Inflation rose slightly in Mexico during the first half of February, lifting annual headline inflation to 3.74% from 3.59%, with core inflation coming in at 3.63%.

Official data released on Monday by the national statistics institute INEGI indicated prices rose by 0.15% in the first two weeks of February, as compared to the second half of January.

En la primera quincena de febrero de 2025, el Índice Nacional de Precios al Consumidor #INPC presentó un nivel de 138.631 y representó un aumento de 0.15% respecto a la quincena previa. Con este resultado, la inflación general anual fue de 3.74%.

Por componente, la inflación… pic.twitter.com/W7euhwnYlh

— INEGI INFORMA (@INEGI_INFORMA) February 24, 2025

Services were among the leading drivers of inflation during the first two weeks of February, but prices of fruits and vegetables shrank by 6.25% compared to one year ago.

According to INEGI, tomato prices dropped 18.53%, while nopales were down 10.66%, squash prices fell 10.27% and onions were down 7.81%.

Bananas and eggs were an exception, however, with banana prices climbing 5.74%.

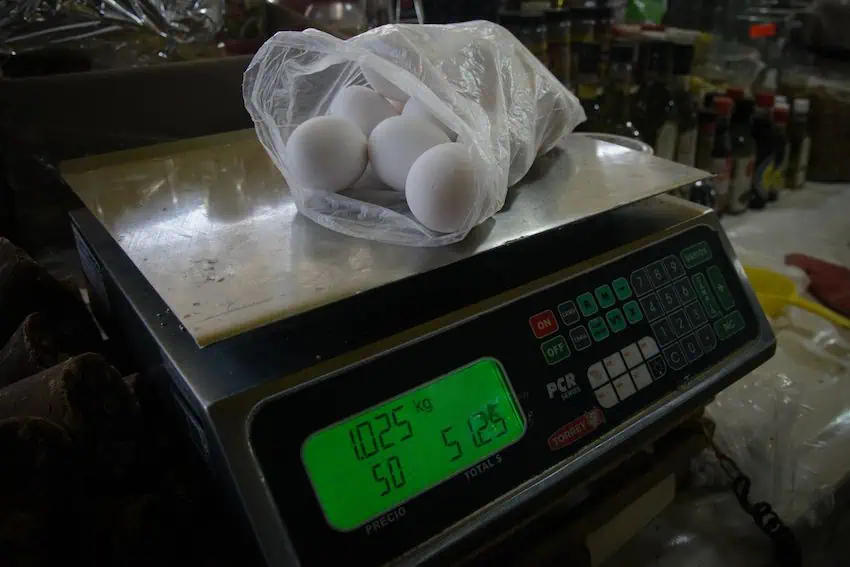

Bird flu in US is increasing egg prices in Mexico

INEGI reported the price of eggs climbed 5.28% in early February due to an increase in demand for eggs in the United States as a result of the ongoing bird flu outbreak.

“We’ve observed an increase in domestic prices driven mainly by the strong demand in the neighboring country, where avian influenza has caused the slaughter of more than 30 million laying hens, which represents approximately 10% of the national inventory,” explained Juan Carlos Anaya, general director of Grupo Consultor de Mercados Agrícolas (GCMA), in an interview with the newspaper El Financiero.

Among services, small restaurants — eateries locally known as loncherías, fondas and taquerías — also boosted prices by 0.50%, while housing prices rose 0.18%.

The slight increase in the headline rate was roughly in line with expectations, according to Bloomberg News.

The 3.63% figure for core inflation suggests the central bank’s plans to deliver a sixth straight interest rate cut could remain in play.

Banxico lowered its benchmark interest rate to 9.5% on Feb. 6, saying that inflation had reached the bank’s target range — 3% plus or minus one percentage point — while also citing economic contraction in the fourth quarter of 2024. The bank said then that “it could consider adjusting [the interest rate] in similar magnitudes.”

Many economists believe that another half-point cut is on the table at next month’s rate decision meeting, in line with Citi México’s Expectations Survey, which projects a 50 basis-point rate cut at the central bank’s next meeting on March 27.

Kimberley Sperrfechter, an emerging markets economist at Capital Economics, concurred, writing in a research note cited by Bloomberg News that Banxico was “dovish” at its last meeting.

“There’s nothing in the mid-month inflation data to change this stance,” Sperrfechter wrote.

Analysts surveyed by Citi Bank estimate annual headline inflation at the end of February to reach 3.8%.

With reports from El Financiero, N+ and Bloomberg News