United States President Donald Trump’s proposed 50% tariff on copper imports would affect Mexican exports worth around US $1 billion per year.

However, President Claudia Sheinbaum on Wednesday raised the possibility that the tariff won’t apply to Mexican exports of the metal.

14/ Live Copper Tariff Decision:

Trump asked about copper tariffs during meeting.

Scott suggested 50% rate.

Trump approved immediately: “50%.” pic.twitter.com/WssCVWBDsJ

— Karl Mehta (@karlmehta) July 9, 2025

At a cabinet meeting on Tuesday, Trump enumerated the various products on which his administration has imposed import tariffs.

“We did steel, as you know 50%; we did aluminum 50%; lumber just came out and we did cars. And today we’re doing copper. I believe the tariff on copper we’re going to make it 50%,” he told reporters.

U.S. Commerce Secretary Howard Lutnick said in a subsequent interview that the tariff on copper would likely take effect at the end of July or on August 1. In February, Trump directed Lutnick to “initiate an investigation under section 232 of the Trade Expansion Act to determine the effects on national security of imports of copper in all forms.”

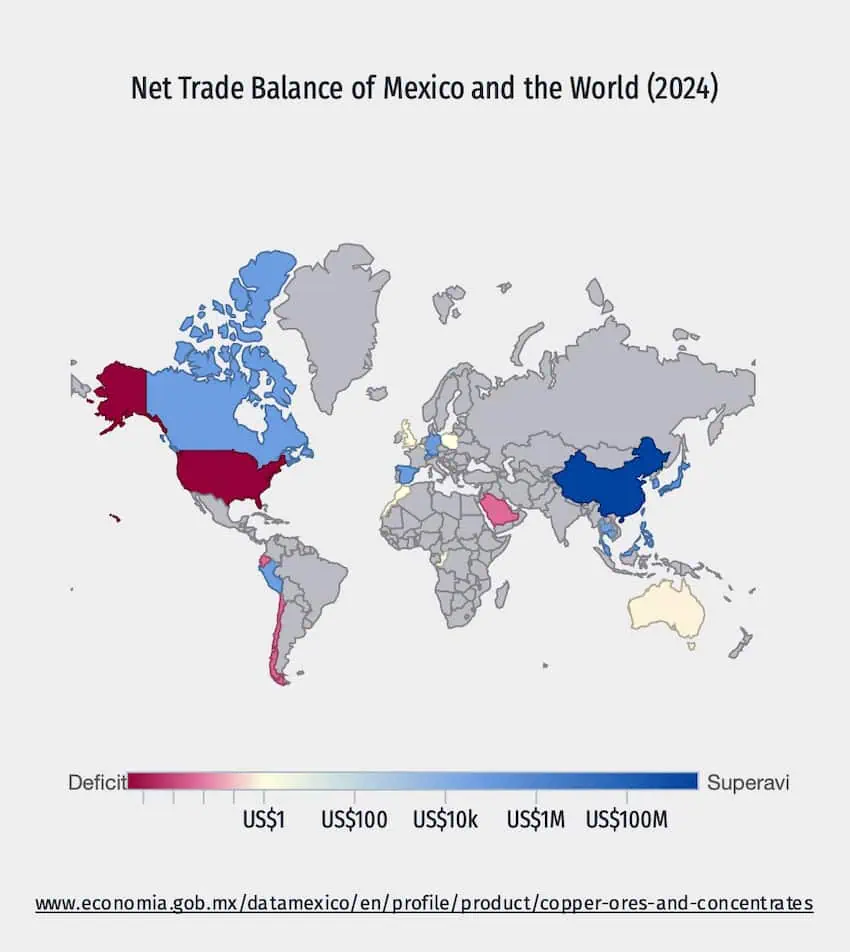

Mexico was the third-largest exporter of copper and copper products to the United States in 2024, behind Chile and Canada. Those exports were worth US $976 million, according to U.S. Department of Commerce data.

The United States spent $17.11 billion on copper imports last year. Therefore, Mexico had a 5.7% share of the United States’ market for imports of the essential industrial metal.

Chile, whose copper exports to the United States were worth $6.11 billion last year, had a 35.7% share, while Canada, whose copper exports to the U.S. were worth $3.99 billion, had a 23.3% share.

Mexico’s copper exports to the United States in the first five months of the year were worth $419 million, a 12% annual increase. Despite the increase, Mexico was only the sixth-largest copper exporter to the U.S. between January and May.

Mexico exports significantly more copper to China than to the United States. The value of Mexican copper ores and concentrates exported to China in 2024 was $3.72 billion, according to Mexico’s Economy Ministry.

Sonora is easily Mexico’s top copper-producing state, accounting for around 80% of total output. The metal is “critical to electric vehicles, military hardware, the power grid and many consumer goods,” Reuters reported.

Sheinbaum: ‘We’re always going to seek the best conditions for Mexico’

At her Wednesday morning press conference, Sheinbaum highlighted that Mexico exports more copper to China than the United States.

“We export more [copper] to China than the United States, but we do export to the United States. A lot of it is scrap copper that is refined in the United States,” she said.

Sheinbaum stressed that the United States needs copper from Mexico.

“That is the big issue when they impose these tariffs for the protection of the United States economy and for additional production. In reality, a good part of exports is because United States industry and companies need [foreign copper],” she said.

After saying “we’re going to wait” to see what happens with the United States’ proposed copper tariff, Sheinbaum noted that a delegation of Mexican officials led by Economy Minister Marcelo Ebrard will meet with U.S. officials in Washington on Friday to work on the bilateral “global agreement” she proposed to Trump last month.

She said on June 18 that the U.S. president had agreed to her proposal to establish a “global agreement” between Mexico and the United States covering security, migration and trade.

On Wednesday, Sheinbaum said that the first “conversations” between Mexico and the United States to that end would take place on Friday.

“Of course, we’re always going to seek the best conditions for Mexico,” she said.

In recent months, Ebrard has traveled regularly to Washington to engage in trade discussions with Trump administration officials, including Lutnick. On behalf of the Mexican government, he is seeking to win an exemption from, or at least a reduction of, the tariffs the United States has imposed on imports of steel, aluminum and cars from Mexico, even though the two countries have a free trade agreement, the USMCA, which also includes Canada.

On Tuesday, Ebrard said he would seek more details about the United States’ proposed copper tariff.

“I will have a call with United States authorities today and then I’ll be able to give you a more precise position because even they didn’t know [the details],” he told reporters.

“We need to know what it applies to. We’re going to understand that first,” Ebrard said.

While it exports copper to countries including China and the United States, Mexico imports copper from Chile and Peru for use in a range of manufactured products. The newspaper El Financiero reported that Chilean and Peruvian copper in goods manufactured in Mexico “could be subject” to the U.S. tariffs the Trump administration intends to impose.

That would “affect the competitiveness of our most sophisticated exports and make the entire industrial value chain more expensive,” José de Jesús Rodríguez, a tax analyst, told El Financiero.

With reports from El Economista, El Financiero and Reuters