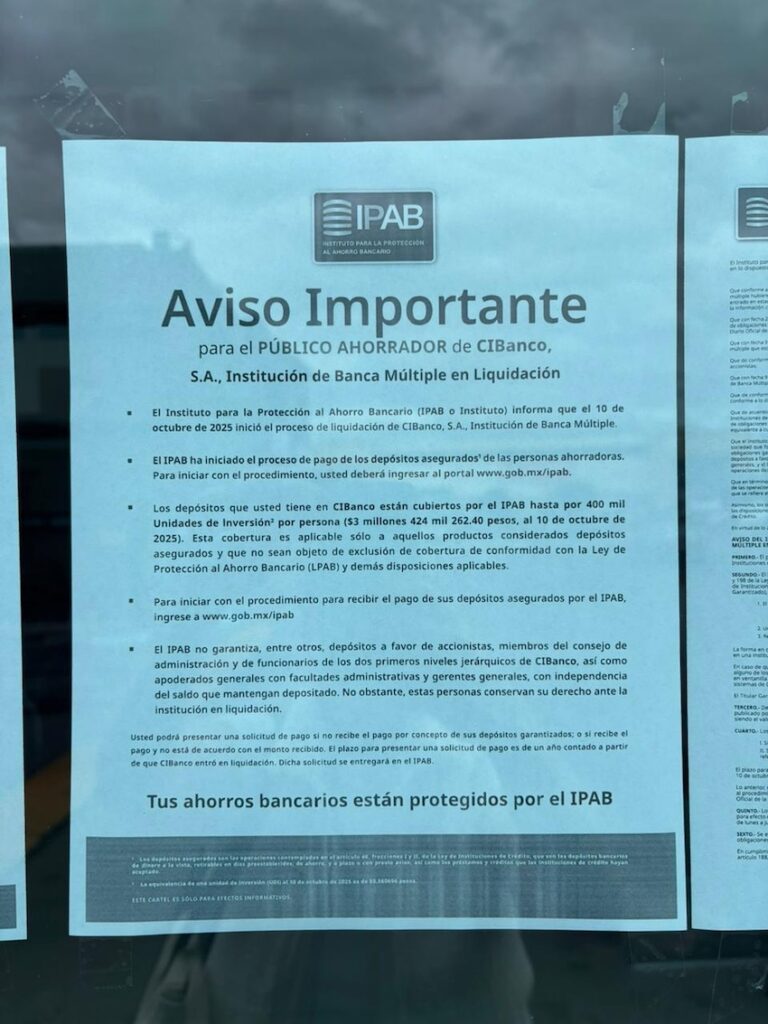

Mexico’s Institute for the Protection of Bank Savings (IPAB) has revoked CIBanco’s license and has begun to liquidate the embattled financial services provider.

IPAB announced Friday that it will begin paying out insured deposits beginning on Monday, Oct. 13, and advised account holders to visit its official website for information: www.gob.mx/ipab.

CIBanco clients with loans or credits can register to receive their funds at the government-managed payment portal beginning Oct. 13. The instructions are as follows:

- Visit the IPAB payment portal at www.gob.mx/ipab.

- Complete the form with the required information, as shown on your latest CIBanco account statement.

- Provide a CLABE account number from a Mexican commercial bank to receive your guaranteed deposits by transfer.

- You will receive a confirmation email on the same day that the account holder’s details are correctly registered.

The estimated processing time is 48 to 72 business hours, depending on the bank you have registered to receive the transfer. If you do not have another bank account in Mexico, you must go to a CIBanco branch or an IPAB office to file a physical Payment Request; bank accounts corresponding to a third party will not be accepted.

The government has also created a website to explain the legal framework for the actions being taken and issued an alert warning about fraudsters.

Deposits at CIBanco are protected by the IPAB for up to 400,000 Investment Units (UDIs) per person, equivalent to $3,424,262.40 pesos as of Friday.

IPAB cautioned that this coverage only applies to products considered insured deposits, provided they do not fall under the exclusion criteria established in the Bank Savings Protection Act (LPAB). The deadline to complete the liquidation procedure is one year, that is, by Oct. 13, 2026.

Those who do not receive their payment or believe the amount refunded is incorrect may submit a request or claim directly to IPAB offices.

However, people holding loans with CIBanco must continue making payments, even though the bank is in liquidation.

Click here for a list of the CIBanco branches that will remain open for inquiries, clarifications and requests for payment of secured obligations. They will not be providing financial transactions or services.

IPAB also announced that it does not cover deposits belonging to CIBanco Shareholders, members of the board of directors, representatives with administrative powers and general managers, although they still retain their right to file claims directly.

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) sanctioned CIBanco and two other financial institutions in June, accusing them of laundering millions of dollars for drug cartels.

The Governing Board of the National Banking and Securities Commission (CNBV) soon thereafter ordered the temporary management intervention of CIBanco, Vector and Intercam.

After initially staving off sanctions in July, regulators imposed restrictions on the three companies’ international transfers, depositor withdrawals, and banking operations, prompting them to sell off assets in August.

With reports from El Financiero, Animal Político, La Jornada and Infobae