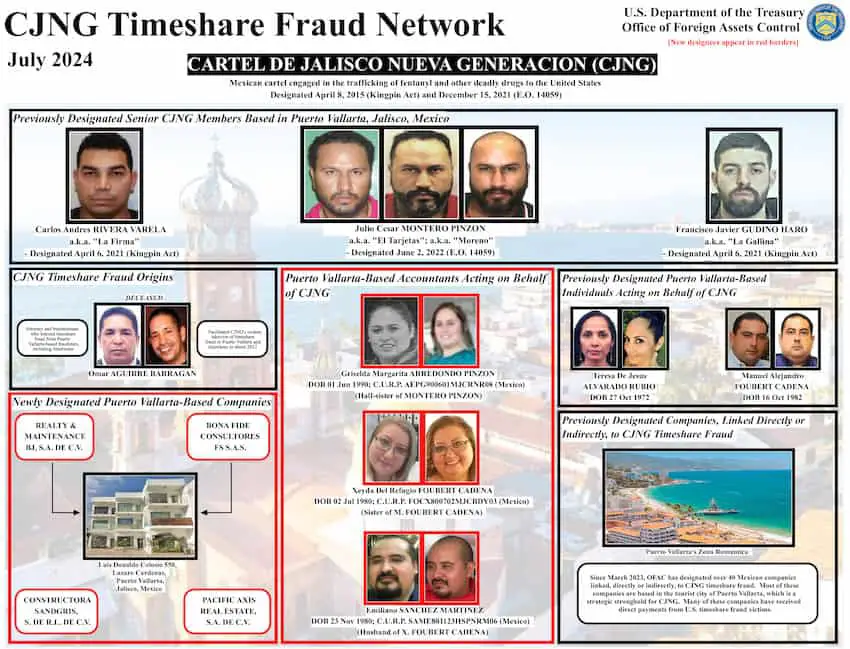

The United States Department of the Treasury (USDT) said in a press release on Tuesday that its Office of Foreign Assets Control (OFAC) had sanctioned three Mexican accountants and four Mexican companies “linked, directly or indirectly, to timeshare fraud” led by the Jalisco New Generation Cartel (CJNG).

The three Puerto Vallarta-based accountants “assist CJNG’s timeshare fraud activities and have familial relationships with previously designated persons,” the USDT said.

The four companies sanctioned have alleged connections to the three accountants in Puerto Vallarta, where many of the defrauded U.S. citizens own timeshare properties.

OFAC has now sanctioned more than 50 individuals and entities allegedly linked to CJNG’s timeshare fraud activities.

The timeshare fraud schemes

The USDT said that the CJNG and other criminal organizations “operate call centers in Mexico with scammers impersonating U.S.-based third-party timeshare brokers, attorneys or sales representatives.”

“The scammers target and defraud U.S. owners of timeshares in Mexico through complex and often yearslong telemarketing, impersonation and advance fee schemes, including timeshare exit, re-rent and investment scams,” the department said.

1/ Today, our Office of Foreign Assets Control (OFAC) sanctioned three Mexican accountants and four Mexican companies linked to timeshare fraud led by the Cártel de Jalisco Nueva Generación (CJNG). https://t.co/SbmOQ9rDYx

— Treasury Department (@USTreasury) July 16, 2024

The USDT said that victims of timeshare fraud in Mexico are often targeted for a second time in “re-victimization schemes where perpetrators impersonate U.S.-based law firms and U.S., Mexican and international authorities.”

“The victims often send payments to the scammers through wire transfers via U.S. correspondent banks to Mexican shell companies with accounts at Mexican banks or brokerage houses (casas de bolsa) before the ill-gotten funds are further laundered in Mexico through additional shell companies and trusts (fideicomisos) controlled by cartel members, their family members or third-party money launderers, such as complicit accountants and other professionals,” it added.

According to the Federal Bureau of Investigation (FBI), around 6,000 U.S. victims have reported losing nearly US $300 million to timeshare fraud schemes in Mexico between 2019 and 2023.

“However, this figure likely underestimates total losses, as FBI believes the vast majority of victims do not report the scam due to embarrassment and other reasons,” USDT said.

Brian E. Nelson, USDT’s Under Secretary for Terrorism and Financial Intelligence, said that “cartel fraudsters run sophisticated teams of professionals who seem perfectly normal on paper or on the phone.”

However, “in reality, they’re money launderers expertly trained in scamming U.S. citizens,” he said.

“Unsolicited calls and emails may seem legitimate, but they’re actually made by cartel-supported criminals. If something seems too good to be true, it probably is,” Nelson added.

The origins of CJNG timeshare fraud

The USDT said that Mexican attorney and businessman Omar Aguirre Barragán, who is now deceased, “learned how to conduct timeshare fraud from Puerto Vallarta-based fraudsters, including Americans” more than a decade ago.

“In about 2012, Aguirre educated CJNG about timeshare fraud and sought its support in taking over this highly lucrative scheme from rivals in Puerto Vallarta and elsewhere. Eventually, CJNG took more direct control and cut out Aguirre as an unnecessary middleman,” the department said.

The sanctioned individuals and companies

OFAC on Tuesday sanctioned the accountants Griselda Margarita Arredondo Pinzón, Xeyda Del Refugio Foubert Cadena and Emiliano Sánchez Martínez pursuant to Executive Order 14059, officially titled: Imposing Sanctions on Foreign Persons Involved in the Global Illicit Drug Trade.

Arredondo is the half-sister of senior CJNG member Julio Cesar “El Tarjetas” Montero Pinzón, the USDT said.

Montero, a Specially Designated National (SDN) since 2022, has previously been identified by the USDT as “part of a CJNG enforcement group based in Puerto Vallarta that orchestrates assassinations of rivals and politicians using high-powered weaponry.”

Foubert is “the sister of Manuel Alejandro Foubert Cadena, a Mexican attorney linked to CJNG’s timeshare activities whom OFAC designated on November 30, 2023,” USDT said.

She is married to Emiliano Sánchez, the third accountant who was sanctioned by OFAC on Tuesday.

The four companies sanctioned on Tuesday are:

- Constructora Sandgris, which the USDT said is “purported to be engaged in wholesale trade.” It was sanctioned for “being owned, controlled or directed” by Arredondo.

- Pacific Axis Real Estate, which is “purported to be engaged in real estate activities.” It was sanctioned for its links to Foubert.

- Realty & Maintenance BJ, which is also “purported to be engaged in real estate activities.” It was also sanctioned for its links to Foubert.

- Bona Fide Consultores, an accounting firm owned by or linked to Sánchez.

The sanctions on the three individuals and four companies cut them off from the United States financial system and freeze any assets they may have in the U.S.

U.S. authorities “deploying all tools available” to combat timeshare fraud

In addition to sanctioning individuals and companies allegedly involved in timeshare fraud, U.S. authorities are cracking down on the crime in a range of other ways.

On Tuesday, the Financial Crimes Enforcement Network (FinCEN), OFAC and the FBI issued a notice to financial institutions that provides an overview of timeshare fraud schemes in Mexico associated with the CJNG and other criminal organizations.

“The joint Notice provides the methodologies, financial typologies and red flag indicators associated with timeshare fraud in Mexico to help financial institutions identify and report suspicious activity to FinCEN and law enforcement,” the USDT said.

Nelson, the USDT undersecretary, said that the “Treasury and our partners are deploying all tools available to disrupt this nefarious activity, which funds things like deadly drug trafficking and human smuggling.”

“… We encourage the public to use our resources to stay vigilant against these threats,” he added.

The FBI issued a warning last month after detecting a rise in scams targeting timeshare owners. The warning noted that “older Americans” are mainly targeted and therefore timeshare fraud is “technically” a form of “elder fraud.”

“Timeshare fraudsters aim to suck their victims dry, with devastating consequences to victims’ financial futures, relationships and physical and emotional health,” said Paul Roberts, who leads FBI New York’s Complex Financial Crimes Branch.

He said that the crime is attractive to cartels because it is cheaper to carry out than other “revenue generators” such as drug and weapons trafficking.

“Timeshare fraud has low overhead costs and minimal reinvestment, needing only a rental of small space, telecom setup and English-speaking employees with access to resort databases,” Roberts said.

Mexico News Daily