Many foreigners living in or visiting Mexico might find it useful to have one of the new and easily obtainable Mexican fintech (financial technology) bank cards, which provide you with a mobile and branchless Mexican bank for no monthly fee.

Sometimes expats have problems paying their utility bills online, sending money to an employee, buying a bus ticket or an item from Mercado Libre online, paying rent online, or receiving money from a friend for his share of a dinner out. Many people might have a foreign credit card that is sometimes not accepted online on Mexican websites, or that has a foreign transaction charge (most do).

There are several similar Mexican fintech cards, but the app for Albo is available on the Canadian iPhone app store, so that is the one I am using in San Miguel de Allende, Guanajuato. Also, Albo is one of the largest and oldest of what are called neobanks. My son in Puerto Escondido, Oaxaca, is using another card called Uala, with basically the same functions.

Doing almost everything with the card is free. At one level it is a pre-paid MasterCard. Use it just like a credit card in any business that accepts credit cards, either in person or online. But Albo is also a bank account with a CLABE (Mexican bank account number), so you can instantly send and receive money to and from anyone in Mexico using SPEI transfers (the money is received in less than one minute).

Note, however, that such transfers are an option that is only available if you are a temporary or permanent resident, which allows you to obtain the personal ID number known as the CURP. You can open an account with Albo without a CURP but you won’t be able to make SPEI transfers.

You do everything from the app on your phone but if you are not a smart phone user, these cards are not going to work for you. You can pay your utility bills online from the app along with Telcel, AT&T, Movistar, CFE for electricity, Telmex, Megacable, Dish, Total Play, with more to come. But with a SPEI bank transfer you should be able to pay any Mexican bill. If your landlord gives you a CLABE number, you can pay your rent as well.

All it takes to get the card is download the app from the Apple App Store or the Google Play Store depending on your phone. For the Albo app you give your name, your address, your CURP, take a photo of your passport and a selfie. That is it: no lease, no utility bill, no 25 signatures and three visits to your bank to create an account. So a tourist or perpetual tourist can get the card.

The only reason for providing your address is so they can send you your physical card. Everything else is done online from the app. After you fund the card with 200 pesos, they will send you your physical card by DHL within a couple of days. However, unless you are going to use the physical card in shops or restaurants as a MasterCard, you can do everything with the app and your virtual card once you add money.

You can put money into your account instantly and for free from any Mexican bank account, or at an Oxxo, Farmacia Guadalajara, 7-Eleven, Extra, Farmacia Ahorro, Farmacia Benavides, Alsuper, and Kiosko for a fee of 8 to 13 pesos per deposit. However, the best option for most expats will be funding their card with direct deposits using Wise (formally called TransferWise) from their home country. I have found that I receive the best exchange rate possible through Wise, better than ATM withdrawals or other methods of international money movement.

Once you create a Wise account, you can easily send money from your U.S. or Canadian accounts (or from accounts in most other countries) to your Albo or other fintech card. My last transfer of Canadian funds to my Albo card took four seconds! You can also take out cash from an ATM (paying the local bank fee), but avoiding the international fee that you are probably paying for each transaction.

Everything with these fintech cards is in Mexican pesos, so if you spend 500 pesos at Farmacia Guadalajara using the credit card function, just 500 pesos comes out. If you send someone 1,000 pesos, they receive 1,000 pesos and you pay no fee. And you can only spend the money that is in the account — not one centavo more. If you pay your CFE or Telmex bill online, again, there is no charge to you. Same with paying your rent directly to your landlord’s account or paying a plumber.

Every transaction immediately shows up on your phone app. So, particularly for people living in Mexico part- or full-time without a Mexican bank account, one of these cards may be a good option. The Walmart stores (Bodega Aurrerá, Walmart, Superama, and Sam’s Club) offer a 2,000-peso cashback option with no fee when you make a purchase of as little as 20 pesos.

The Albo app allows you to turn your card on and off, so there is no chance of anyone hacking your card if you leave it off until needed. To create a new contact to send money you need a name and the bank account’s 18-digit CLABE or 16-digit Albo or other fintech card number. Once entered, the information is saved so the next time you send money it will just be a click and you enter the amount. You can also send a message with the payment. Once you set up a company bill payment, you don’t need to re-enter your account information.

These cards are called Mexican level 2 digital bank accounts, so there is a monthly movement limit. On the Albo card it is a monthly deposit limit of 55,000 pesos and a total balance limit of 200,000 pesos. There are no monthly or transaction fees. The only three fees are 150 pesos to replace a lost card, the 8 to 13 peso charge if you deposit money into your account at an Oxxo or one of the other chain stores, and the local bank ATM fee if you withdraw cash. Some people might just want to tuck some money into the card and have it just as an emergency option. You can see more in Spanish on their website.

I have no affiliation with Albo or any of the companies listed here. I just wanted to share a resource that will be helpful for some people living in Mexico without a Mexican bank account. Other similar Mexican fintech cards include Bnext, Fondeadora, Flink, HeyBanco, Cuenca, Nelo, Enso, Broxel, Warp, MIBO, RappiPay, MIIO, Xpats, Delt.ai, Tauros, Lidh, Klar, Ualá, Spin by Oxxo, and Klu.

Advantages

- Albo is a pre-paid MasterCard that can be used wherever MasterCard is accepted.

- The card is also a mobile and branchless Mexican bank account.

- There are no monthly fees and no transaction fees (except for a small charge for making a deposit to your account at a chain store).

- You can make credit card purchases in person or online.

- Send and receive money instantly from anyone in Mexico who has a bank account or a similar fintech card. (Only available if you have temporary or permanent residency and a CURP.)

- Pay your utility bills online with a couple of clicks.

- Fund the card from accounts in Canada, the U.S., or most other countries using Wise directly to your own card receiving an excellent exchange rate.

- You can move money into your account from Wise when the exchange rate is to your advantage.

- See every transaction instantly on the app.

- Take money out from an ATM (paying the fee for that bank).

- Once you set up a bill payment like your CFE account (or a payment to a landlord, friend, employee, or anyone else) the contact information is saved so you will just need the amount that you want to send the next time.

- When you send money you can include a brief explanation.

- At any of the Walmart stores you can do a cashback of up to 2,000 pesos with no charge with a purchase of 20 pesos or more.

- Perhaps just keep a few thousand pesos in the card for an emergency financial backup.

- You can turn the card on and off with the app, so you will not risk being hacked.

- There is no minimum balance.

- The card can replace most of the functions available with a Mexican bank.

- You can make all payments, send and receive money while outside of Mexico.

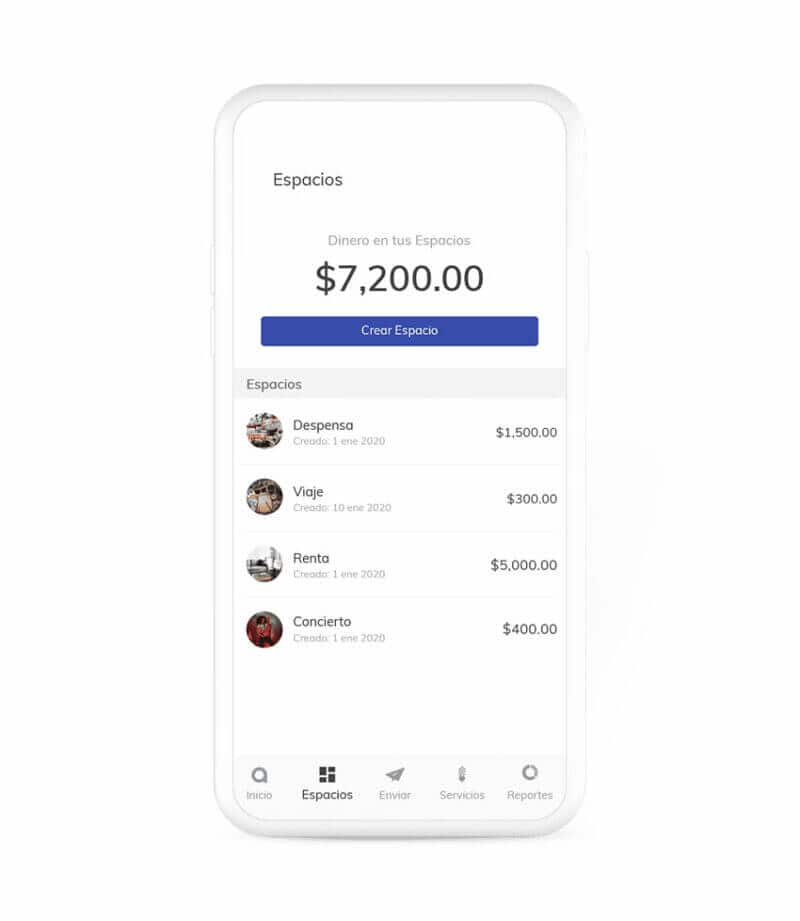

- You can create “jars” in your account to set aside money for whatever categories you choose to create (rent, CFE, vacation, or Telcel).

Downsides

- Albo requires the smartphone app. It will not work from a computer.

- If you are not funding your card from a direct Mexican bank transfer or a Wise transfer from a foreign bank, there is a charge of between 8 and 13 pesos per transaction at the chain stores like Oxxo that will receive the deposit.

- When you withdraw cash from any ATM you will be paying the local bank charge.

- The maximum daily ATM withdrawal limit is 9,000 pesos per 24 hours.

UPDATE No. 2: An Albo account can be obtained without temporary or permanent residency but the account holder will not be able to make interbank SPEI transfers.

Jim Blakley is a former college counselor from Canada and now remote worker who is a 16-year resident of San Miguel de Allende, Guanajuato.