According to statistics released by both the U.S. and Mexican governments, record numbers of Americans are moving to Mexico to live and work. And why not? With its rich culture, temperate climate, proximity to the United States and affordable living, relocating to Mexico could be the new American Dream. In the six years that I have lived in San Miguel de Allende, I’ve seen more and more U.S. citizens taking advantage of opportunities to purchase vacation homes, investment properties and places to settle in retirement.

When buying real estate in Mexico however, it’s important to understand the tax consequences of your decision, both in Mexico and the United States.

Can Americans own land in Mexico?

You may have heard that Americans can’t own property in Mexico. That is false. Americans — and any other foreign citizen — can easily and legally purchase property in Mexico directly and hold title in their own name, so long as the property is not in a restricted zone.

A restricted zone, as defined by Article 27 of the Mexican constitution, is an area within 100 kilometers of an international border or within 50 kilometers of the coast. A U.S. citizen can still buy a house or land within a restricted zone, but title to the property has to be held within a Mexican corporation or within a bank trust, called a fideicomiso.

Typically, a house in a restricted zone that is intended to be used as a permanent residence or vacation home, as opposed to a purely business use, is purchased using the fideicomiso model. Although fideicomisos do add some time and cost to the process, once set up, the individual beneficiary — presumably you — can make all the decisions regarding the property: you can build on it, live on it, rent it, sell it or pass it down to friends or family. That also means the tax consequences belong to you as well.

Whether you purchase property directly or through a fideicomiso, keep records of what you pay for the property and the expenses associated with your purchase, including closing costs, fees for real estate agents, attorneys and notaries and taxes or other items that you assume on behalf of the seller. These costs are your basis in the property. Your basis is the amount you invested in the property and it is important for tax purposes because if you sell the property, you can deduct your basis from the sales price to arrive at the taxable gain.

Now that I own the property, what are the U.S. tax consequences?

Generally, the same tax rules that apply to U.S. property apply to your property in Mexico. Just like in the U.S., however, the rules depend on whether you use the property as your primary residence, as a vacation home, solely as a rental, or in some combination of these ways.

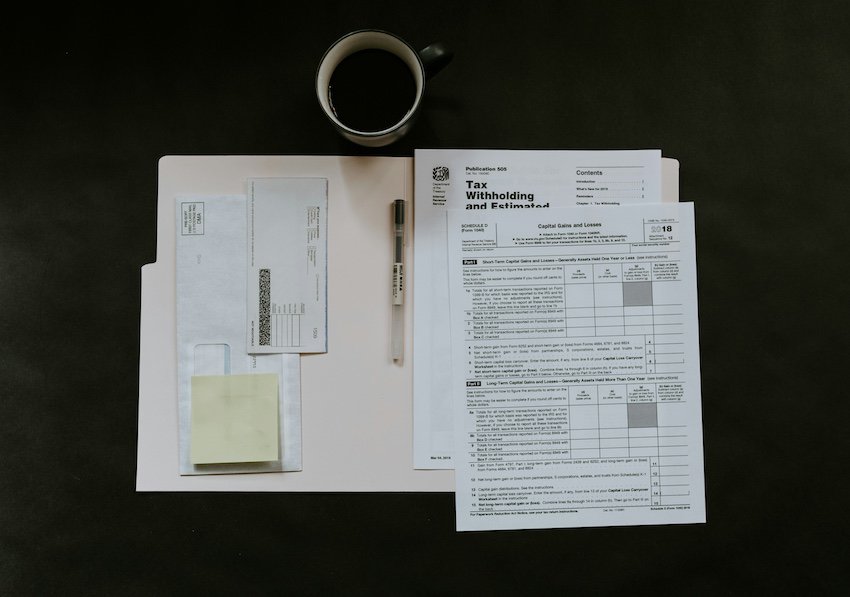

If you use your foreign home as your primary residence — i.e., you spend the majority of your time there — or as a vacation home, you can deduct mortgage interest. The amount that you can deduct depends on whether the loan was made before or after Dec. 16, 2017. See IRS Publication 936, “Home Mortgage Interest Deduction,” for more information. Report your mortgage interest deduction for a foreign home on Schedule A, Itemized Deductions, in the same way that you would deduct mortgage interest on a qualified home in the U.S..

If the lender is a foreign person, including a foreign bank, it most likely will not provide you or the IRS with a Form 1098, Mortgage Interest Statement, which totals the amount of interest you paid during the year. If you don’t receive a Form 1098, you can still deduct the mortgage interest on Schedule A, but you should attach a statement to your tax return explaining to whom you paid the interest. Keep detailed records of your payments for at least three years in case the IRS requests evidence.

You can’t deduct costs for utilities, minor maintenance, homeowners association fees, security or similar expenses if you use your foreign home as your primary residence. These are considered personal expenses and the same prohibitions on deduction apply to U.S. residences. However, if you operate a business from the home and are able to claim the home office deduction, these expenses may offset self-employment income on Schedule C, Profit or Loss from Business. For a full explanation of tax deductions for your home office, see Publication 587, “Business Use of Your Home.”

Currently, the significant difference with foreign property as compared to a home located in the U.S. is that you cannot deduct foreign real estate taxes in years 2018 through 2025. The deduction for foreign real estate taxes is scheduled to return in 2026.

Your foreign home as a rental property

Owning a foreign rental property is the ultimate dream for many Americans. However, rental income from a foreign property must be included on your U.S. tax return using Schedule E, Supplemental Income and Loss. The good news is that you can deduct more expenses when you use your property as a rental than you can when you use it only for personal use.

Rental deductions include those expenses such as mortgage interest and insurance premiums that you can deduct on Schedule A when you use your property as a home. But they also include things that you can’t deduct when you use your house as a home. These can include repair and maintenance costs that keep the property in an efficient operating condition, such as painting a room or house cleaning between tenants.

Generally, small improvements such as these are categorized as general maintenance and do not increase your basis. Expenses for improvements to the property, such as new construction, replacement of windows and other projects that add value to the property must be added to your basis rather than currently deducted. Publication 527, “Residential Rental Property,” has tables listing deductible expenses as compared to improvements.

Deductions can also include outlays such as advertising costs, management fees and travel expenses incurred to manage or maintain the rental property. Whether you can deduct some or all of your travel costs depends upon how much of your trip is related to the business of the rental versus personal reasons. If the purpose of your trip is part business and part personal, an allocation of expenses is required. See IRS Publication 463, “Travel, Gift, and Car Expenses,” for an explanation of the rules and examples.

Do I have to report all of my rental income?

Generally yes, but an exception does exist. If you rent your foreign house for 14 days or less and use the property as a home, you do not have to report its rental income to the IRS. In this case, however, your deductions would continue to fall into the category for personal use of your foreign home described above.

For this purpose, the IRS considers a property a home — as opposed to a rental — if your personal use was the greater of:

- 14 or more days during the year, or

- 10% of the total days it was rented to others at a fair rental price.

An example can help illustrate how to apply the 14-day or 10-percent rule.

Mary owns a condo in Puerto Vallarta. In 2023, she rented the unit at a fair rental price for 280 days. She also used it for a 10-day vacation with her family and allowed her brother to use it for 10 days, rent-free, on a separate occasion. Allowing a family member or friend to use the unit without paying rent counts as Mary’s personal use. Incidentally, the IRS also considers it a day of personal use if you allow someone to use the house under an arrangement that lets you use some other dwelling unit, such as in a home exchange.

Even though Mary used the condo in a personal capacity for more than 14 days, she is not considered to have used it as a home because ten percent of the days it was rented is greater than 14 days — 10% of 280 days equals 28 days. Mary’s case thus falls under the 10% rule rather than the 14-day rule. Since she used the house in a personal capacity for only 20 days, she is not considered to have used it as a home.

In this case, Mary is required to report the rental income and she can deduct her expenses in maintaining the house. However, because she used the house in a personal capacity, the expenses need to be allocated between personal and rental. Publication 527, “Residential Rental Property,” explains how to report income and expenses in this situation.

Selling your foreign home

The rules for sale of a foreign property are similar to those for selling a home in the U.S. If you lived in the home as your primary residence for two out of the previous five years, you can exclude a portion of the gain from U.S. tax. In 2023, the amount of gain a married couple can exclude from the sale of their principal residence is US $500,000; for a single person, the exclusion is $250,000. If you don’t meet the two-in-five-year rule, or if your gain exceeds the amount you can exclude, you will owe capital gains tax on the profit.

This situation demonstrates the importance of keeping track of your original cost and improvements that increase your investment basis in the property. The higher your basis, the less gain you have when the property is sold.

If you are married and your gain is less than $500,000, you would pay no tax. If you don’t meet the rule, or if your gain exceeds the exclusion amount, you can still benefit by keeping good records regarding your basis. For example, if you purchase a house for $320,000 and invest $1,500 building a rooftop terraceand another $3,000 installing a pool, these costs would increase your basis from $320,000 to $324,500.

While adding such a small amount to your capital investment in the property doesn’t seem like much, if you assume a 15% capital gains tax rate, increasing your basis $4,500 would save you $675.

In Mexico, that can go a long way.

One More Thing – Foreign Bank Account Reporting

The U.S. requires citizens who have a financial interest in or signature authority over a foreign financial account that exceeds $10,000 at any time during the calendar year to file a Report of Foreign Bank and Financial Accounts, commonly referred to as the FBAR.

You’ll be happy to know that real estate owned directly by an individual or within a fideicoimso is excluded from FBAR reporting. This is true regardless of whether you use the foreign residence as a home or as a rental property. That’s good news.

Paul Carlino is an attorney living in San Miguel de Allende and the founder of Pickleball Mexico. He writes for Mexico News Daily.