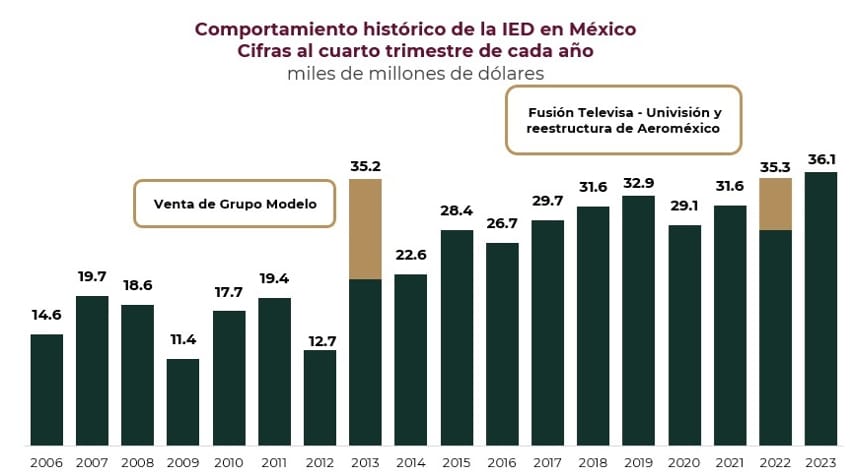

Foreign direct investment (FDI) in Mexico exceeded US $36 billion in 2023, the highest preliminary data total on record, with almost 40% of the investment coming from the United States and half the money going to the manufacturing sector.

Data published by the Economy Ministry on Wednesday night showed that FDI totaled $36.06 billion last year, a 2.2% increase compared to 2022.

Excluding the Televisa-Univisión merger and the restructuring of Aeroméxico — which together added $6.87 billion to the FDI total in 2022 — the annual foreign investment increase in 2023 was a more impressive 27%.

If the preliminary data for 2023 is compared to final data for previous years, last year was the second best year ever for FDI.

The best year on record is 2013, when the sale of brewer Grupo Modelo to Belgian multinational AB InBev added $13.25 billion to the final FDI total, which was $48.4 billion.

FDI wasn’t as high as expected

The preliminary data total for 2023 is just $3.1 billion higher than the total for the first nine months of the year and only $7 billion higher than the total for the first six months.

Just over 80% of all FDI in 2023 occurred in the first half of the year, indicating that there was a sharp slowdown in investment inflows in the final six months of 2023.

The final FDI figure is more than 20% below a $43.9 billion projection from the United Nations Conference on Trade and Development and over 5% below a $38 billion consensus forecast of 25 economists polled by the Bank of Mexico.

John Soldevilla, an economist and director of the financial consultancy ECOBI, said the FDI result for 2023 is “somewhat disappointing.”

He asserted that Mexico should already be seeing “tangible results” from nearshoring — the relocation of foreign companies to Mexico due to its proximity to the United States and other factors.

“It seems this is not occurring,” Soldevilla said.

In contrast, the SE was buoyant in its assessment of the “historic” foreign investment in 2023.

It is the “result of economic stability, competitive advantages and the good business environment in Mexico” and “affirms the confidence of foreign investors in the country,” the ministry said.

That confidence, it added, is shown through “record” reinvestment of profits by foreign companies that operate in Mexico.

New investment only accounted for 13% of FDI last year

The SE said that 74% of the FDI total, or more than $26.6 billion, came from reinvestment of profits. Many companies that have operated in Mexico for years have invested to expand their existing operations or announced their intention to do so. Those companies include French aerospace company Safran and Argentine steel manufacturer Ternium.

Just over 13% of the FDI total, or $4.82 billion, was new investment while just under 13%, or $4.61 billion, was loans and payments between companies of the same corporate group.

Janneth Quiroz Zamora, director of economic analysis at the Monex financial group, said there were expectations that “new investment linked to nearshoring” would be higher.

“The fact that new investment was limited … appears [to show] that we’re not yet seeing that great wave of investment to the country [we were expecting],” Quiroz said.

One positive is that the contribution new investment made to the 2023 FDI total was up five percentage points compared to the 8% contribution it made to the total for the first nine months of last year. However, the 13% figure is well below the 48% contribution new investment made to the FDI total in 2022.

The figure should rise in coming years as foreign companies made investment announcements totaling well over $100 billion in 2023. One such company, Tesla, is expected to begin construction of its Nuevo León “gigafactory” this year.

Where did Mexico’s FDI come from?

SE data shows that 87% of total FDI in 2023 came from just 10 countries.

Around 38% of total investment, or $13.64 billion, came from the United States. The SE highlighted that Citigroup, General Motors and Ford are among the U.S. investors in Mexico.

While the United States remained the top foreign investor in Mexico, its investment total declined 9% compared to 2022.

Via companies such as the energy firm Iberdrola and the bank BBVA, Spain was the second largest foreign investor in Mexico last year, contributing $3.77 billion, or just over 10% of the FDI total, while Canada ranked third, investing $3.47 billion, or almost 10% of the FDI total, through companies such as TC Energy and Scotiabank.

The other countries in the top 10 were:

- Japan: $2.9 billion or 8% of FDI.

- Germany:$2.4 billion or 7% of FDI.

- Argentina: $2.2 or 6% of FDI.

- United Kingdom: $936 million or 3% of FDI.

- Netherlands: $892 million or 2% of FDI.

- Belgium: $759 million or 2% of FDI.

- South Korea: $497 million or 1% of FDI.

Which sectors and states did the money go to?

Just over 50% of the 2023 FDI total — $18.08 billion — went to the manufacturing industry.

The transport equipment sector, which includes automakers, was the biggest winner, receiving 41% of the manufacturing investment. The remaining 59% was split between a number of sectors including beverages and tobacco; metals; computer equipment; and chemicals.

The other 50% of total FDI went to several sectors including financial services; mining; and temporary accommodation.

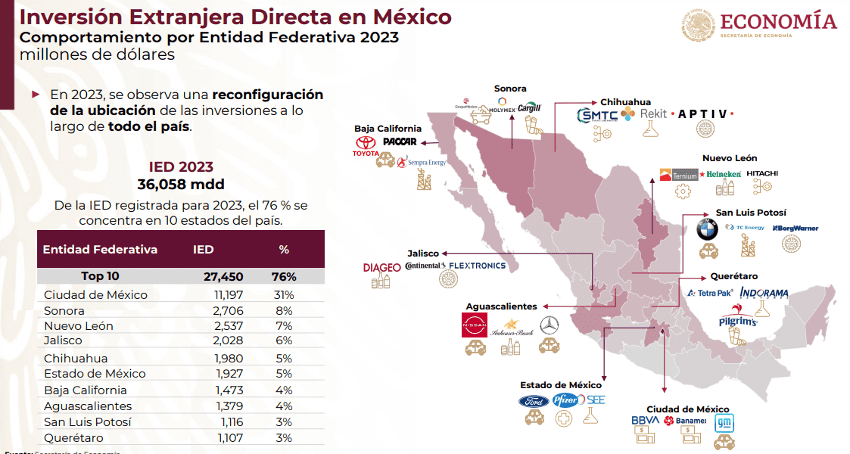

Almost one-third of FDI — 31% — went to Mexico City, where many major international companies have offices.

Sonora ranked second, receiving 8% of total FDI last year, followed by Nuevo León (7%); Jalisco (6%) and Chihuahua (5%).

The federal government has invested heavily in Mexico’s southern and southeastern states, but none was among the top 10 recipients of FDI last year.

The development of the Interoceanic Corridor of the Isthmus of Tehuantepec, which will include 10 new industrial parks, could help Oaxaca and/or Veracruz enter the top 10 in coming years.

With reports from El Financiero and El Economista