Mexico’s largest mining company will invest US $815 million to build major new transmission lines for the Baja California peninsula, according to the firm’s vice chairman.

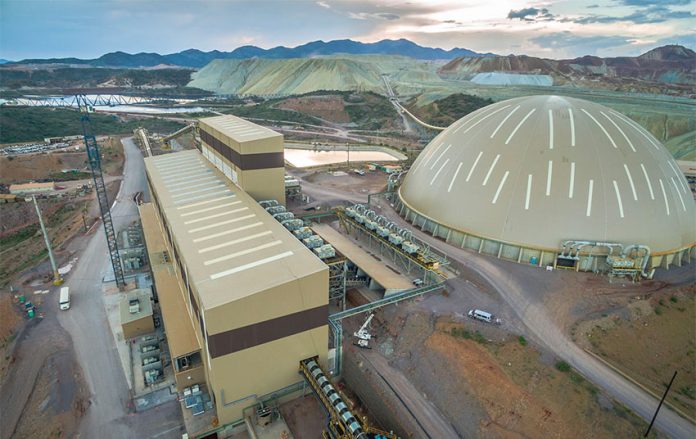

In an interview with the news agency Reuters, Xavier García de Quevedo of Grupo México revealed new investments totaling $3.1 billion over six years for metals refining in Sonora and power infrastructure for the proposed El Arco copper mine in the municipality of Mulegé, Baja California Sur.

The latter project is expected to bring cheaper electricity to the Baja peninsula, including the Los Cabos tourist area. Power costs in the region are higher than in many other parts of Mexico.

García de Quevedo said the energy plans would benefit the El Arco mine — slated to produce 190,000 tonnes of copper annually starting in 2027 — as well as domestic and commercial electricity customers in the southern part of the peninsula.

Grupo México’s proposed power infrastructure includes a 500-kilometer transmission line running north to south in Baja California Sur.

“Baja California’s huge potential can’t be developed without electricity,” García de Quevedo said, citing electricity rates he claimed are about three times higher than the national average.

The executive, a five-decade veteran of the company owned by Mexico’s second-richest person, Germán Larrea, declined to say where the power to feed the new transmission line would originate.

Reuters reported that Grupo México’s six-year investment blueprint also includes $2.3 billion to increase smelting capacity in Sonora, where the company has major mines. It said that García de Quevedo outlined almost $9 billion in investments through 2027, including a previously-announced $2.8 billion for the El Arco mine. Other resources will go to additional infrastructure, two other Grupo México mines and additional zinc refining capacity.

García de Quevedo played down suggestions that political factors could have an impact on the company’s investment plans, saying said they have already been discussed with senior officials in the federal government, which has not been a wholehearted supporter of mining.

“This is something that the government knows very well,” the vice chairman told Reuters, adding that while permits are needed for the company’s planned projects, no new mining concessions are required. “We all trust that we could have all the authorizations very soon.”

President López Obrador and his government, now 2 1/2 years into its six-year term, have been widely criticized by the mining industry for being too slow to issue permits and approvals, a pattern of tardiness attributed to budget cuts at the Environment Ministry. The government has also faced criticism for its policy of not issuing any new mining concessions, a position the president has trumpeted proudly.

Before López Obrador came to power, Larrea warned that as president, he could seek to implement policies that “represent a backward step of decades and a return to an economic model that has been thoroughly proven not to have worked in several countries.”

In addition to its lucrative mining interests, Grupo México — the world’s fifth-largest copper producer and Mexico’s third-biggest company by market capitalization – operates a major rail freight business in Mexico and transports refined products by both rail and pipeline for Pemex, the state-owned oil company.

It was also awarded a contract with Spanish conglomerate Acciona to build a section of the government’s Maya Train railroad project, which will link towns and cities in Mexico’s southeast.

While Larrea and López Obrador have been critical of each other in the past, Grupo México is now willing to work closely with his administration, according to García de Quevedo. “What we want is to be an ally of the government,” he said.

Source: Reuters (en)