The Mexican peso traded below 17 to the US dollar on Wednesday, but the currency will weaken significantly in 2024, according to the results of a recent survey of more than 30 banks, brokerages and research organizations.

The peso strengthened to just under 16.91 to the greenback on Wednesday morning before weakening slightly. One US dollar was trading at 16.93 pesos at 1:30 p.m. Mexico City time, according to Bloomberg.

The 16.91 level was the peso’s strongest position since Aug. 30, when it reached 16.74 to the greenback.

The USD:MXN exchange rate has mostly remained below 17 since the peso strengthened to 16.93 to the dollar last Friday on the back of data that showed that inflation in the United States was lower than expected in November.

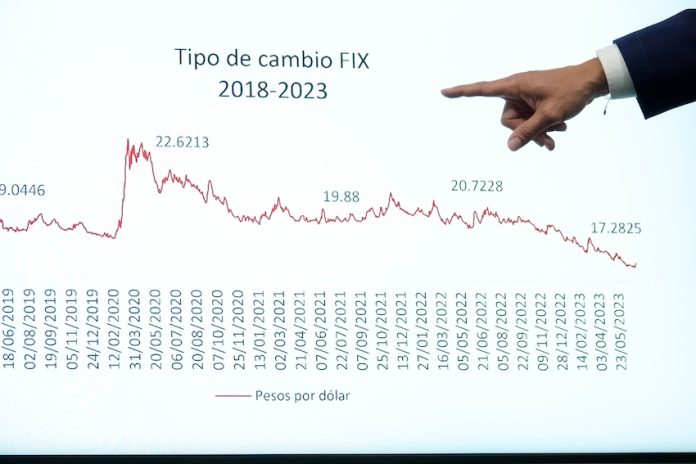

After starting 2023 at around 19.5 to the dollar, the peso strengthened significantly this year due to a range of factors including the vast difference between the official exchange rates in Mexico and the United States, strong incoming flows of investment and remittances and healthy tourism revenue.

The national currency has been dubbed the “super peso” on various occasions this year, including when it strengthened to a near eight-year high of 16.62 to the dollar in July.

But the peso’s superpowers will wane in 2024, according to all 33 banks, brokerages and research organizations consulted by Citibanamex for its most recent “expectations survey.”

In a survey report published Dec. 19, the bank said the consensus forecast is that the USD:MXN exchange rate will be 17:50 at the end of 2023 and 18.65 at the end of 2024, an election year in both Mexico and the United States. The latter forecast represents a 9.3% depreciation for the peso compared to the 16.91 rate it reached Wednesday morning.

Ten of the 33 entities surveyed by Citibanamex, including Banorte, Morgan Stanley and Santander, forecast that the peso will trade at or above 19 to the dollar at the end of next year.

Masari Casa de Bolsa, a Mexican brokerage, made the most pessimistic prediction for the peso, anticipating a USD:MXN exchange rate of 19.70 at the close of 2024.

While none of those surveyed predicted that the peso will be below 17 to the dollar at the end of next year, five entities – BNP Paribas, HSBC, Multiva, Natixis and Vector – forecast that it will be below 18.

Vector, a Mexican brokerage, made the most optimistic forecast, predicting a 17.40 rate at the end of 2024.

The other respondents to the survey – i.e. the majority – made forecasts of between 18.00 and 18.80.

For its part, the federal Finance Ministry said in a document in September that it anticipated a 17.60 exchange rate at the end of next year.

Citi Global Wealth, an investment division of Citigroup, noted in its “Wealth Outlook 2024” report earlier this month that “inflows of foreign capital associated with U.S. nearshoring” drove a 20% appreciation of the peso to 16.62 to the dollar in July.

“As electoral uncertainty picks up ahead of the June 2, 2024 general elections, this longer-term [nearshoring] trend should at a minimum continue to provide a floor under the peso,” Citi said.

Later in the report, Citi said that it views a USD:MXN exchange rate in the 19.00 area “as much closer to fair value.”

However, “[we] fully recognize that the strong nearshoring flows could keep this currency relatively overvalued for some time to come,” the bank added.

Foreign direct investment in Mexico reached a record high of almost US $33 billion in the first nine months of the year, while foreign companies made investment announcements totaling more than $106 billion between January and November. That money is expected to flow into Mexico in the next two to three years.

Among the other consensus forecasts derived from the Citibanamex survey were that the Bank of México will make an initial cut to its record high 11.25% interest rate next March, and that the Mexican economy will grow by 2.3% in 2024.

With reports from El Financiero and El Universal