The United States will partner with Mexico in a new semiconductor initiative whose ultimate aim is to strengthen and grow the Mexican semiconductor industry, U.S. authorities said Thursday.

The U.S. Department of State announced that it would partner with the Mexican government to “explore opportunities to grow and diversify the global semiconductor ecosystem” under the five-year US $500 million International Technology Security and Innovation Fund, which was created by the CHIPS Act of 2022.

The U.S.-Mexico chip partnership will “help create a more resilient, secure, and sustainable global semiconductor value chain,” the State Department said in a statement.

The department said that an initial phase of the partnership would include “a comprehensive assessment of Mexico’s existing semiconductor ecosystem and regulatory framework, as well as workforce and infrastructure needs.”

“Key stakeholders in the Mexican ecosystem, such as state governments, educational institutions, research centers and companies will participate in this analysis in conjunction with Mexico’s Secretariat of Economy. The insights gained from the assessment will serve as the basis for potential future joint initiatives to strengthen and grow this critical sector,” it said.

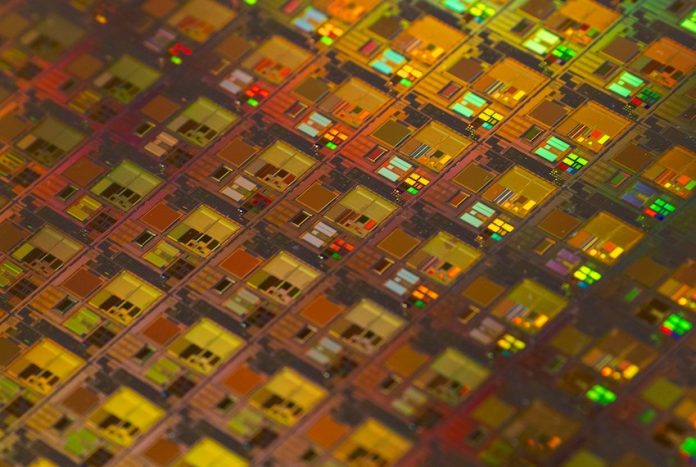

The announcement of the partnership comes as the U.S. government seeks to reduce reliance on China and Taiwan for semiconductors, or chips, which are used in the manufacture of a range of products including cars, electronics and medical devices. The State Department highlighted that the manufacturing of such products “relies on the strength and resilience of the semiconductor supply chain.”

Thus, strengthening the Mexican semiconductor industry to supply chips to companies in North America makes a lot of sense.

Taiwan is currently the world’s largest semiconductor manufacturer, accounting for 50% of total production, according to the international freight platform ShipHub. China ranks fourth behind South Korea and Japan, and ahead of the United States.

The State Department said that “the United States and Mexico are key partners in ensuring the global semiconductor supply chain keeps pace with the digital transformation underway worldwide” and “this [new] collaboration” between the two countries “underscores the significant potential to expand Mexico’s semiconductor industry to the benefit of both nations.”

It also said that the U.S.-Mexico semiconductor partnership “will build on existing cooperation under the bilateral High-Level Economic Dialogue and trilateral North American Leaders Summit process.”

“This partnership will also support the work already underway to bolster regional competitiveness in semiconductors, including workforce development, in the Americas Partnership for Economic Prosperity,” the department added.

Former foreign affairs minister Marcelo Ebrard revealed in September 2022 that the United States had invited Mexico to take advantage of massive U.S. investment in the semiconductor industry.

“They already authorized an approximately US $50 billion [semiconductors] program and they’re inviting us to participate,” he said after talks between high-ranking Mexican and U.S. officials.

In October last year, United States Secretary of State Antony Blinken announced a “joint semiconductor action plan” between the U.S. and Mexico “to accelerate our integration” and “scale our efforts to attract new investment.”

Mexican Foreign Affairs Minister Alicia Bárcena said at the time that the two countries had “a very clear strategy — for this region to become the most powerful region in the world in the production of semiconductors and conductors.”

Economy Minister Raquel Buenrostro said that the collaboration with the U.S. represented a “significant opportunity” and highlighted that the development of the semiconductor industry in Mexico would create “better paying jobs.”

Writing in Forbes last month, the co-CEO and head of business development at the Texas-based Nearshore Company said that “Mexico’s advantages for chip manufacturing go beyond its geographical proximity to the U.S.”

“Over the years, Mexico’s technological capabilities have been on the rise. While traditionally viewed as a low-cost, labor-intensive manufacturing hub, the presence of automotive and aerospace companies in the region … has been the driving force behind transforming Mexico’s manufacturing labor force from one that is labor intensive only, to now include more advanced manufacturing skills,” wrote Jorge González Henrichsen.

“As the semiconductor industry expands in North America, I believe it will attract high-skilled professionals, further bolstering Mexico’s capabilities and transforming the border region into a thriving, advanced manufacturing ecosystem,” he said.

Mexico News Daily