Mexico can expect to receive almost US $26 billion in new investment in the next two to three years based on investment announcements made by foreign and Mexican companies in the first two months of 2024.

The Economy Ministry (SE) said in a new report that companies made 52 investment announcements totaling $25.84 billion between Jan. 1 and Feb. 29.

“It’s expected that said amount will enter the country in the next two or three years,” the SE said, although at least some of the money will presumably come from Mexico given that almost 40% of the total was announced by FEMSA, a Mexico-based multinational that is a Coca-Cola bottler and convenience store owner.

The SE said that the 52 investment announcements made in January and February are expected to generate 28,702 jobs. On the X social media platform, the ministry said that the announcements reaffirm that there is no better time than now to invest in Mexico “thanks to the economic policy of the Mexican government, which promotes the relocation … of strategic industries.”

The 10 largest investment announcements

FEMSA announced in February that it would invest around 170 billion pesos in Mexico over the next five years. That amount is listed as US $ 9.96 billion in the SE report.

FEMSA, which owns the Oxxo chain of convenience stores and has 17 Coca-Cola bottling plants in Mexico among other assets, said the money would go to “organic growth initiatives in our key businesses.”

The SE listed the company’s “country of origin” as both Mexico and the United States, presumably due to its association with the Atlanta-based Coca-Cola Company.

Ranking second to fifth for the size of their investment announcements in the first two months of the year are:

- Amazon Web Services (United States), which plans to invest some $5 billion in a cluster of data centers in Querétaro. (The SE said the amount announced was $4.96 billion).

- DHL Supply Chain (Germany), which plans to invest an additional $4 billion in Mexico.

- Ternium (Argentina), which intends to invest $1.94 billion in its steelworks.

- Volkswagen (Germany), which will spend around $1 billion to upgrade its plant in Puebla. (The SE listed the investment announcement at $942 million).

Having made investment announcements of between $270 million and $601 million, the other companies in the top 10 are: Solarever (China); ELAM-FAW (China); Nemak (Netherlands); Unison Shanghai (China); and Aspen Aerogels (United States).

Where will the money come from and where will it go?

The SE said that $15.83 billion, or more than 60% of the total announced in January and February, will come from the United States. That amount includes FEMSA’s investment.

The United States was the top foreign investor in Mexico last year, with $13.64 billion flowing into the country from the U.S., according to SE data.

The next biggest investors by country based on announcements made in the first two months of the year were:

- Germany: $5.23 billion or just over 20% of the total.

- Argentina: $1.94 billion or 7.5% of the total.

- China: $1.58 billion or 6.1% of the total.

- Netherlands: $404.6 million or 1.6% of the total.

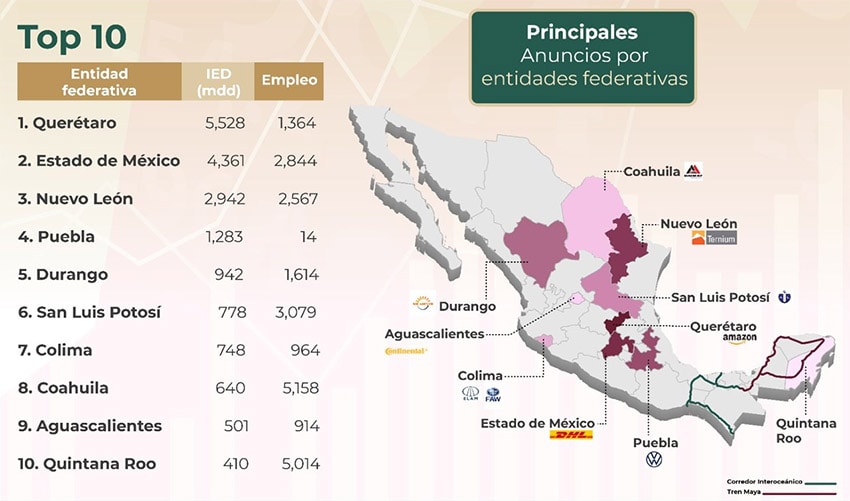

The biggest recipients of the investment are set to be Querétaro (mainly due to Amazon’s data center project); México state; Nuevo León; Puebla; and Durango.

The SE said that 62% of the money, or just over $16 billion, will go to the manufacturing sector, while just over 19%, or almost $5 billion, is headed for the “mass media” industry, which includes data centers. Just over $4.4 billion, or 17% of the total, will go to the transport sector, the ministry said.

The SE provides semi-regular updates on private companies’ investment announcements for Mexico. It previously reported that there were 363 announcements totaling over $106 billion between January and November 2023. That figure is almost triple the actual foreign direct investment (FDI) received in 2023, which was just over $36 billion.

FDI in Mexico is expected to increase in coming years.

That expectation takes into account the investment announcements already made as well as the belief that more and more foreign companies will choose to nearshore to Mexico to take advantage of proximity to the United States as well as things such as the country’s free trade agreement with that country and Canada (the USMCA) and affordable labor costs.

Mexico News Daily