The recent appreciation of the Mexican peso against the US dollar has been a topic of much debate and discussion – even distress! – for anyone living in Mexico.

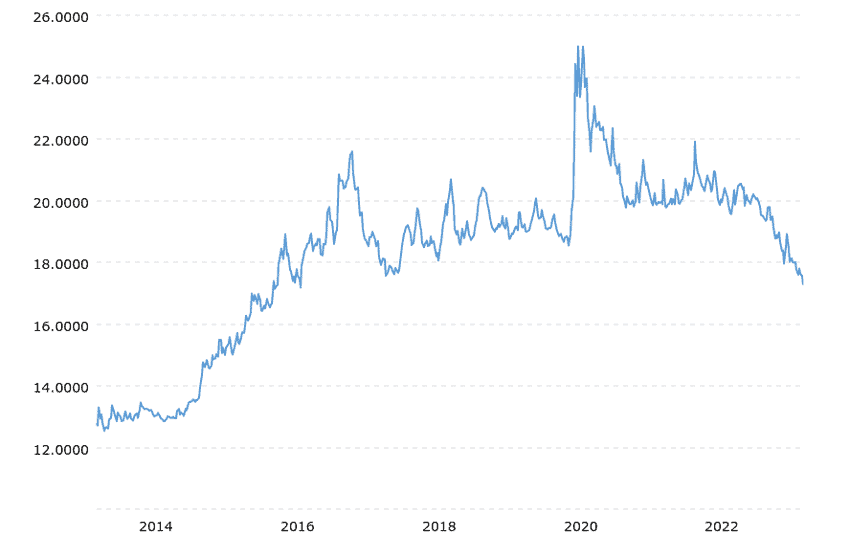

The “superpeso”, which reached a new 7-year high against the dollar this week, does make daily purchases bought using foreign currency more expensive. From an individual expat’s perspective, it seems the recent peso appreciation is not good. But perhaps a bit of context and history is important here.

The first time I came to Mexico in early 1996, the peso to US dollar exchange rate was 3 to 1. Just ten years ago, the exchange rate was 12 to 1. Even with the recent appreciation, the peso is still relatively much weaker than it has been when looked at from a longer time perspective.

How does this strengthening currency affect Mexican individuals and businesses? What about multinationals doing business in Mexico? And the expat population? I give a general overview and my perspective below.

Mexicans earning in pesos

The net impact of a stronger peso on Mexicans earning in pesos would generally be considered positive. Their pesos are stable for local goods and stronger for imported goods. Those with the resources to travel and spend abroad will have more purchasing power. In general terms, their standard of living would increase.

Mexico-based businesses

These businesses would see a mix of positives and negatives, depending on the type and nature of their business. Those that sell primarily in the domestic market would see little impact. Those that sell abroad would see their costs and prices relatively higher. Those that buy raw materials from abroad would be able to buy them at a lower cost, which could improve their profits.

Multinationals doing business in Mexico

Multinationals doing business in Mexico would also see pros and cons in this currency environment. A multinational primarily using Mexico for production for export would see their costs increase. A multinational doing business in Mexico for domestic customers would see their profits – when reported back in US dollars – go up. The higher profits ultimately make Mexico a more attractive place to do business, potentially catalyzing further investment and job creation.

Mexicans receiving remittances from abroad

This group would be negatively impacted by the strong peso. The foreign currency that they receive from family members abroad is worth fewer pesos than if the peso were weaker. This hurts the value of their remittances, and their purchasing power.

Property-owners in Mexico

The impact on this group is not as easy to diagnose, as there are a lot of variables. In a city where most transactions are done in pesos, the impact would be minimal, even favorable, as Mexicans would have more buying power. In a city where some real estate transactions are done in US dollars, there are contrasting currents.

Some home and property values could decrease due to foreigners being less interested in buying, with overall lower purchasing power. On the other hand, some home and property values could increase due to increased demand from Mexican buyers.

So, what’s the big picture here?

Viewed in the short term, and from the perspective of anyone earning in dollars, we definitely feel that things are more expensive than they were just a few months ago – and that’s painful.

Viewed with a longer-term perspective, my personal opinion is that this is a very good macrotrend for Mexico, as long as the peso doesn’t move too far too fast. Economic stability brings investor confidence, as well as growth and prosperity through better infrastructure, better schools, better healthcare, and higher standards of living.

I think that is something we can all be optimistic, even excited, about despite the short-term impact on our wallets.