Tala, a United States-based microlender that offers small loans to clients in Mexico and a few other countries, announced on Wednesday that it has secured a US $150 million debt facility to expand its business in Mexico.

The California-based fintech company said in a press release that it closed on the debt facility with Neuberger Berman, a New York-based investment management firm.

“This facility will support the company’s rapidly growing business in Mexico,” Tala said.

“Tala intends to use the proceeds from this facility to enhance its lending capabilities and fuel its ongoing mission to deliver truly scalable, data-enabled financial infrastructure,” the company said.

“… With initial committed capital of US $75 million, the facility enables Tala to draw up to US $150 million, making this Tala’s largest capital markets transaction to date and underscoring the strength of its operations and growth trajectory in Mexico,” Tala said.

In an interview with Reuters, Tala’s CEO and founder Shivana Siroya said that many of the company’s clients in Mexico are owners of small businesses. She said that Tala has more than 3 million clients in Mexico and provided loans worth more US $500 million in the country last year.

She said that the capital Tala will be able to access via the debt facility “is for the growth of our Mexico business.”

“As we think about how to widen access, it’s … starting to talk about different platforms, embedded partnerships,” Siroya told Reuters.

“The second piece is, how do we provide more value? “So whether that’s higher [credit] limits, more dynamic pricing, starting to think about specific credit products,” she said.

According to Tala’s Mexico website, the maximum loan is currently 10,000 pesos (about US $500) while the minimum is 500 pesos (US $25). The duration of personal loans ranges from 15 to 61 days and fixed interest rates start at 11%.

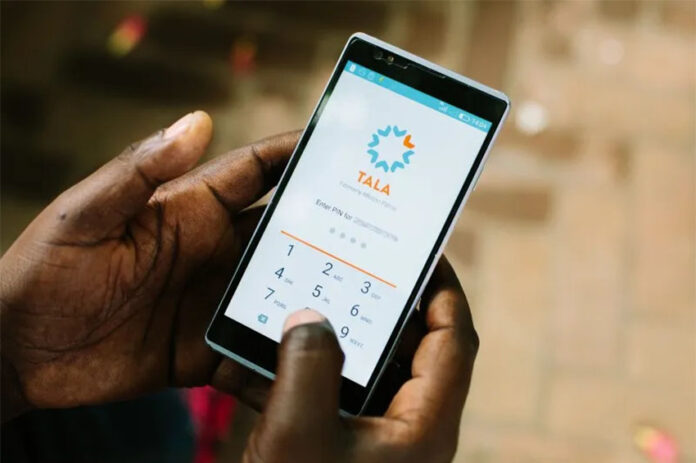

Clients can apply for loans using Tala’s mobile app, and the company says the loans can be approved in minutes without checking a borrower’s credit history.

Siroya said that Tala’s average loan in Mexico is about 2,300 pesos (US $114).

Tala also offers loans in Kenya, India and the Philippines.

Siroya told Reuters that there is “more to come this year” for Tala in Latin America, indicating that it will expand into other countries in the region.

Among the other fintechs that offer loans in Mexico are Brazil’s Nubank and Mexico City-based Konfío.

With reports from Reuters