By the end of the month, Mexicans will send millions of remittance payments home from the U.S., likely more than any other month this year. May is usually the month with the highest volume of remittances, even beating out December and the Christmas holidays, possibly due to the “Mother’s Day effect.”

A recent survey of 58 users of Zapp, a platform to send money via WhatsApp particularly targeting Mexican immigrants in the United States, revealed that about 67% of respondents make a special transfer to their mother on May 10, the day when Mother’s Day is celebrated in Mexico.

Zapp reported that, on average, users send $360 USD to their mothers on this day.

According to BBVA Research’s Migration and Remittances Observatory, remittances are often used for savings, everyday expenses, or for a celebration honoring mothers, aunts, sisters or grandmothers.

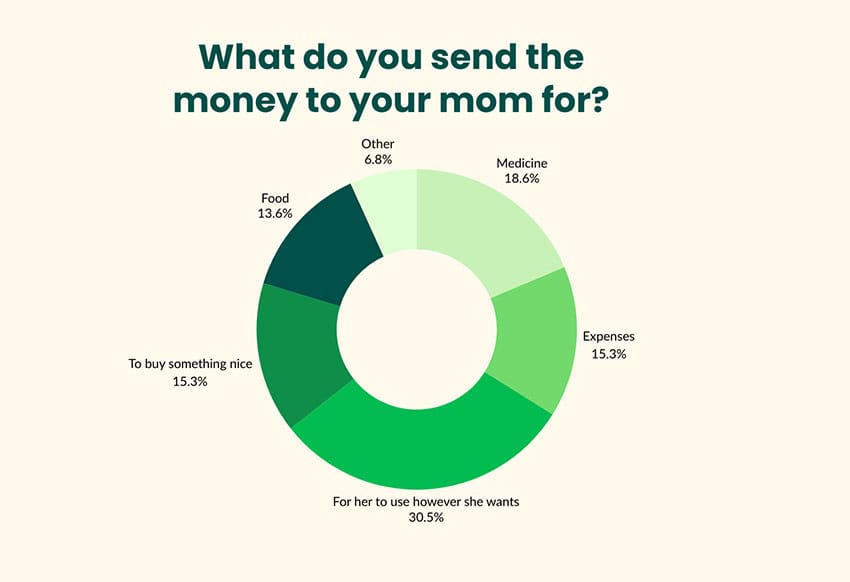

Meanwhile, Zapp’s survey found that 79% of respondents send money directly to their mothers, while the rest do so through other relatives including sisters (30%), children (30%), or deliver it in person (10%). About 31% said they send money so that they can spend it however they wish. Others say it’s for medicine (19%), food (13%), or simply to buy something nice (15%).

Between 2019 and 2023, the month of May saw 6.5% more remittances than the adjacent months of April and June, possibly explained by the Mother’s Day effect.

In May 2024, Mexico recorded 14.8 million remittance transactions, representing a 1.4% annual increase — its highest level ever. BBVA’s report suggests that the reduction in remittance costs observed in recent decades and a gradual increase in digital remittances through financial applications may be some of the factors driving this growth in transaction volume. Yet, the average remittance amount in 2024 was US $381, down 2.3% compared to the same month of 2023.

BBVA remittance specialists have also found that over the past 20 years, remittance transfers received during May have increased by an average of 14% compared to the rest of the year. In May 2020, remittances peaked by 18% attributed to concerns about Mexico’s health crisis during the COVID-19 pandemic.

Another survey by Visa showed that 42% of Mexican migrants who send remittances to the country do so electronically. The report dubbed “The Money Journey: Adopting Digital Remittances in 2024,” noted that seven out of 10 users of these digital money transfer platforms consider them to be a faster and more efficient payment method than traditional channels.

With reports from El Economista