Donald Trump’s victory in the 2024 Republican Party presidential caucuses in Iowa and other factors caused the Mexican peso to depreciate against the US dollar on Tuesday and in Wednesday morning trading, resulting in the currency reaching its weakest position in over a month.

The US dollar was trading at 17.38 pesos at around 8:30 a.m. Mexico City time on Wednesday, according to Bloomberg data. The last time the peso was weaker than that level was Dec. 11.

After depreciating to 17.38 to the dollar, the peso appreciated slightly to trade at 17.34 to the dollar at 10 a.m. and 17.26 at 11 a.m.

The low the peso reached on Wednesday morning represented a 2.9% decline compared to the currency’s position of 16.88 to the dollar at the close of markets on Monday.

On Tuesday, the peso depreciated more than any other major currency, according to Banco Base director of economic analysis Gabriela Siller.

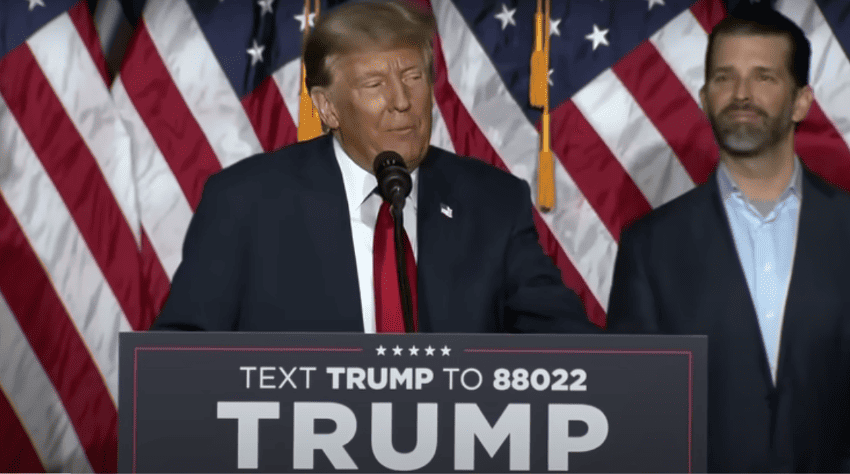

The slide came after Trump won a comprehensive victory in the Iowa caucuses, the first contest in the Republican Party’s 2024 presidential primary race.

The El Financiero newspaper reported that the peso weakened due to increased aversion to risk related to a combination of factors, including Trump’s victory, the United States-Houthi conflict in Yemen and the Red Sea, and uncertainty about the future of monetary policy in the U.S.

Slightly lower than expected economic growth in China last year also added to risk aversion and affected the peso, the news website Expansión reported.

In a victory speech on Monday, Trump pledged to “seal up the border” with Mexico “because right now we have an invasion … of millions and millions of people that are coming into our country.”

Such a move could affect trade flows between Mexico and the United States, as has occurred at times when Texas conducted strict inspections of trucks entering the U.S.

The El Economista newspaper reported Tuesday that the US dollar had strengthened due to aversion to risk and lower expectations of a prompt interest rate cut in the United States.

The U.S. Federal Reserve is widely expected to reduce interest rates in 2024, but there is uncertainty about when the first cut will be made.

“Investors have begun to pencil in a good chance of rate cuts as soon as March, though some economists have warned — and officials have hinted — that they may be seeing an imminent move as too sure of a bet,” The New York Times reported Tuesday.

The wide difference between the Bank of Mexico’s record high benchmark interest of 11.25% and the Fed’s 5.25%-5.5% range is one factor that helped the peso strengthen in 2023.

Siller said on the X social media platform on Monday that “it’s estimated” that both central banks will reduce interest rates by 100 basis points this year, and predicted that the Bank of Mexico will make its first cut in the first quarter of the year, and that the Fed will follow in May.

A reduction in rates in Mexico before a cut in the United States would benefit the dollar as it would reduce the gap between official rates in the two countries, at least temporarily.

Siller: Trump is a lesser risk to Mexico (and the peso) than he was previously

On Tuesday, Siller acknowledged that the peso depreciated after Trump’s victory in Iowa, but asserted that he “is no longer as strong a risk to Mexico as he was in 2016,” when he defeated Hilary Clinton in the U.S. presidential election.

In a series of posts on X, the Banco Base analyst noted that the former U.S. president — and heavy favorite to become the Republican Party’s presidential candidate — “chose” Mexico as a trade partner via the negotiation and implementation of the USMCA trade pact, which took effect in 2020, “while he began a trade war with China.”

“The market already knows his rhetoric and aggressive way of speaking. Of course the market will react [in 2024], but not as strongly as it did in 2016,” Siller wrote.

“Of course there are risks,” she added.

“The risks for Mexico with Trump are related to 1) the fentanyl crisis; 2) migration; 3) the relocation of companies due to incentives he could offer and which could take some of the nearshoring opportunity away from Mexico; 4) the scheduled review of the USMCA in 2026; 5) comments with respect to current geopolitical conflicts.”

Siller said that the risks “are the same with Biden,” but noted that Trump is “more aggressive” in his rhetoric “and that causes more movement in markets.”

She predicted that the USD:MXN exchange rate will react in a “limited way” to Trump’s remarks in 2024, and that the peso will depreciate to between 18 and 18.50 to the greenback this year.

Such a depreciation would not just be a result of Trump’s rhetoric, but also “the commencement of a cycle of interest rate cuts and aversion to risk due to geopolitical conflicts,” Siller wrote.

With reports from Expansión, El Financiero and El Economista