State oil company Pemex plans to settle a debt with suppliers totaling up to US $6.4 billion between March and April, according to Rocío Abreu, the head of the Chamber of Deputies’ Energy Commission.

Abreu told the newspaper El Economista that the figure represents about a quarter of its total debt to suppliers.

“This month, we will disburse US $3 billion followed by $3.4 billion next month,” Abreu said in an interview with El Economista during the commemoration of the 87th anniversary of the state oil company’s expropriation at the Pemex Tower in Mexico City.

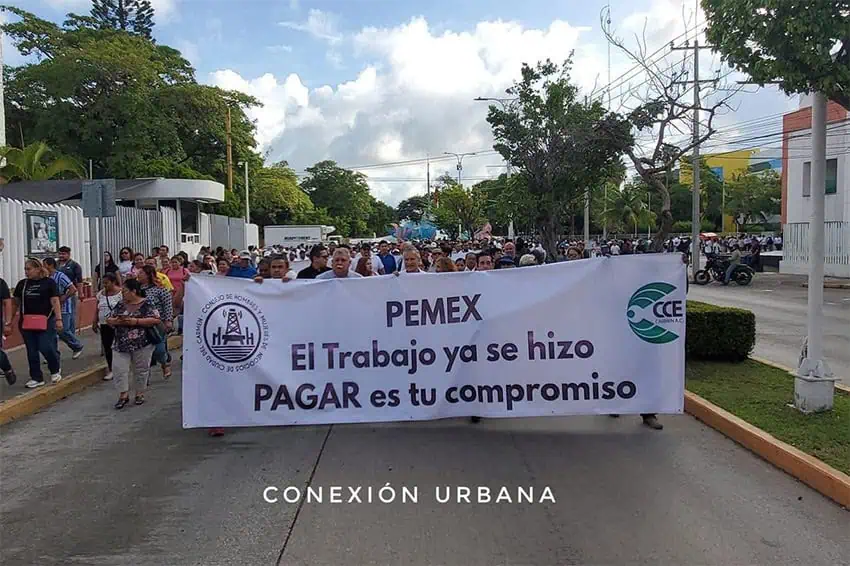

She added that these advances include payments to small and medium-sized companies (SMEs) and micro-companies (MSMEs) in the states where Pemex’s debts have increased, such as Campeche, Tabasco, Veracruz, Tamaulipas and Chiapas.

“We’re working with Petróleo Mexicanos, but also with the Finance Ministry, to ensure this benefits small, medium-sized, and large businesses,” she said.

As for the origin of the funds, Abreu explained that while part of the funding comes from Pemex, the federal government will also contribute. Additionally, a bank factoring plan allows those with outstanding debts to convert their invoices into collectible assets backed by Pemex’s promise of payment.

At the end of last year, Pemex’s debt to suppliers exceeded US $25 billion, reaching historic highs with a 26% annual increase.

According to El Economista, Pemex’s supplier debt increased after President Claudia Sheinbaum took office in October of last year. The new administration temporarily paused several payments to review their origins and negotiate agreements with the Finance Ministry to avoid placing an overwhelming short-term financial burden on Pemex.

In an interview with Radiofórmula, Rafael Espino de la Peña, president of the Mexican Association of Petroleum Service Companies (Amespac) — which includes multinational companies such as Baker Hughes, Emerson, Halliburton, and Grupo México — said that Abreu’s statement is encouraging.

“Any payment is welcomed. It is always encouraging to hear that a payment will be made, but we’re waiting for it to actually happen,” he said.

Espino noted that Pemex made no payments in the last three months of the previous administration — which ended in September 2024 — and that the situation remains unchanged since Sheinbaum took office, as unnecessary reviews of payment delays occurred despite each project having a budget allocation for contracting.

According to Espino, SMEs have shut down due to insufficient financial resources as they awaited payment. He also noted that the recent drop in Pemex’s liquid hydrocarbon production is linked to a reduced supply of goods and services caused by the company’s failure to make payments.

“[Lack of payment] seriously compromises production,” Espino highlighted “Production has been declining because [capital expenditures] were reduced.”

Pemex is one of the world’s most indebted oil companies, with debt and liabilities in excess of US $100 billion.

With reports from El Economista