Although General Motors Co. stock has taken a hit as a result of U.S. tariffs, the Big Three automaker insists it will not move its successful electric vehicle (EV) operations out of Mexico.

“At this time, GM has no plans to halt or relocate production of any of our EV models made in Mexico,” the director of GM de México’s EV operations Adrián Enciso told the newspaper Milenio.

Enciso, also the director of Brightdrop México (a GM subsidiary focused on developing a system of connected products for first- and last-mile delivery customers), said the success of the EV division makes it unlikely that changes will be made to production.

Production of 100% EV models as well as the assembly of Equinox, Blazer and Cadillac Optic models will continue at the company’s factory in Ramos Arizpe, Coahuila, Enciso said.

Enciso conceded that the company is studying the impact of the U.S. tariffs and analyzing plans of action for all potential scenarios.

“But for now, instructions from HQ are to stay the course with regard to production,” he said, adding that demand for EVs in the U.S. is growing, making it likely that some production in Mexico will be exported to the U.S.

Exposure to Mexico a concern

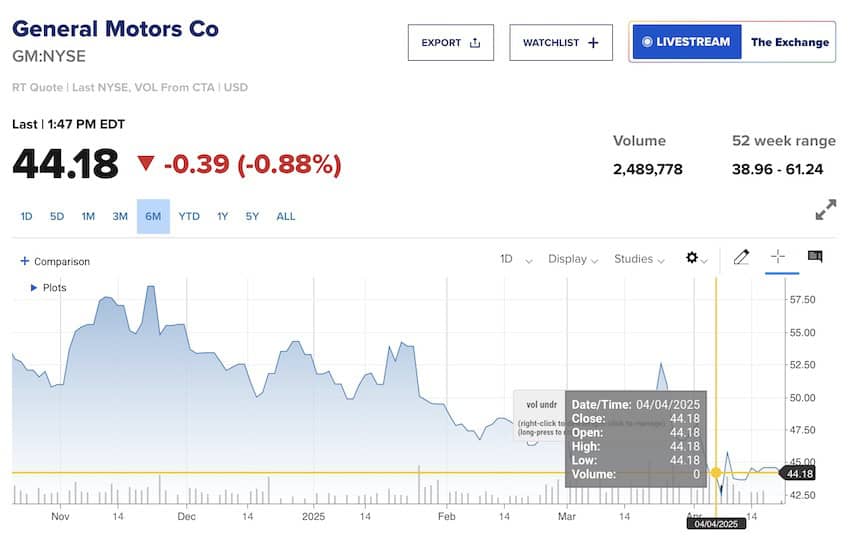

Shares of GM are down more than 17% in trading this year, and UBS downgraded the U.S. automaker’s stock to neutral on April 10, while also slashing the price target on the stock to US $51. As trading opened on April 21, GM’s stock had dipped under US $44.

Citing Deutsche Bank analysts, CNBC reported in late March that GM’s difficulties stem from the number of vehicles the automaker imports to the U.S. and its exposure to Mexico in particular.

More than 16% of GM vehicles sold in the U.S. last year were assembled in Canada and Mexico, according to CNBC. That represents the largest share of any country in terms of import volume, about double the shares of South Korea and Japan, which ranked second and third, respectively, according to GlobalData.

Barclays analyst Dan Levy told CNBC that GM relies heavily on Mexico and South Korea to produce some of its small crossovers, including its Equinox and Blazer vehicles.

GM is scheduled to report its first-quarter results on April 29.

Based on the tariffs already imposed, UBS foresees a troubling scenario for GM, projecting that the cost of GM cars made in Mexico or Canada and sold in the U.S. will go up by about US $4,300 each.

With reports from Milenio, Market Watch and CNBC

Editor’s note: The statement from Adrián Enciso originally published by Milenio offered inaccurate information about future production plans for the Spark. Upon clarification from GM, we have removed the quote from the text.