The U.S. House of Representatives on Thursday passed legislation that would impose a 3.5% remittance tax on funds sent abroad by individuals who are not U.S. citizens, disappointing some Mexican officials.

Whereas Mexico’s Ambassador to the U.S. Esteban Moctezuma celebrated the reduction of the tax from the initial proposal of 5%, Mexican President Claudia Sheinbaum has said that any tax is unacceptable, arguing that such a measure would violate treaties prohibiting double taxation.

‼️Buenas noticias sobre el cargo a las remesas

El comité de reglas aprobó el paquete de reconciliación con una enmienda que incluye una *reducción del impuesto a las remesas del 5% al 3.5%*, no obstante que hicieron mayores recortes a Medicaid y a incentivos fiscales para…

— Esteban Moctezuma Barragán (@emoctezumab) May 22, 2025

On Friday, Sheinbaum called for the creation of a permanent binational panel to address issues of fiscal fairness and economic sovereignty.

The proposal — part of a broader fiscal package sponsored by U.S. President Donald Trump — now moves to the U.S. Senate, where Republican leaders hope to secure final approval before July 4.

Remittances are funds sent by migrants to friends and families in their home countries. Mexico received US $64.7 billion in remittances last year, a 2.3% increase over 2023 and the 11th consecutive year of growth.

Remittances are the largest single source of foreign income for Mexico — the world’s second-largest recipient of remittances after India — and last year’s total represented roughly 4.5% of GDP, according to the Center for Strategic and International Studies (CSIS).

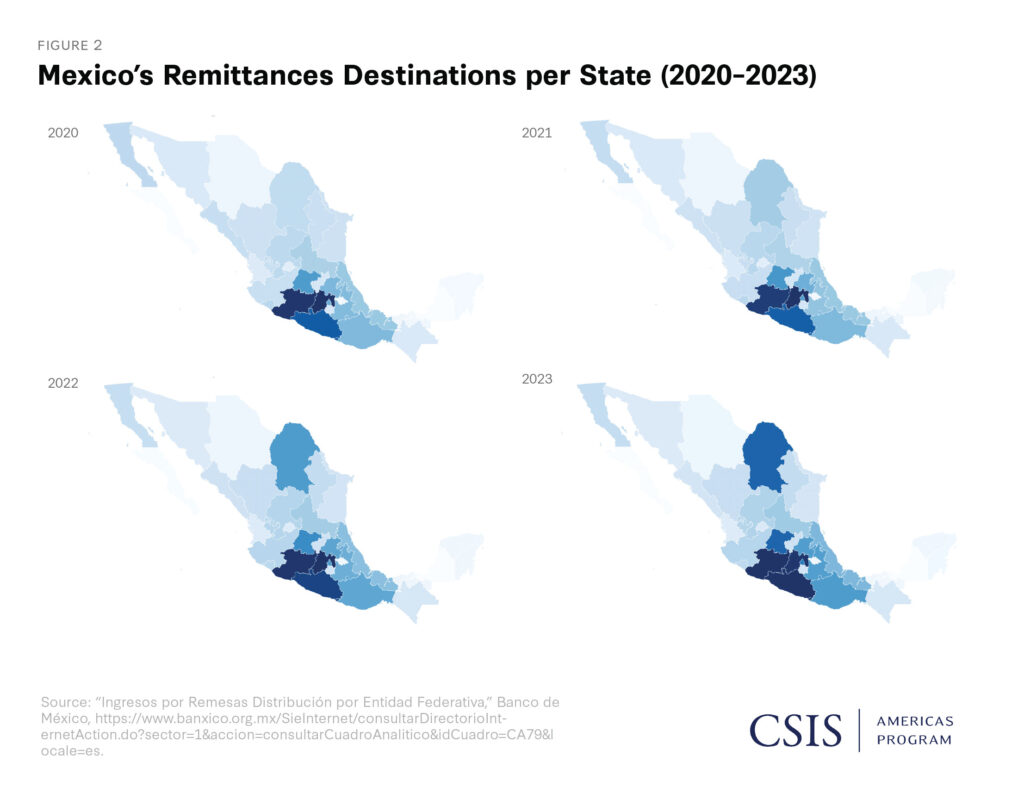

The Mexican Institute of Finance Executives (IMEF) said a tax would “negatively impact the state-level GDP in regions heavily reliant on remittances.”

According to CSIS, remittances provide “supplemental income for Mexican households [and] a stable flow of developmental finance to the poorest subregions of the country.”

As of 2022, the average remittance transaction sent to Mexico amounted to approximately US $390. CSIS said that, considering Mexico’s average monthly salary is roughly 6,150 pesos (US $297), such transactions can contribute a sizable portion — or even the entirety — of a family’s income.

“This income is particularly essential for the nearly 60% of Mexicans engaged in informal labor who often lack employment stability and safety nets to ensure consistent income,” the CSIS said.

News of the proposed tax prompted Mexico’s Foreign Affairs Ministry to issue a statement on May 16 saying it would “pursue the strongest political and legal defense” against the proposed remittance tax.

Foreign Affairs Minister Juan Ramón de la Fuente said the proposed tax on remittances “has no justification and we disagree with it.” De la Fuente said the bill targets people who have already paid taxes and who contribute significantly to the U.S. economy.

“[The] remittances represent only 18% of all income earned by our compatriots, with the remainder staying in the United States,” he said.

Mexican lawmakers traveled to Washington, D.C., to lobby for the elimination of the tax. They argued that the measure was essentially double taxation, since immigrants are already required to pay U.S. income taxes regardless of their immigration status.

With reports from El Universal, Infobae and El Economista