Chinese electric vehicle manufacturer BYD has rejected a Bloomberg News report Tuesday that said the company has postponed a final decision about its proposed plant in Mexico until after the United States presidential election.

“BYD hasn’t postponed any decision about a Mexico plant,” the company’s Americas CEO Stella Li said in a statement, according to Reuters.

Indeed, BYD’s general director for Mexico Jorge Vallejo said last month that the company is aiming to settle on a location for its proposed plant by the end of the year. A plant decision after the Nov. 5 election is in line with that timetable.

In the BYD statement — which was apparently sent to Reuters and does not appear to be publicly available — Li described Mexico as a “very relevant” market for the company. She reiterated that the plant here will make electric vehicles solely for the Mexican market and not for export to the U.S. or anywhere else.

Reuters didn’t say that Li refuted other aspects of Bloomberg’s reporting, including that a decision on BYD’s proposed plant could be affected by the result of the U.S. presidential election and that the company has paused its search for a suitable location in Mexico.

In reporting that BYD wouldn’t announce a major plant investment in Mexico until at least after the U.S. presidential election, Bloomberg cited unnamed people it said were familiar with the automaker’s plans.

Vallejo said last month that the Shenzhen-based company was considering locations in three Mexican states for its proposed plant. However, several of Bloomberg’s sources said that BYD has stopped actively looking for now.

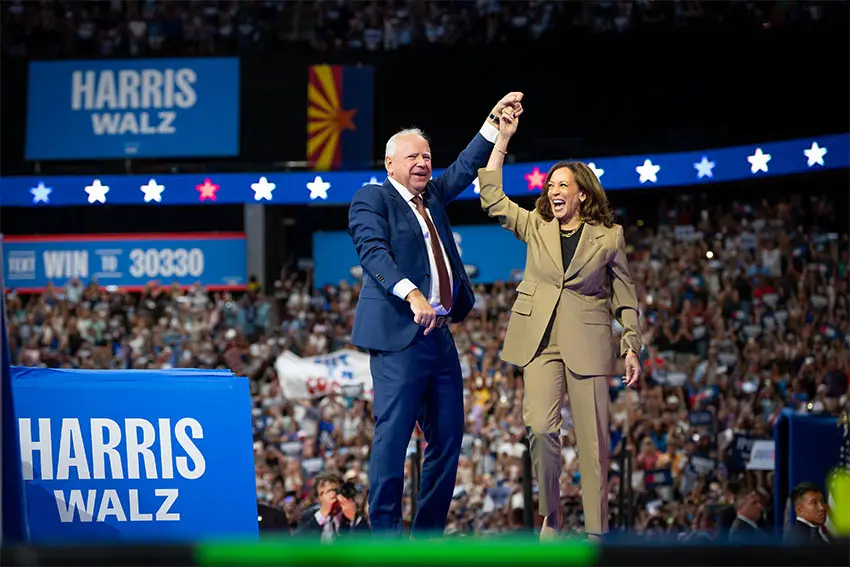

The sources told Bloomberg that BYD postponed its plant decision largely because the electric car company first wants to see who wins the U.S. presidential contest between former president Donald Trump and current Vice President Kamala Harris.

They told Bloomberg that “BYD’s paused factory plans” could be revived or may change. No final decision has been made, they said.

Bloomberg’s reporting comes six weeks after Elon Musk said that Tesla’s planned “gigafactory” project in Nuevo León was “paused” because of the possibility that Trump will impose tariffs on vehicles made in Mexico if he wins the U.S. presidential election.

The explanation for the decision appears strange, given that Trump has made no such threat, and because under the USMCA free trade pact, electric vehicles (EVs) made in Mexico by Tesla — a U.S. company — would not be subject to tariffs when exported to the U.S., provided that they comply with the USMCA’s rules of origin for content.

Trump has said he would impose heavy tariffs on cars made in Mexico by Chinese companies, but doing so might require a modification to the USMCA, which is up for review in 2026. Mexico and Canada, as members of the trade pact, would have to approve any modifications.

In May, United States Trade Representative Katherine Tai said “stay tuned” when asked whether the U.S. would introduce any protectionist measures aimed at EVs made in Mexico by Chinese companies. The U.S. government has already announced 100% tariffs on EVs made in China.

Bloomberg’s reporting suggests that BYD has its eyes on the U.S. market, even though Li said in February — and reiterated on Tuesday — that vehicles made in Mexico would be sold in the Mexican market, where Chinese-made vehicles are becoming increasingly popular.

BYD, which has been selling some of its EV models in Mexico since 2023, has dealerships in major Mexican cities, including Mexico City, Querétaro and Guadalajara. It has also licensed sales of its cars to seven regional automotive sellers in Mexico, as well as the nationwide department store chain Liverpool.

“Our plan is to build the facility for the Mexican market, not for the export market,” she said in February.

In an interview with Reuters last month, Vallejo didn’t reveal which three states BYD was considering for its proposed plant.

But Bloomberg reported Tuesday that one area under consideration is near Guadalajara, the capital of Jalisco. BYD representatives visited the state in March.

Bloomberg also said a plant in Mexico “could be one of BYD’s key overseas production sites, along with plants that it’s currently building or already operating in Brazil, Hungary, Turkey and Thailand.”

The company confirmed in February that it was planning to open a factory in Mexico, and said in July the proposed operations would create around 10,000 jobs.

Li told Bloomberg in late August that she planned to meet with Claudia Sheinbaum at some stage to discuss BYD’s plans. The president-elect will take office on Oct. 1.

The Mexican government is keen to attract foreign investment, announcing tax incentives late last year to encourage nearshoring to Mexico.

But Chinese-owned automotive plants don’t appear to be at the top of its wish list.

Mexican officials who spoke to Reuters in April said that pressure from U.S. authorities had led the Mexican government to refuse to offer incentives to Chinese EV manufacturers planning to invest in Mexico.

The United States government is determined to protect the U.S. EV industry from comparatively cheap imports and has concerns about the capacity of Chinese “smart cars” to collect data and thus compromise national security.