The National Hydrocarbons Commission (CNH) has approved a revised Pemex plan to develop the once-abandoned Lakach deepwater natural gas project off the coast of Veracruz.

The oil sector regulator approved the proposed development at a public meeting on Monday that was chaired by new CNH chief Agustín Díaz Lastra.

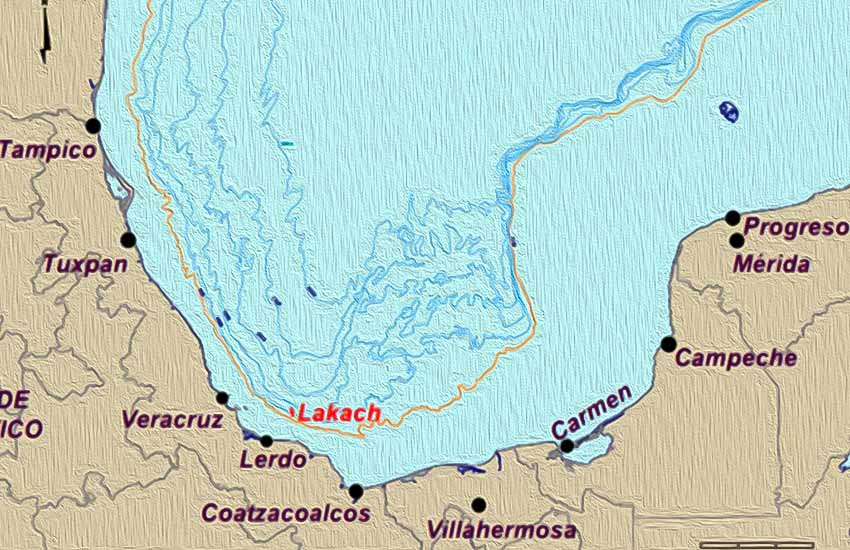

Located in the Gulf of Mexico about 90 kilometers southeast of the port city of Veracruz, the Lakach field is estimated to have gas reserves totaling as much as 937 billion cubic feet. High costs have been a barrier to development, but President López Obrador believes the field could be an important source of gas for Mexico.

The news agency Reuters reported that CNH officials raised questions about whether Pemex – which has debt in excess of US $100 billion – could shoulder the cost of the previously abandoned venture, but they all ultimately supported the project.

The state oil company intends to develop the field in conjunction with New Fortress Energy, a United States-based liquified natural gas company. The project approved by the CNH has a cost of US $1.79 billion.

Alma América Porres, one of the CNH officials, described the investment – and associated uncertainty – as “huge.” “It’s very important that we supervise this [project] very strictly, much more so than others,” she said.

One risk factor is that Pemex has little experience in deepwater projects. But Díaz – appointed as CNH chief by López Obrador last week – said he was optimistic about the Lakach project.

“This is fundamental for the production of gas,” said Díaz, who is a former Pemex official. “We should increasingly strive to use new technologies that allow us to develop deepwater fields,” he added.

Pemex previously proposed developing Lakach with New Fortress Energy via a service contract. Under such a contract, Pemex would retain full ownership of the gas field but bear the risk if prices fall, Reuters reported. The details of the new arrangement between Pemex and the U.S. company were not addressed at Monday’s public NHC session.

Meanwhile, the state oil company reported a net third-quarter loss of 52 billion pesos (US $2.6 billion) last Friday. In a filing to the Mexican Stock Exchange, Pemex said the higher cost of importing fuel was a factor in its negative result.

The company also lost money on the oil it refined. For every barrel it processed in the third quarter of 2022, Pemex lost US $7.37, its worst refining result since the first quarter of 2020. The negative refining margin followed per-barrel profits of $18.32 and $14.74 in the first and second quarters, respectively.

“This result is due to lower prices for crude and the increase in processing rates at refineries around the world combined with weak demand,” Pemex said.

Energy analyst Ramsés Pech said that operating and maintenance costs are very high at Mexican refineries, and that affects Pemex’s per-barrel results. He noted that some U.S. refineries make up to $30 profit per barrel.

Mexico’s refineries are operating at no more than 50% capacity, but running them is still costly, Pech said. “The [profit] margins fell [in the third quarter] due to the [high] cost of producing … [stemming from] the inefficiency of the refineries,” he said.

With reports from Reuters, Bloomberg and El Economista