Steel manufacturer Grupo Deacero will invest US $1 billion over the next three years to build a new state-of-the-art steel mill in Saltillo, Coahuila, and expand its facilities in the Celaya Industrial Complex in Guanajuato.

The investment will allow the Monterrey-based consortium to increase production capacity by 1.2 million tons of steel per year, according to its president, Raúl Gutiérrez Muguerza.

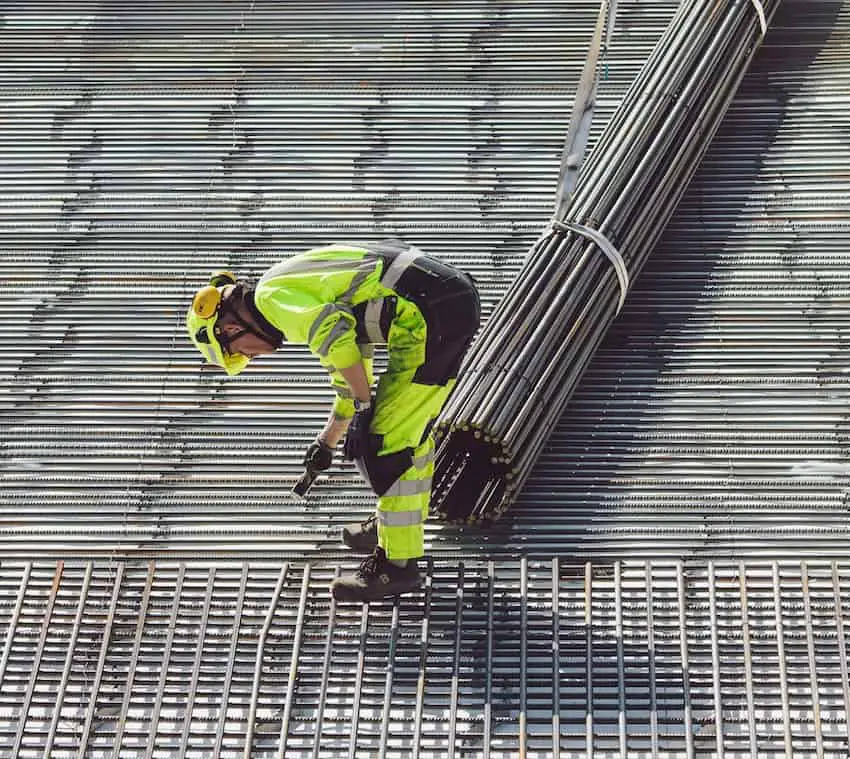

“It will be an intelligent, automated and sustainable plant to take care of the physical integrity and safety of employees and guarantee high standards of quality, service and productivity,” he said.

The announcement builds on Deacero’s November 2022 pledge to invest 12 billion pesos (US $700 million) in Mexico between 2022 and 2024.

Deacero’s new developments are expected to generate 1,000 direct jobs and 5,000 indirect jobs, which Gutiérrez assured would be high-skilled and among the best-paid in Mexico. The company also plans to build new plants in Ciudad Juárez and Baja California to meet further demand.

“The purpose is to promote regional development and increase the production capacity of the business units with investments aimed at the domestic market,” he said.

He added that the plants would also help to meet demand from foreign businesses looking to nearshore production in Mexico.

“Mexico has a lot of potential also because of large infrastructure projects that are being carried out, from the Maya Train to the Tulum Airport and the Trans-Isthmus Corridor,” Gutiérrez said last year, while announcing the 12 billion peso strategic investment.

Steel exports to the U.S., however, are more controversial. Grupo Deacero was one of five Mexican companies mentioned in an investigation by the U.S. Department of Commerce (DOC) in June, which alleged unfair “dumping” practices by some Mexican steel companies.

The investigation, conducted between 2020 and 2021, found that Deacero held average dumping margins of 3.05%. This means it was exporting steel to the U.S. at 3.05% under its market value, to the disadvantage of U.S. steel producers. Other Mexican companies held dumping margins of up to 16.28%, the investigation found.

In response, the Mexican Economy Ministry (SE) requested a review of antidumping quotas on steel exports to the U.S., under the United States-Mexico-Canada Agreement (USMCA).

During negotiations for the USMCA free trade pact, the U.S. threatened tariffs on Mexican structural steel imports, alleging unfair state subsidies for the Mexican steel industry. The two countries eventually reached an agreement to monitor the trade balance of steel and aluminum in order to prevent “dumping.”

With reports from Real Estate Market and Inmobilare