Some suppliers and service providers for state oil producer Pemex are facing severe financial difficulties as the beleaguered company has fallen behind on payments.

Several businesses have been meeting with Pemex officials to address the mounting debt, but as of Thursday no payment plans had been announced, according to El Economista newspaper.

“I can confirm that no payments have been made nor is there a tentative date for payments to be made,” one oil drilling company rep told El Economista. “It appears possible that we might not get paid until February.”

Oil and Gas Magazine reported on Wednesday that Pemex canceled a Monday meeting with Senate Energy Committee members during which the debt to subcontractors was to be discussed.

Committee member Óscar Cantón Zétina, a senator from the oil-producing state of Tabasco, expressed a desire to reschedule the meeting in the near future. Before the congressional session went into recess last week, Cantón had presented a point of order demanding that Pemex’s debt with suppliers be made public.

President Sheinbaum orders review of Pemex debt

Pemex has been the world’s most indebted oil company for years and owed national and international service providers nearly US $22 billion back in April, according to the news agency Reuters.

Earlier efforts to reduce its overall debt of nearly US $100 billion have done little to ease the debt owed to suppliers which now sits at around US $20.5 billion, according to El Economista.

On Nov. 28, President Claudia Sheinbaum ordered a review of the debt owed to suppliers, saying that a variety of payment mechanisms were being studied and refined, though she provided no details.

That same day, it was reported that Pemex had placed a freeze on new contracts with service providers.

The news agency Bloomberg News reported that an internal company document described the action as a temporary halt by Pemex’s exploration and production arm that applied to new agreements with contractors that had not been previously formalized.

A Pemex statement explained that it would be performing an analysis of pending deals coming due before year-end and that select contracts deemed necessary could still be signed.

The Finance Ministry is reportedly working “to enlist a group of banks to provide Pemex with financing to pay off the company’s debts to service providers,” Bloomberg reported, but such loans may come too late for some suppliers.

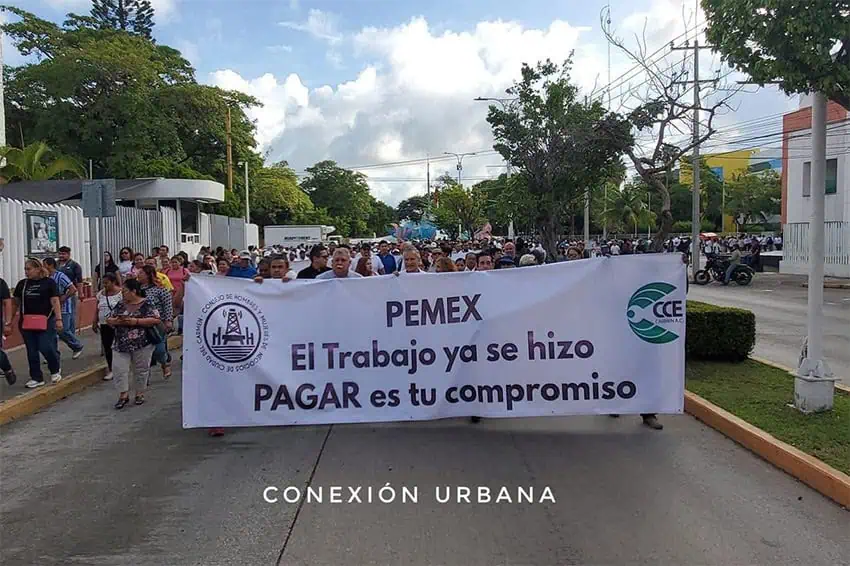

Suppliers in Campeche sound off

Mexico Business News reported on Dec. 3 that business leaders in the state of Campeche sounded the alarm over the delayed payments from Pemex.

Many local companies are having difficulty meeting year-end obligations, such as employee bonuses, social security contributions, taxes and payments to Infonavit, Mexico’s public housing agency.

Some of the debt dates back to 2023, El Economista reported. Several businesses face threats of asset seizure due to their own unpaid loans, Mexico Business News reported, and the situation is so dire that an organization called “The Broad Front of Subcontractors Serving Pemex” was formed.

The Front staged several demonstrations in November, threatened to blockade a bridge in Ciudad del Carmen and announced a protest march for Friday.

Around the same time, Reuters reported, the Mexican Association of Oil Service Companies (Amespac) sent a letter to Pemex asking the company to pay its members overdue debts totaling US $5.1 billion. The association represents some of the most important oil service providers in Mexico.

Amespac argued that just setting up a schedule “would provide certainty for operations and allow companies to fulfill their commitments.”

“This situation has caused an adverse effect on our finances and a negative impact in the areas where we operate,” it wrote.

The financial difficulties impact a variety of businesses, including multinationals such as Baker Hughes and Halliburton.

Small companies also have been hit by the debt crisis. El Economista reported that a Campeche helicopter company that transports oil workers to offshore rigs closed down this month.

In the state of Tamaulipas, state Energy Development Minister José Ramón Silva said roughly 700 local businesses have been affected, including 400 companies that had bid on contracts or applied to be formally registered as suppliers.

With reports from El Economista, Bloomberg News and Mexico Business News