Shrugging off the weight of a 25% tariff from the United States, Mexico’s steel industry doubled down on its commitment to President Sheinbaum’s Plan México last week, confirming it will invest US $8.7 billion over the next five years to increase domestic production.

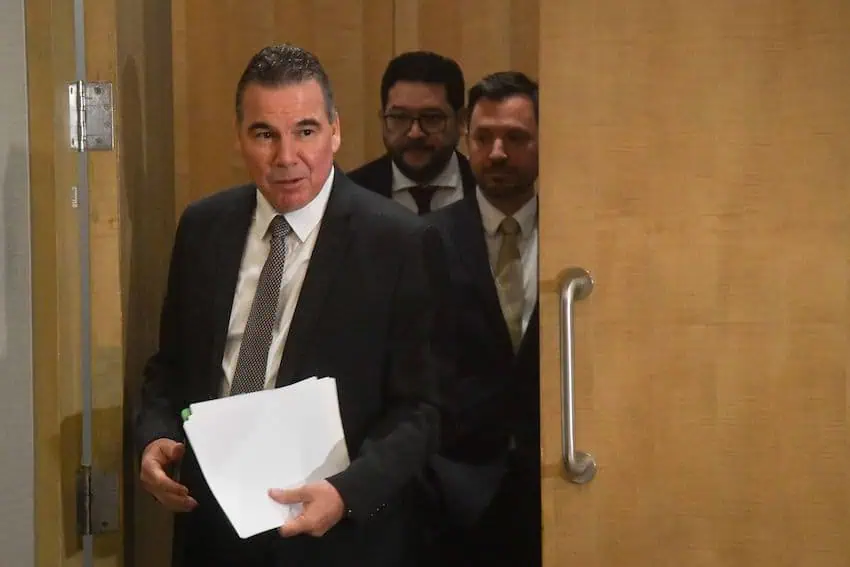

“The funds to expand facilities will go ahead with or without [U.S.] tariffs,” said National Steel and Iron Industry Chamber (Canacero) President Víctor Martínez Cairo, while emphasizing that all members of his Chamber support Plan México.

Plan México — officially The National Strategy for Industrialization and Shared Prosperity — is President Sheinbaum’s economic development project focused on strengthening the country’s role in global value chains.

Canacero’s expressed goal is to fulfill all of Mexico’s steel needs via local production. To do so, however, Canacero has suggested that the Mexican government will have to take action.

One of those actions could be to abandon the Trans-Pacific Partnership (TPP) free trade agreement. Canacero has asked the administration to do just that, or at least to consider applying tariffs to steel imported from Vietnam and Malaysia.

A significant amount of steel of dubious origin is imported to Mexico from Vietnam and Malaysia, with the U.S. market as the ultimate destination, Canacero claims. The implication is that China is using TPP to triangulate its steel through Mexico and into the U.S., a practice that the U.S. government is determined to eliminate.

Members of Canacero say they are willing to absorb the tariffs on steel imports to the U.S. in exchange for a crackdown on Asian imports by the Mexican government.

While expressing confidence in the negotiations Mexico’s government has undertaken to negotiate U.S. tariffs on steel, Martínez Cairo said he believes there are “opportunities to create synergies with the United States.”

“This is the moment to join forces to eliminate disloyal practices that affect our nations and our industries,” he said. “We want to work together as a regional bloc to strengthen national and regional content.”

Martínez Cairo said that North American neighbors import roughly 9.7 million tonnes of steel from Asia each year. Replacing this with domestic and regional production would be a boon to both countries, he said.

Mexico consumes approximately 30 million tonnes of steel each year. Canacero says its five-year investment plan, first publicized in February, seeks to satisfy all of the country’s domestic needs, complementing its own production with imports from the U.S. and ending reliance on heavily subsidized Chinese steel.

Bilateral trade in steel between Mexico and the U.S. is approximately 7.6 million tonnes annually — 4.4 million tonnes from the U.S. to Mexico and 3.2 million tonnes from Mexico to the U.S.

As such, Martínez Cairo points out, the U.S. has a 1.2 million-tonne trade surplus in steel vis-a-vis Mexico, making a trade war illogical.

With reports from Forbes México, El Economista and Axis Negocios