International mining companies have lost interest in investing in Mexico due to over-regulation and insecurity among other factors, says the CEO of Canada’s Torex Gold.

“Mining companies don’t feel comfortable in places where governments change the rules of the game,” Fred Stanford told the newspaper El Universal during the International Mining Conference in Acapulco, Guerrero.

He cited excessive regulation, difficulty to obtain permits, higher taxes, mine blockades, weak rule of law and insecurity problems due to the presence of organized crime as factors that have caused Mexico to lose its attraction as an investment destination.

Stanford said that Torex, which operates the Media Luna gold mine in Guerrero, has had to sell off some of its Mexico mining interests because investors want to reduce their exposure in the country.

He said the company is unlikely to open a new mine in Mexico any time soon but added that it “could return if the [business] environment is right.”

The Toronto-based CEO said there are several countries that are currently more attractive for mining investment, citing Canada, the United States, Australia, Chile, Peru and certain African nations.

“. . . The rule of law is predictable . . . They’re countries where there are no concerns about security and tax issues,” Stanford said.

In contrast, Mexico’s government has done nothing to put an end to blockades at Peñasquito – the country’s largest gold mine, raised taxes on mining companies and changed the rules of the game for the sector, he said, adding “it appears that there is no commitment to mining.”

Stanford said it was concerning that “everyone thinks the gold is theirs: communities, government, organized crime, the farmer . . .”

“They don’t care about how you extract it as long as you leave them something,” he said.

The CEO said that Torex will spend US $15 million this year to explore a site adjacent to Media Luna but asserted that if the company hadn’t committed to investing in the mine, it might not be in Mexico at all.

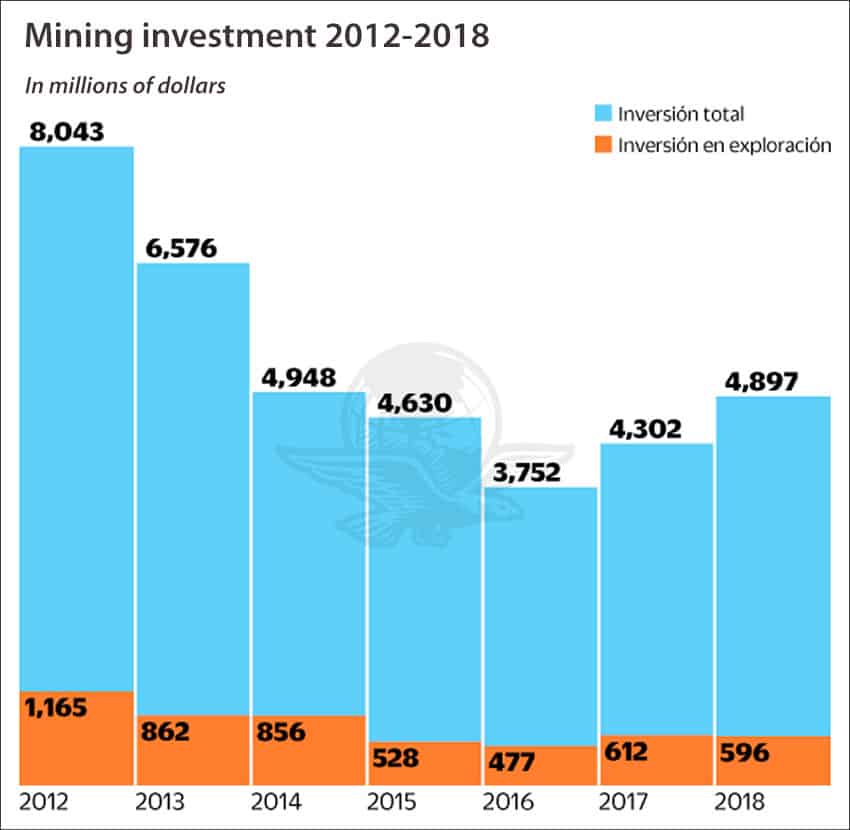

Francisco Quiroga, undersecretary for mining at the Economy Secretariat, rejected Stanford’s assertion that Mexico is no longer attractive for mining investment, although he did acknowledge that the country has lost some competitiveness.

“Mexico continues to be attractive and has enormous mining potential,” he said.

“Torex itself has very significant investment programs and has invested in places with a high level of complexity such as Guerrero,” Quiroga added.

“We’re working to improve the competitive position,” the official said, asserting that every problem the mining industry faces is being dealt with by the government.

Source: El Universal (sp)