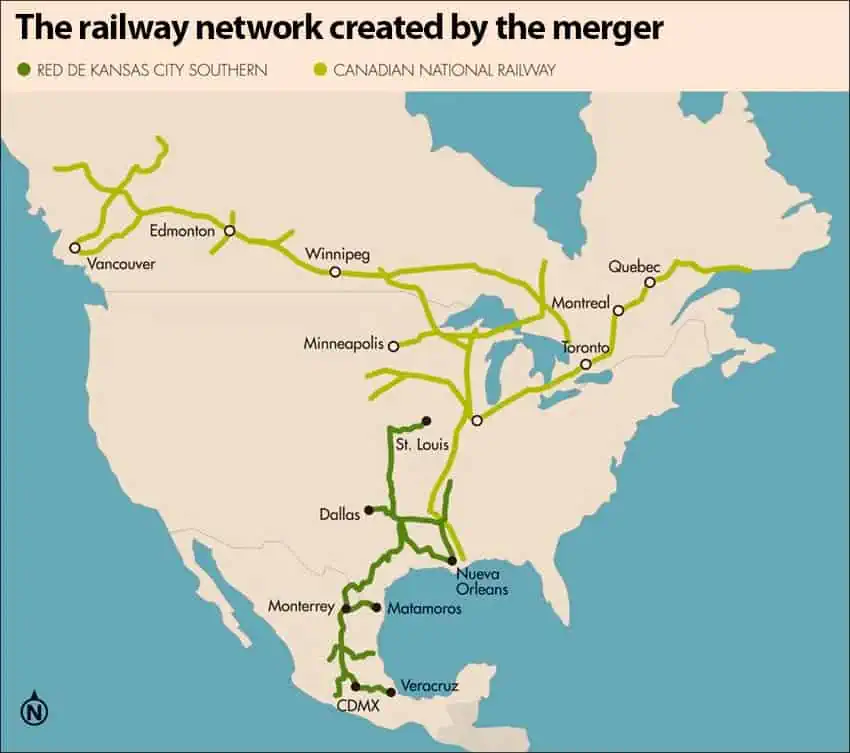

Railway company Canadian National (CN) agreed to a US $33.6-billion deal to take over Kansas City Southern (KCS) on Friday, which will connect ports between Mexico, the United States and Canada with 42,000 kilometers of track.

KCS transports freight from the ports of Tampico and Altamira in Tamaulipas, the port of Veracruz, and from the Pacific port of Lázaro Cárdenas in Michoacán. It takes automobiles and industrial products into the United States, and hauls farm goods to south of the border.

Clearance will be subject to a thumbs up by KCS shareholders and regulatory approval from the the Federal Economic Competition Commission and the Federal Telecommunications Institute in Mexico, and the Surface Transportation Board (STB) in the United States.

Another Canadian railroad, Canadian Pacific, had agreed to take over KCS in a $29-billion deal in March, only for rival CN to come in with an improved offer. In its sweetened proposal, CN agreed to add more stock and cover the $700-million breakup fee Kansas City Southern would owe Canadian Pacific for walking away from their existing agreement. If the deal fails to get approval from regulators, CN would also owe KCS a $1-billion reverse breakup fee.

Canadian Pacific’s deal had already received preliminary regulatory approval from the STB, but the regulator might be more cautious about giving CN the go ahead: the company is larger and has more overlap with KCS, which could put it at a disadvantage in winning antitrust approval. Railroad takeovers have to be in the public interest and enhance competition to gain approval.

Logistics and transport professor at the Tec de Monterrey university, Sergio García, said he expects Canadian Pacific will strike a deal with a different U.S. railroad. “I think that at this moment Canadian Pacific is looking for another alliance with another U.S. operator. We will probably see in the coming months the announcement of another unexpected merger because the conditions will require it. It’s one thing to compete with a company, and another to compete with a large company with a presence in three countries,” he said.

Canadian National CEO JJ Ruest said the deal would “meaningfully connect the continent,” while chairman Robert Pace said he was confident the deal would be given the green light. “KCS is the ideal partner for CN to connect the continent, helping to drive North American trade and economic prosperity. We are confident in our ability to gain the necessary regulatory approvals and complete the combination with KCS, and we look forward to combining with KCS to create new opportunities, more choice and a stronger company,” he said.

KCS CEO Patrick J. Ottensmeyer said the takeover will drive prices down for customers. “As North America’s most customer-focused transportation provider, we are excited about this combination with CN, which will provide customers access to new single-line transportation services at the best value for their transportation dollar, and increase competition,” he said.

CN is Canada’s largest railway company, spanning 32,831 kilometers of track. It gained control of the U.S. Illinois Central railroad in 1998, and Bill Gates is its biggest shareholder.

KCS is the smallest of the major freight railroads in the U.S, covering 10,800 kilometers of track in the U.S. and Mexico. Its routes cross through Mexico City, various cities of El Bajío and Monterrey, meeting the U.S. border at Texas, and it also runs a rail link along the Panama Canal.

Sources: Wall Street Journal, El Economista (sp), Milenio (sp)