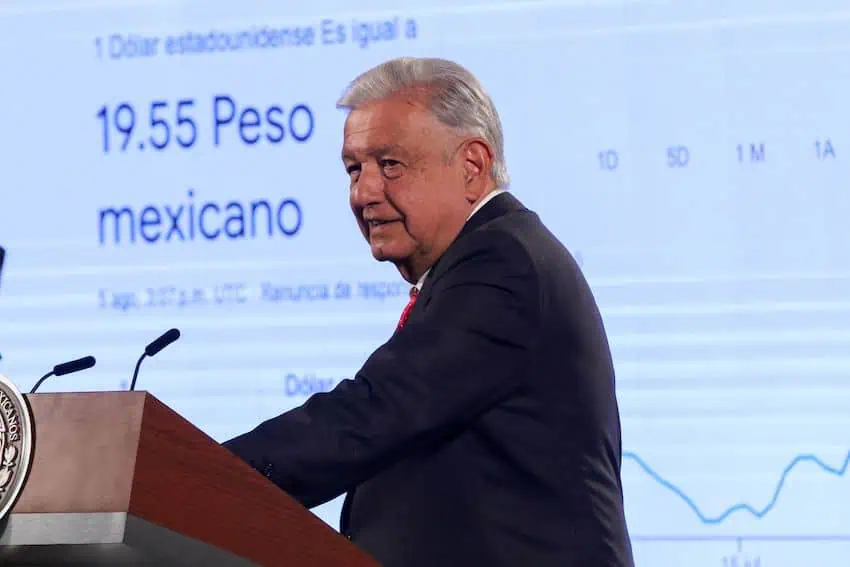

The Mexican peso plummeted to above 20 to the US dollar late Sunday as fears of a recession in the United States upended markets around the world.

Bloomberg data shows that the peso slumped to 20.16 to the greenback shortly after 10 p.m. Mexico City time on Sunday.

Compared to its position at the close of North American markets on Friday, the peso depreciated by almost 5% to reach 20.16 to the dollar.

It was the first time since October 2022 that the USD:MXN exchange rate went above 20.

At 12:30 p.m. Mexico City time on Monday, the peso had recovered considerably from its position on Sunday night to trade at 19.42 to the dollar.

In a post to X late on Sunday, Banco Base’s director of economic analysis Gabriela Siller said that the depreciation of the peso wasn’t caused by any internal factor in Mexico.

The weaker peso is “a consequence of the collapse of the Japanese market and fear of the possibility of a recession in the United States and an escalation of the war in the Middle East,” she wrote.

Earlier on Sunday, Siller said that the expectation that the Bank of Japan will again lift its key interest rate — after raising the rate to 0.25% last week — and “aversion to risk about Mexico” were two factors weighing on the peso.

“After everything, it seems that the Japanese carry trade was not so good for Mexico,” she said in another post to X.

Bloomberg reported Monday that “an unwinding of global carry trades is helping to jolt markets around the world.”

Today is shaping up to be one of the heaviest trading days for S&P 500 members that we’ve seen since the global financial crisis.

Four hours into the session and more than 2.3 billion shares have already changed hands https://t.co/RCqdwJfcjk pic.twitter.com/eKyvpNph6k

— Bloomberg Markets (@markets) August 5, 2024

“The yen and yuan pushed higher Monday, while the Mexican peso extended its decline as traders continued to roll back the popular trading strategy,” the news agency reported.

According to Investopedia, “a carry trade is a trading strategy that involves borrowing at a low-interest rate and investing in an asset that provides a higher rate of return.”

The Bank of Mexico’s key interest rate is currently set at a near-record high of 11%.

Bloomberg reported Friday that Japanese individual investors had “cut bullish bets on the Mexico peso against the yen to the lowest this year, in a sign of how interest-rate hikes at home may reduce their appetite for higher-yielding assets abroad.”

The peso depreciated to above 19 to the dollar on Friday after data showed that hiring in the United States slowed significantly in July.

Janneth Quiroz, the Monex financial group’s director of economic analysis, said Friday that the July employment numbers and separate data showing that manufacturing activity in the United States dropped to its lowest level since November last month were generating fear that an economic slowdown in the U.S. could become more pronounced.

A slowdown in the U.S. could negatively affect Mexico’s economy and reduce the inflow of dollars to Mexico due to “lower exports, remittances and foreign direct investment,” the analyst wrote on X.

The New York Times reported Monday that “a wave of panic” was rippling through markets, “with stocks falling sharply in the United States and around the world as investors zeroed in on signs of a slowing American economy.”

A volatile year for the peso

Bloomberg data shows that the peso began the year at just above 17 to the dollar. In early April, it appreciated to its strongest position in almost nine years against the greenback, reaching 16.30.

Just before the June 2 elections in Mexico, the peso was again trading at just above 17 to the dollar, but it depreciated sharply after Claudia Sheinbaum and the ruling Morena party scored comprehensive victories in the presidential and congressional contests.

The peso fell to as low as 18.99 to the dollar 10 days after the elections on concerns that a coalition led by Morena will approve a range of constitutional reform proposals — including a controversial judicial reform proposal — once recently-elected lawmakers assume their positions on Sept. 1.

However, the currency subsequently recovered to trade at 17.6-17.7 to the dollar in mid-July.

The peso ended July at around 18.6 to the dollar, before losing further ground in the first days of August.

With reports from El Universal, López-Dóriga Digital, Bloomberg and Reuters