The Mexican peso broke through the 19.50 to the US dollar barrier on Thursday, depreciating for a fourth consecutive day as the government’s judicial reform proposal continues to weigh on the currency.

The peso closed at 19.28 to the dollar on Wednesday, but sank to as low as 19.52 to the greenback Thursday morning, according to Bloomberg data.

The currency subsequently regained some of the ground it lost, but by late afternoon the USD:MXN exchange rate was back at 19.52.

That rate represents a depreciation of 4.5% for the peso compared to its closing position of 18.64 to the US dollar last Friday. The last time the peso was weaker was in late 2022.

The government’s proposed judicial reform — which seeks to allow citizens to directly elect judges — has contributed to the weakening of the peso this week.

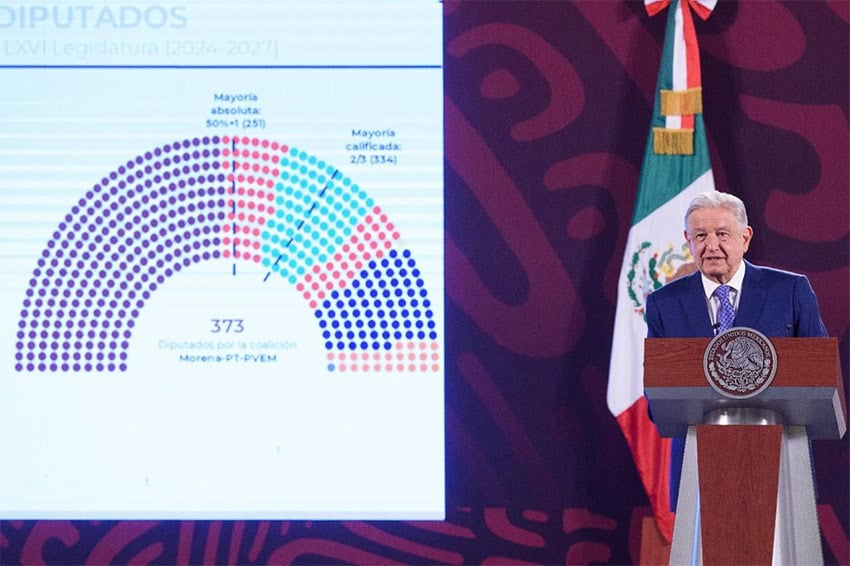

The proposal — which critics argue threatens the independence of the judiciary — could be approved as soon as next month, when the ruling Morena party and its allies will have a supermajority in the lower house of Congress and a strong majority in the Senate.

If approved, citizens will be able to elect Supreme Court justices and other judges from candidates put forward by the sitting president, Congress and the judiciary itself. The first judicial elections are slated to be held next year.

Among the additional factors that weighed on the peso on Thursday were a general strengthening of the dollar and data showing that inflation declined in the first half of August.

The decline in inflation as well as data showing that quarter-over-quarter economic growth slowed to just 0.2% between April and June increased the likelihood that the Bank of Mexico (Banxico) will make a second successive cut to interest rates after its board’s monetary policy meeting on Sept. 26.

The wide gap between Banxico’s key rate — currently 10.75% — and that of the United States Federal Reserve (5.25%-5.5%) supported the peso for a long period, but an unwinding of global carry trades and political developments in Mexico have hurt the currency in recent weeks.

Kimberley Sperrfechter, emerging markets economist at Capital Economics, said that the decline in inflation to 5.16% in the first half of August, along with weak economic data for June and “the Fed’s confirmation that it will kick off its loosening cycle next month means that we expect Banxico to lower its policy rate by another 25bp, to 10.50%.”

In addition to publishing inflation data, national statistics agency INEGI reported Thursday that month-over-month economic growth in Mexico was 0% in June. Annual growth was 1.1%.

US ambassador: ‘Direct election of judges is a major risk’ to democracy

In a statement posted to social media on Thursday afternoon, United States Ambassador to Mexico Ken Salazar outlined his opposition to the judicial reform proposal President Andrés Manuel López Obrador sent to Congress in February.

“Based on my lifelong experience supporting the rule of law, I believe popular direct election of judges is a major risk to the functioning of Mexico’s democracy,” he said.

“Any judicial reform should have the right kinds of safeguards that will ensure the judicial branch will be strengthened and not subject to the corruption of politics,” Salazar added.

The ambassador also said he believes that “the debate over the direct election of judges … as well as the fierce politics if the elections for judges in 2025 and 2027 were to be approved, will threaten the historic trade relationship we have built, which relies on investors’ confidence in Mexico’s legal framework.”

“Direct elections would also make it easier for cartels and other bad actors to take advantage of politically motivated and inexperienced judges,” Salazar said.

“… We understand the importance of Mexico’s fight against judicial corruption. But direct political election of judges, in my view, would not address judicial corruption nor would it strengthen the judicial branch of government. It would also weaken the efforts to make North American economic integration a reality and would create turbulence as the debate over direct election will continue over the next several years.”

Analyst: Approval of reform could ‘rapidly deteriorate’ business environment

Gabriela Siller, director of economic analysis at Banco Base, wrote on X that the approval of the judicial reform proposal “could rapidly deteriorate the environment to do business” in Mexico.

She also said that approval of the reform could “lead the Mexican economy toward a recession, as occurred in 2019 after the cancellation of the construction of the [new] Mexico City airport.”

Siller asserted that the reform will have a negative impact on economic growth by slowing down new inflows of foreign direct investment as well as reinvestment of profits by companies that already have a presence in Mexico.

“Given that the reform to the judicial power would weaken Mexico’s legal framework, the administration of justice and the application of USMCA rules in the country, it places the trade relationship with the United States at risk and would inhibit new investments from that country,” she wrote.

Siller said earlier this week that approval of the reform would “move Mexico away from the nearshoring opportunity.”

La reforma al Poder Judicial podría tener un impacto sobre México de al menos 1.9% del PIB, por el freno en la llegada de nuevas inversiones y el freno de reinversión de utilidades de las empresas extranjeras que están en México.

A esto se sumaría el efecto dominó sobre otras…

— Gabriela Siller Pagaza (@GabySillerP) August 22, 2024

Concern about the proposed reform is widespread and growing, including among court workers and judges, who commenced a strike this week.

New York-based investment bank Morgan Stanley downgraded its investment outlook for Mexico earlier this week, issuing an “underweight” warning on Mexican shares due to concern over the proposed judicial reform.

For its part, the Bank of America described the reform as “very high risk” for Mexico’s corporate sector.

US banks are ‘misinformed’, says Sheinbaum

President-elect Claudia Sheinbaum asserted Wednesday that both Morgan Stanley and the Bank of America are “misinformed” because the approval of the judicial reform will lead to “a better justice system in Mexico.”

The banks and other foreign companies and individuals with investments in Mexico have nothing to worry about, said Sheinbaum, repeating a view she has expressed previously.

She also rejected claims that the reform poses a threat to the USMCA, the North American free trade pact that superseded NAFTA in 2020.

Sheinbaum will take office Oct. 1, while recently elected lawmakers will assume their positions in the Chamber of Deputies and the Senate a month earlier.

The coalition led by Morena will be able to approve the judicial reform proposal and other constitutional bills without the support of opposition lawmakers in the lower house as it will have a two-thirds majority. It will require the votes of three opposition senators to get such initiatives through the Senate.

With reports from Aristegui Noticias, Reuters, El Financiero and FX Street