Citigroup said on Tuesday that it would purchase Deutsche Bank’s Mexican banking license to maintain its corporate investment and private banking presence in the country following the planned sale of its local retail unit, Citibanamex.

“The acquisition of this license, subject to all the corresponding regulatory approvals, facilitates our exit from consumer banking and the ability to continue with our institutional operations in Mexico,” Citi said in a statement to the Reuters news agency over email.

Citi Chief Executive Jane Fraser announced early in 2022 that the financial group would retreat from consumer, small-business, and middle-market banking in Mexico. However, Fraser also said that it would keep its Mexican investment bank and private banking in order to cater to institutional clients in the country, because “Mexico is a priority market for Citi.”

This is all part of Fraser’s efforts to sell some international operations and simplify the firm, she said. The current deal with Deutsche Bank would make it easier for Citigroup to continue offering services to large corporations and wealthy clients after the sale.

Although no financial details were given about the agreement, a buyer is expected to be named by the end of 2022 or beginning of 2023.

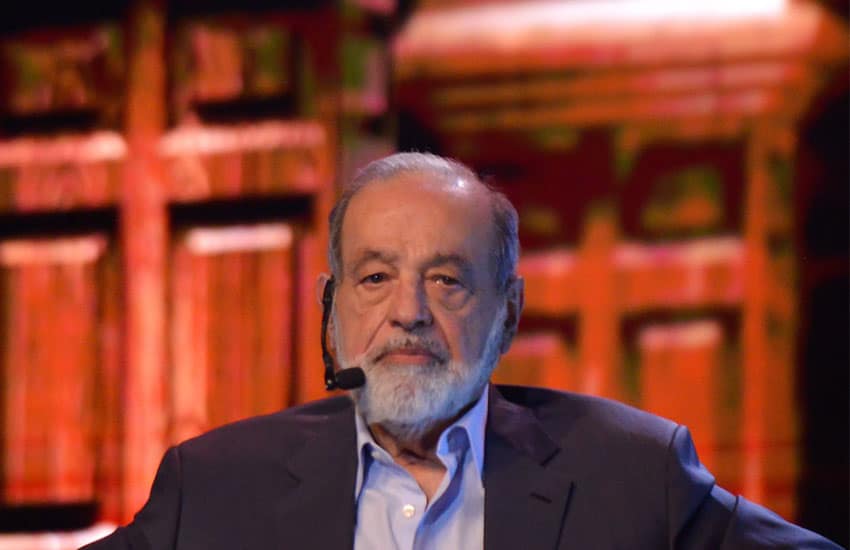

Among the main bidders to buy Citibanamex, are Grupo Financiero Inbursa, owned by billionaire Carlos Slim, and mining Mexican titan Germán Larrea, the main owner of the copper mining concern, Grupo México. Both are the front-runners to buy the local retail arm of the group valued at between US $7 billion and US $12 billion.

However, the small local firm Grupo Financiero Mifel, backed by Advent International, is leading a group of investors who will also present an offer, Mifel said in a statement.

Citigroup is asking bidders to submit final binding bids for the next round, which should mark the end of the auction process, according to the newspaper El Financiero, which said another round is unlikely.

This week, President Andrés Manuel López Obrador said in his morning press conference that he expects the deal to be closed before the year ends.

With reports from El Financiero, Milenio and Reuters.