Kansas City Southern México (KCSM), which for the moment owns the cross-border freight railroad at the heart of every rail transportation supply chain connecting the United States and Mexico, expects to make an investment of more than US $200 million in Mexico, says its president.

The investment, KCSM President Oscar del Cueto said at a press conference last week, seeks to improve the company’s connectivity and take advantage of nearshoring opportunities.

Del Cueto said that the company saw 14% growth in sales in 2022, while its volume increased 7%, and that in 2023, he expects 7% growth in sales and 2% in volume, driven by the need for shipping by businesses in the automotive sector and the grain industry.

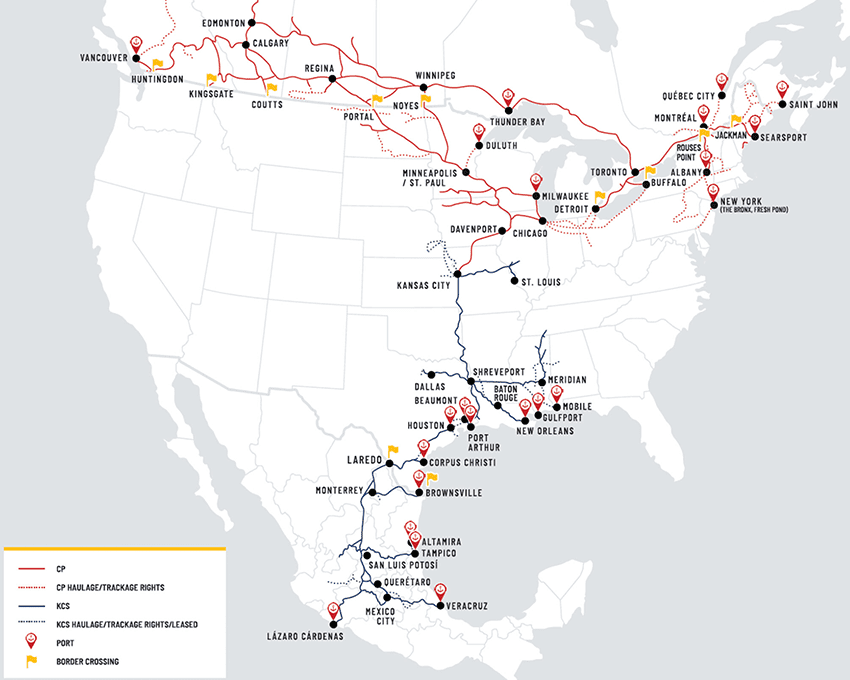

He said he also hopes the company’s numbers will improve once the US $31 billion merger between KCSM’s parent company Kansas City Southern and Canadian Pacific Railway is approved by U.S. officials and the two companies’ new merged railroad line — which will be the only single-line railroad connecting Canada, the United States and Mexico — can begin operation.

Canadian Pacific purchased Kansas City Southern in December 2021. The deal will merge the two companies into a new entity, Canadian Pacific Kansas City (CPKC).

Assuming the merger receives authorization from the U.S. Surface Transportation Board, which del Cueto said he expects to happen this quarter and possibly by the end of February, CPKC will have a combined 32,000 km in rail lines crossing the three countries. It also gives the new company access to Kansas City Southern Mexico’s strategic ports of Lázaro Cárdenas, Altamira and Veracruz.

The merger comes at a strategic moment for international trade, del Cueto said, specifically for Mexico, which is benefiting from nearshoring particularly in the automotive sector, a strategic industry for the KCSM, del Cueto said.

Del Cueto did not address if and how KCSM would be restructured if the STB approves the merger. But he did say CPKC sees opportunity in Mexico after COVID-19’s disruption of logistics and supply chains, which has resulted in backlogged shipping seaports worldwide.

“With nearshoring, especially in the automotive sector, we have seen interest in the arrival of some companies, especially in the Bajío [area], and we are trying to offer a faster service regarding containers,” he said.

As an example, he spoke of what he said were CPKC’s plans to begin moving merchandise by rail from the Lázaro Cárdenas port in Michoacán to Chicago in 5 days.

By sea, the same trip normally takes 26–28 days, he said.

Nearshoring has occurred more in the northern part of Mexico, but CPKC also wants it to happen in the country’s central Bajío region, del Cueto said. With CPKC’s new extended railway, they will also offer three intermodal terminals.

“We already have three available in Toluca, San Luis Potosí and Salinas Victoria,” he said, adding that his company wants to offer containers to move both domestic and international merchandise.

Del Cueto also said that he recently met with Ministry of Infrastructure, Communications and Transport (SICT) head Jorge Nuño to discuss the benefits of the merger.

“We talked about how interesting it will be to have a single railway line in the three countries,” he said, adding that they will be “able to ship in Mexico and with reassurance that it will be the same supplier that takes the merchandise to Canada […].”

Del Cueto mentioned that this was already done case with the Volkswagen company, which transports many vehicles bound for Canada with Kansas City Southern México to the Mexico-U.S. border.

“We exchanged them at the border, and they were going on another railway to Canada. Now we will be a single line. It will be a service without borders, point-to-point, with a single lock.”

With reports from Forbes Mexico and El Economista.