The International Monetary Fund (IMF) has revised down its economic growth forecast for Mexico in 2024 to 2.4% from 2.7%, citing “weaker-than-expected” outcomes early in the year.

The updated forecast came in the organization’s latest World Economic Outlook (WEO) report, which was published on Tuesday.

The IMF, a financial agency of the United Nations, also cut its 2025 growth projection for Mexico, lowering it to 1.4% from 1.5% in January.

“In Mexico, growth is projected at 2.4 percent in 2024, supported by a fiscal expansion, before declining to 1.4 percent in 2025 as the government is expected to tighten the fiscal stance,” the Washington D.C.-based organization said.

“The forecast for Mexico is revised downward on account of weaker-than-expected outcomes for end-2023 and early 2024, with a contraction in manufacturing.”

The lowering of the 2024 GDP forecast for Mexico — the world’s 12th largest economy — comes after the IMF in January raised its prediction for 2024 to 2.7% from 2.1% in October last year.

In its WEO Update in January, the IMF said that its 0.6 percentage point upgrade for Mexico was “largely due to carryover effects from stronger-than-expected domestic demand and higher-than-expected growth in large trading-partner economies in 2023.”

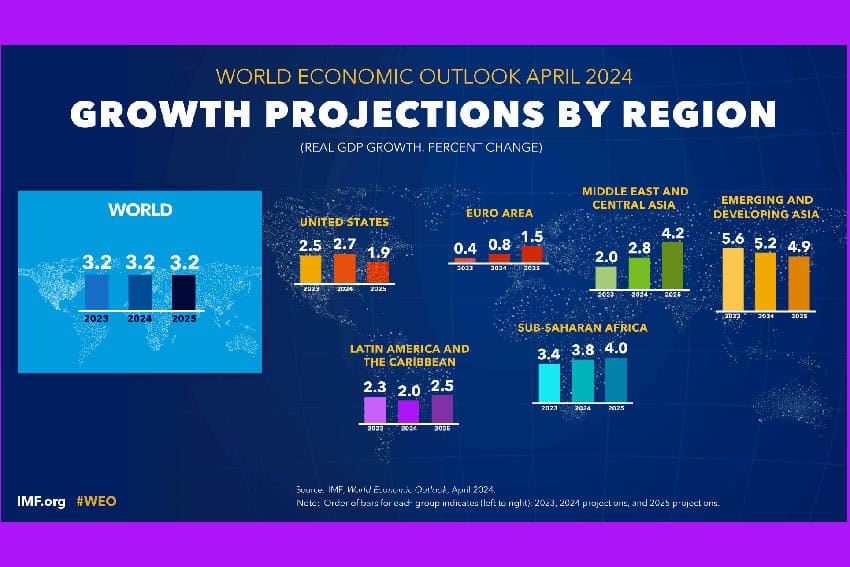

The economy of the United States — easily Mexico’s largest trading partner — grew 2.5% last year and is forecast by the IMF to expand by 2.7% in 2024.

However, the IMF said Tuesday that its 0.6 percentage point upward revision for the U.S. economy since the January WEO Update “reflects largely statistical carryover effects from a stronger-than-expected growth outcome” in 2023’s fourth quarter.

“Some of the stronger momentum” is “expected to persist into 2024,” it added.

In its latest WEO report, the IMF also revised up its forecast for overall global growth this year, lifting its projection from 3.1% previously to the current 3.2%.

Its forecast of 3.2% global growth in 2025 remained unchanged.

The lower growth forecasts for Mexico indicate that domestic consumption in Mexico and revenue from Mexican exports — a major contributor to GDP — will not be as high as previously expected.

The inflow of remittances supports internal spending, but some analysts believe that the dollar value of transfers from abroad will decline this year, although they remained strong in the first two months of 2024.

Speaking after national statistics agency INEGI reported in late February that the Mexican economy grew 3.2% in 2023, but just 2.5% in the final quarter of the year, Andrés Abadia, chief Latin America economist at Pantheon Macroeconomics, said it was “probable that growth will continue to be weak in the short term due to stricter financial conditions and less favorable remittances from abroad.”

For its part, the Federal Reserve Bank of Dallas said last week that “as job growth slows and unemployment ticks up in the U.S,” remittances to Mexico — whose real value has fallen recently due to the strength of the peso and inflation — could decline, “curtailing consumption growth in Mexico.”

“In addition, trade flows between U.S. and Mexico could be impacted, as demand for intermediate goods declines, causing manufacturing production and exports to decelerate,” the bank said.

It should be stressed that the remarks made by Abadia and the Federal Reserve Bank of Dallas were made before the IMF upgraded its outlook for the U.S. economy in 2024.

On Monday, Finance Minister Rogelio Ramírez de la O expressed another concern, saying that Mexico’s economy is “extremely sensitive” to global problems such as geopolitical tensions in the Middle East.

Speaking at an Atlantic Council event in Washington, Ramírez said that the sensitivity comes from Mexico being one of the most open economies of Latin America and having exports that account for 35% of GDP.

However, at a Council of the Americas event on Tuesday after the IMF published its updated growth forecasts for Mexico, the finance minister was more optimistic.

According to a Finance Ministry (SHCP) statement, Ramírez asserted that “the Mexican economy will continue growing next year, mainly due to the dynamism of its labor market, the strength of the internal market, the changes in global trade and the nearshoring momentum.”

In a document submitted to the federal Congress in late March, the SHCP forecast that the Mexican economy will grow between 2.5% and 3.5% in 2024 and 2%–3% next year.

In the United States on Tuesday, Ramírez asserted that the Mexican economy has “solid foundations to promote the positive nearshoring trend” and that “there is a dynamism” in the country “that is not just benefiting consolidated sectors, but also new industries that are beginning to grow.”

He also said that the government has carried out a range of “actions” to encourage companies to relocate to Mexico, including the development of industrial parks, “the expansion of commercial chains and the modernization and expansion of infrastructure.”

With reports from El Economista, El Financiero and EFE