Pressure from United States authorities has led the Mexican government to refuse to offer incentives to Chinese electric vehicle (EV) manufacturers planning to invest in Mexico, according to Mexican officials who spoke with Reuters.

Three officials said to be “familiar with the matter” told Reuters that the government is not offering Chinese EV makers incentives such as low-cost public land or tax cuts.

The sources said that the move was the result of pressure from the United States government, in particular the Office of the U.S. Trade Representative (USTR).

The United States government is determined to protect the U.S. EV industry from comparatively cheap imports, and reportedly has concerns about the capacity of Chinese “smart cars” to collect data and thus compromise national security.

On Wednesday, Trade Representative Katherine Tai said that the United States must take “decisive” action to protect U.S.-made EVs from subsidized Chinese car makers.

A bipartisan group of United States lawmakers wrote to Tai last November in part to request that the U.S. government be ready to “address the coming wave of [Chinese] vehicles that will be exported from our other trading partners, such as Mexico.”

In December, Mexico and the United States reached an agreement to cooperate on foreign investment screening as a measure to better protect the national security of both countries. The agreement was widely interpreted as a means to stop problematic Chinese investment in Mexico.

A White House spokesperson told Reuters that United States President Joe Biden will not allow Chinese car makers to flood the U.S. market with vehicles that pose a threat to national security.

Incentives for foreign car makers have been generous in the past

Francisco Bautista, a partner at professional services firm EY in Mexico, told Reuters that the Mexican government has previously offered generous incentives to automakers, including free land, water and energy facilities and assistance to hire workers.

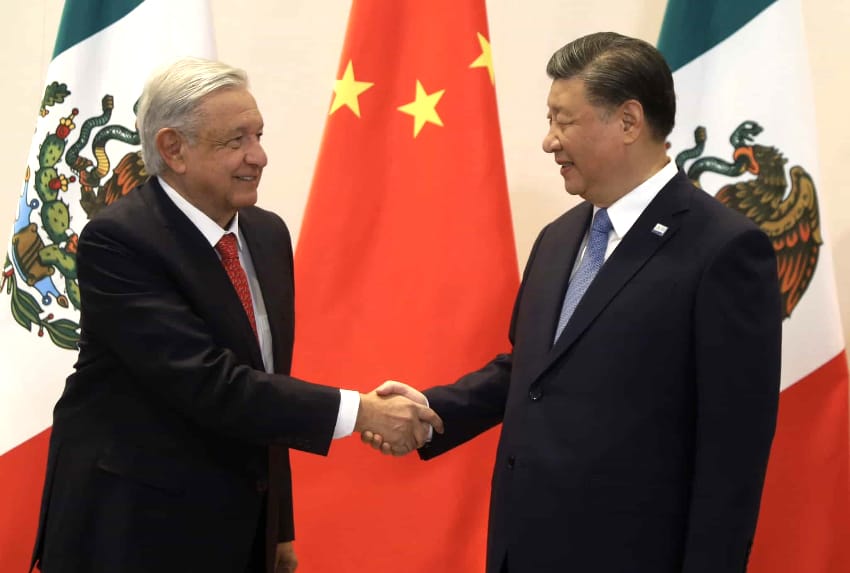

He said that such incentives have declined during the government led by President Andrés Manuel López Obrador, who took office in late 2018, although they have been offered to large investors such as Audi.

Several Chinese car makers have announced plans to manufacture in Mexico

No Chinese car maker currently has a plant in Mexico, but several have announced plans to make vehicles here. They include BYD — the world’s leading EV company by sales — Jaecoo and Jetour.

BYD Americas CEO Stella Li said in February that Mexican officials had been receptive to the company’s plan to open a plant in Mexico, despite the concerns of the United States government and U.S. automakers. She said that BYD’s plan was “to build the facility for the Mexican market, not for the export market,” but there is skepticism about that remark.

Reuters’ Mexican government sources said that the last time top officials met with a Chinese automaker was in January when they spoke with BYD executives. The same month, U.S. officials asked their Mexican counterparts to “hinder Chinese automakers,” Reuters said.

The news agency’s sources, who asked to remain anonymous, said that Mexican officials made it clear to BYD that the government would not offer incentives such as those provided in the past. In addition, the sources said that the officials told the BYD executives that future meetings with Chinese automakers would be put on pause.

Reuters said that López Obrador’s office didn’t immediately respond to a request for comment on the issue, while the Economy Ministry declined to comment.

After Donald Trump said last month that he would impose a 100% tariff on cars manufactured in Mexico by Chinese companies if he wins the upcoming U.S. presidential election, López Obrador said that Chinese investment in Mexico is “safe” and will continue.

One Mexican official told Reuters that in the absence of federal incentives, BYD would seek state government ones, although they are typically not as generous.

Reuters said that states including Durango, Jalisco, Nuevo León and México state are all attempting to lure Chinese automakers and are consequently offering a range of incentives.

More on the United States’ concerns

A USTR official told Reuters that the USMCA, the North America free trade pact that superseded NAFTA in 2020, was not meant to “provide a back door to China and others who may be seeking to access our market without paying … tariffs.”

The U.S. automotive industry, including unions, and the U.S. government are concerned that Chinese car makers could export vehicles made in Mexico to the U.S. without paying the 27.5% tariff that is currently applicable to Chinese cars.

“Chinese automakers can get around U.S. tariffs by setting up shop in Mexico, as long as they meet rules for how much of a vehicle must be produced locally,” Reuters reported.

Dozens of Chinese auto-parts manufacturers already operate in Mexico. Chinese car makers could source inputs from them and other Mexico-based companies to ensure that they comply with the USMCA requirement of having at least 75% of core vehicle parts originating in North America.

Reuters reported that Mexico “is caught in the crossfire between the world’s two biggest economies and car markets.”

There is certainly the potential for Mexico’s trade and investment relationship with China to cause problems in Mexico’s bilateral relationship with the United States.

But López Obrador appears to believe that Mexico under his leadership is managing its relationships with both countries successfully. He said in late March that Mexico has “very good” trade relationships with both China and the United States when commenting on steel-related issues that have concerned the U.S.

Mexico has imposed tariffs on some Chinese steel products amid concerns in the United States about an increase in steel exports from Mexico, a move that was possibly the result of U.S. pressure, although Economy Minister Raquel Buenrostro asserted that Mexico is not receiving exports from China only to ship them north of the border.

Meanwhile, Chinese investment in Mexico is on the rise, and is almost certain to increase in coming years.

Reuters’ sources said that while Chinese investment benefits the Mexican economy, the federal government is worried about upsetting its U.S. counterpart ahead of the scheduled review of the USMCA in 2026, when the three parties will decide whether to extend the agreement for an additional 16 years.

S&P Global said in a recent report that “Chinese investment and exports to Mexico are highly likely to become a headline issue ahead of the 2026 scheduled review of the USMCA.”

One source told Reuters that Mexican officials are afraid that the U.S. government could seek to overhaul the pact to Mexico’s detriment.

Mexico will have a new president when the review takes place, while either Biden or Trump — barring a circumstance that precludes them from holding office — will be in the White House.

With reports from Reuters