Nearly every day the team at MND reports on business and economic activity in the country. I myself spend several hours a day reading and researching as well. So why is it that it is so hard to make sense of what’s really happening in the economy right now? Obviously the recent threats on tariffs from the Trump administration have not helped with the level of uncertainty, but the actual economic indicators are confusing as well. Let me explain.

We recently reported on Mexico hitting a record level of foreign direct investment in 2024 — this is good. But we also reported on the fact around 8% of that record level, a much lower percentage than usual, was new investment from new companies — this is not good. We have reported on the fast growth of occupancy in industrial parks nationwide — another positive. But we have also recently reported on already-low GDP projections for Mexico for 2025 being lowered even further to below 1% — not good at all. We have reported on companies like Nemak and Nissan being impacted by tariff rate uncertainties and potentially moving some manufacturing out of Mexico, while at the same time report on companies as varied as Netflix, Nestlé, Santander and Amazon each recently announcing new US $1 billion-plus investments in the country.

So what is actually happening? How bad are things economically? Or how good are they?? To help shine some light on these questions, I decided to do a little market research of my own by recently spending a day at an industrial park near where I live in San Miguel de Allende with Zonia Torres, the commercial director of the park.

Given that Mexico has hundreds of industrial parks with thousands of companies located across the country, I realize that my little “one industrial park market research” is not statistically significant. But that being said, I think much of what I saw does help one understand what is going on in the rest of the country.

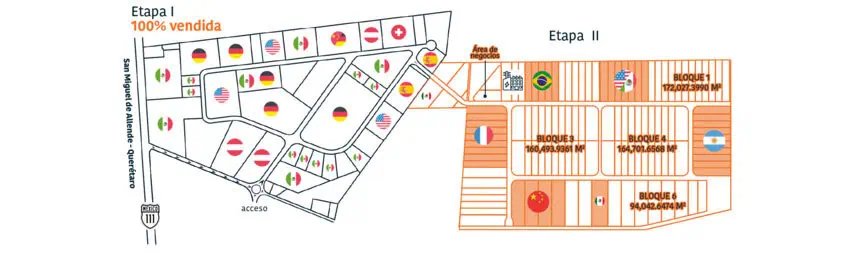

Polígono Empresarial San Miguel, as the industrial park is known, is not necessarily a typical one, but then again what park would be? This SMA industrial park is on the smaller end of the spectrum, with a total of 200 lots spread across two phases.

It is obviously not located in the booming northern areas near the U.S. border, but neither is it located in the slower-growing southern parts of the country. It is not located in a major city, but rather about 15 minutes from SMA and 30 minutes from fast-growing Querétaro. It is not located on a major highway and not connected to a rail line. If anything, my first reaction was, “Why would any industrial company want to be located here, given that there are literally hundreds of options elsewhere?”

Following are my top 10 takeaways from the visit:

1. Energy availability matters. The SMA industrial park is blessed with consistent and available power. As we have often reported, this is not the norm in many other parts of the country. There are industrial parks in the northern part of the country that have strong demand from companies for space, but have a lack of supply of energy. This lack of available and green energy has without a doubt acted as a brake on growth so far in many areas. President Claudia Sheinbaum has recently presented a comprehensive energy plan that will attract more private investment in the sector, more green energy solutions, and ultimately much more supply. This cannot come fast enough in the eyes of many companies.

2. The lack of energy has led to many industrial parks needing to take matters into their own hands. The SMA park I visited is currently building a second substation to accommodate more energy, as well as building out a natural gas line network in the park to connect to the natural gas grid to provide other energy options sooner.

3. Water matters. This particular park does not host particularly water-intensive industries, but water is still a very important consideration. The water used in the park does not come from a city utility but rather from an on-site well. The companies in the park pay a nearly US $4 per cubic meter for water. To put this in perspective, the cost of water would be on average 50% to 75% less in a typical industrial park in the United States. Given the higher costs of water at many Mexican industrial parks, many companies install on-site reuse or recycle solutions for much of their industrial water usage. Zonia tells me that nearly every new company installs these types of systems. One of the new customers in the park, a food producer, is installing a dedicated water line, given their special water needs.

4. The diversity of industries is mind-boggling. In this one small industrial park in the middle of the country, there are already — or soon will be — companies dedicated to the production of pharmaceutical products, food, plastic auto parts, aluminum auto parts, data centers, personal yachts and more. Yes, you read that correctly, even water transportation vehicles used around the world are being built in the mountains of central Mexico!

5. The country of origin of the parent companies is equally mind-boggling. Again, in this one small park, the parent companies are from Mexico, the U.S., France, Germany, Switzerland, Austria, Spain, Italy, Argentina, Brazil and China.

6. The Chinese are coming. Much has been written about the relatively small percentage of FDI coming directly from China. But a visit to this park gave me insight into another way that the Chinese are gaining market access — though acquisitions. Two different European based companies that are located in the SMA park have recently been acquired by China-based companies. I had assumed that many of the Chinese people I often see in SMA were visiting tourists, perhaps they are instead associated with the companies in the park.

7. The park employs a lot of people, but the profile of those being hired is changing quickly. Currently there are over 6,000 people that work in the park. Many of the companies already there are installing increased automation and robotics, and new companies coming in have significant automation planned. They will still be hiring significant numbers of employees, but will be looking for those that have education and experience in engineering, computer, and robotics.

8. Just about every company in the park is expanding. New production lines are being added, new higher tech or higher capacity equipment is being installed, and plant expansions are being built. None of this would be considered “new” FDI, but it definitely is helping create more jobs and production.

9. Data centers are becoming the next utility. Given the rapidly increasing demand for computation, proximity to data centers is vital and demand for data center services is booming. The SMA park currently has two separate data center customers building out data centers in the park. I will repeat that again: Just this one little park in SMA is going to have two separate data centers!

10. Proximity to San Miguel is a very nice plus. Despite not being near a major airport, there is no doubt that proximity to the UNESCO world heritage city of SMA helps attract companies. The park is just 15 minutes from central SMA, and literally has vineyards on both sides of it. One can imagine how visiting executives from abroad enjoy the perks of lunches at the vineyards and dinners and accommodations in downtown SMA, making the trip a little extra-special.

I found the day trip to the park to be a fascinating one. The visit to the SMA park gave me little doubt about the direction and potential of the Mexican economy when seen at the ground level, despite the news headlines giving us mixed message. Let’s hope the tariff issue is quickly resolved, and also that the Mexican government provides sensible incentives for more energy and water reuse investments. With the right economic leadership, I see a very bright future for industry in the country in the years ahead.

Travis Bembenek is the CEO of Mexico News Daily and has been living, working or playing in Mexico for nearly 30 years.