Mexico continues to consolidate its position as the world’s top exporter to the United States, shipping products worth more than US $162 billion to its northern neighbor in the first four months of the year, according to U.S. government data.

Data published by the U.S. Census Bureau and the U.S. Bureau of Economic Analysis on Thursday also shows that Mexico earned more revenue from its exports to the U.S. in April than in any previous month.

Mexico’s exports to the U.S. in April were worth $43.06 billion, a 13.2% increase compared to the same month of 2023.

Export revenue in the first four months of the year was $162.91 billion, a 6.2% increase compared to the same period of last year.

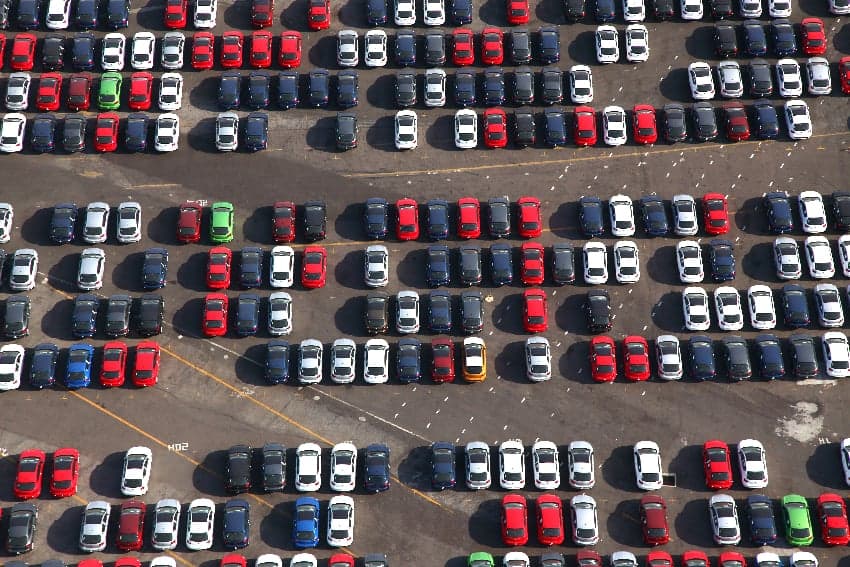

Most of Mexico’s export income comes from manufactured goods including cars, computers and machinery, but it is also a significant exporter of oil and agricultural products to the U.S.

Mexico’s total share of the U.S. market for imports in the first four months of 2024 was 15.9%, up from 15.4% last year and 14% in 2022.

Canada and China ranked second and third, respectively, for exports to the U.S.

Canada’s revenue from exports to the U.S. fell 0.8% annually in the first four months of the year, while China’s income declined 2.5%.

In 2023, Mexico surpassed China to become the top exporter of goods to the United States.

Mexico has benefited from a “decoupling” of the world’s two largest economies amid the ongoing China-United States trade war, as well as the relocation of foreign companies here as part of the nearshoring trend.

Imports from the U.S. also increased between Jan. and April

The U.S. data also shows that Mexico spent $29.39 billion on imports from the United States in April and $109.56 billion in the first four months of the year.

Imports to Mexico from the U.S. increased 18.2% in annual terms in April and 3.4% in the January-April period.

The strength of the Mexican peso is a factor that contributed to the increase in spending on imports in the first four months of the year, the El Economista newspaper reported.

Mexico remains the United States’ top trade partner

Two-way trade between Mexico and the United States was worth $272.47 billion between January and April, a 5% increase compared to the same period of last year.

Trade with Mexico accounted for 16% of the United States’ total trade in the first four months of the year. Canada was the United States’ second largest trade partner with a 14.8% share of total trade, while China ranked third with a 10.4% share.

Mexico recorded a trade surplus of $53.5 billion with the U.S. between January and April.

Other ‘need-to-know’ economic data

- The USD:MXN exchange rate was 18:00 at 3 p.m. Mexico City time on Thursday, according to Bloomberg.

- The national statistics agency INEGI reported in late May that Mexico’s economy grew 1.9% in annual terms in the first quarter of 2024.

- The annual headline inflation rate was 4.78% in the first half of May.

- Mexico’s unemployment rate was 2.6% in April.

- The Bank of Mexico’s benchmark interest rate is set at 11%. The central bank’s board will hold its next monetary policy meeting on June 27.

With reports from El Economista and El Financiero