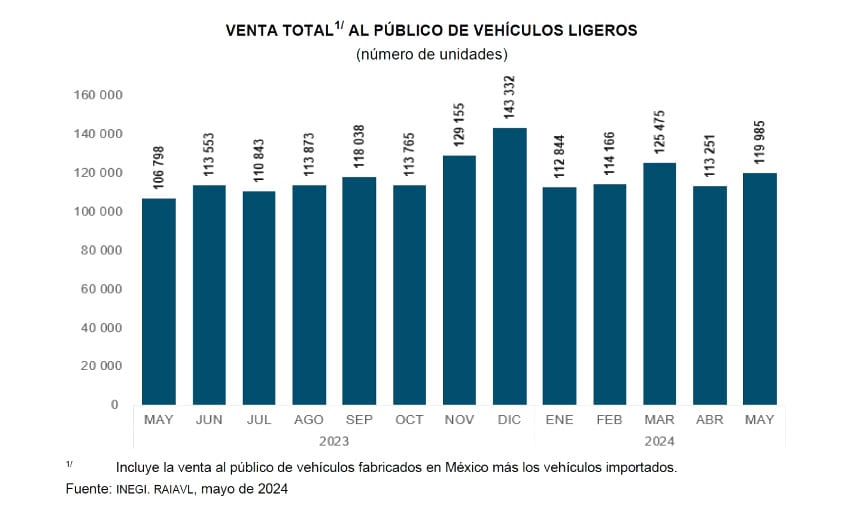

Car dealerships in Mexico had their best May in seven years last month, selling almost 120,000 new light vehicles, official data shows.

Meanwhile, new car sales in Mexico in the first five months of the year increased nearly 13% compared to the same period of last year.

The national statistics agency INEGI reported that 119,985 new light vehicles were sold in Mexico in May, a 12.35% increase compared to the same month last year.

It was the best car sales result for the month of May since 2017 and the second best monthly result this year after March, when 124,395 new cars were sold. The celebration of Mother’s Day on May 10 is one factor that likely contributed to the strong sales result last month.

In the first five months of 2024, a total of 585,721 new light vehicles were sold in Mexico, according to INEGI. The increase in percentage terms compared to the same period last year was 12.74%.

Guillermo Rosales, president of the Mexican Association of Automotive Distributors (AMDA), said that the sector has fully recovered from the pandemic-induced downturn in new car sales.

The number of units sold between January and May was 9.7% higher than in the same period of 2019.

The AMDA is now forecasting that around 1.5 million light vehicles will be sold in Mexico this year, a figure that wouldn’t be far off the 1.6 million all-time high recorded in 2016.

Rosales noted that inflation for cars, at around 2%, is below the headline inflation rate, which was 4.69% in May. He said that the arrival of Chinese brands has increased competition in Mexico and helped keep prices down. Another factor incentivizing the purchase of new cars is that many buyers can access financing with favorable terms, Rosales said.

Which automakers sold the most cars between January and May?

Nissan was the market leader in Mexico in the first five months of the year, selling 100,733 new light vehicles, or 17.2% of the total number of vehicles sold in the country. The Japanese automaker’s sales in Mexico increased 6.9% compared to the January-May period of 2023.

Ranking second to fifth for new car sales in Mexico in the first five months of the year were:

- General Motors, whose sales increased 23.1% in annual terms to 83,020 units or 14.2% of the total.

- Volkswagen, whose sales increased 23.2% annually to 52,866 units or 9% of the total.

- Toyota, whose sales increased 24% annually to 47,643 units or 8.1% of the total.

- Kia, whose sales increased 9.1% annually to 42,062 units or 7.2% of the total.

Over 55% of all new cars purchased in Mexico between January and May were made by the five automakers listed above. They all have plants in Mexico.

Ranking sixth to 10th for new car sales in Mexico in the first five months of the year were Stellantis, Mazda, Ford, Hyundai and MG Motors.

Which automakers recorded the biggest year-over-year increases in car sales?

Porsche recorded the biggest annual increase in the first five months of the year, selling 52.6% more cars than in the January-May period of last year. However, the German automaker’s sales were relatively low. They rose to 978 from 641 a year earlier.

Isuzu recorded a 43.2% increase in sales, while Honda sold 37.5% more cars than it did a year earlier.

Rounding out the top five were Ford and Mitsubishi, both of which recorded 27.2% annual increases in sales.

How are sales of Chinese cars going?

Sales by Chirey Motor and MG Motor both declined on a year-over-year basis in the first five months of the year, but JAC and Motornation increased the number of units they moved.

Chirey Motor, which includes the Chirey and Omoda brands, sold 11,683 light vehicles in Mexico between January and May, a 22.8% decline compared to the same period of last year.

MG Motor, formerly a British company, sold 20,402 units between January and May, a 7.5% decline compared to a year earlier. Despite the decline, MG was the No. 1 Chinese automaker by sales in Mexico in the first five months of the year.

Sales by JAC increased 18.5% to 9,741 units, while Motornation, which includes the BAIC, JMC and Changan brands, recorded a 22.6% increase to 4,400 light vehicles.

Great Wall Motor, which didn’t begin selling cars in Mexico until last October, sold 5,245 units in the first five months of the year.

Just under 9% of all cars sold in Mexico between January and May were made by Chirey, MG Motor, JAC, Motornation and Great Wall Motor. None of those companies have plants in Mexico.

One in five cars purchased by buyers in Mexico last year was made in China, but more than half of the 273,592 Chinese-made vehicles sold here in 2023 were manufactured by Western brands such as General Motors, Ford, Chrysler, BMW and Renault.

With reports from El Economista and Milenio