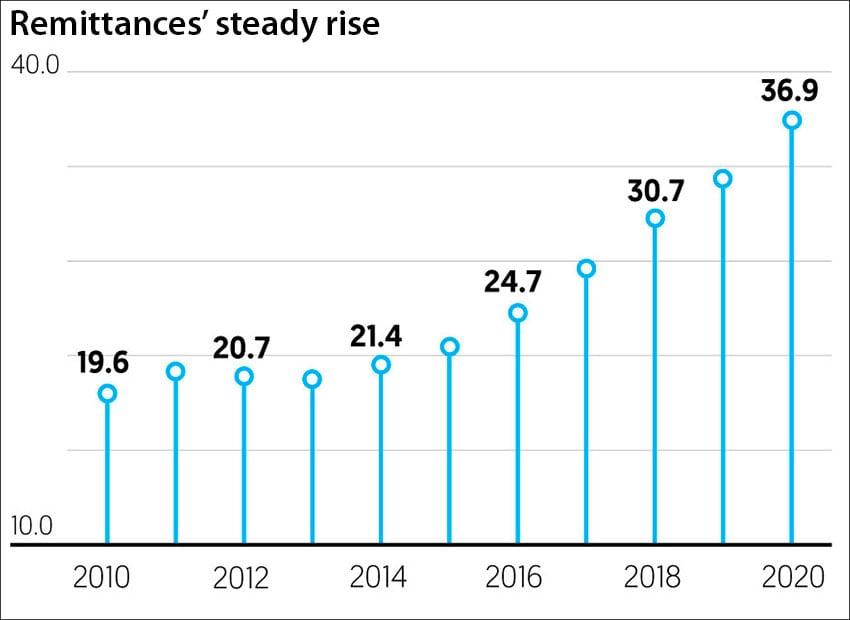

Remittances sent home by Mexicans working abroad increased 15.6% in November to US $3.38 billion, pushing the total for the first 11 months of 2020 to a record high of $36.95 billion, central bank data shows.

The amount sent to Mexico between January and November was 10.9% higher than total remittances received in the first 11 months of 2019. The January-November total exceeds that for all of 2019, during which a then-record high of just over $36 billion in remittances flowed into the country.

The payments reached record high levels in several months last year despite the heavy toll the coronavirus pandemic and associated restrictions took on the economy and employment in the United States, home to the vast majority of Mexicans working abroad.

Analysts cited a range of factors for the increase in November and other months of last year.

Goldman Sachs chief Latin America economist Alberto Ramos said that generous economic support in the United States amid the pandemic, a “very competitive” dollar-peso exchange rate and a “deep contraction” of the economy and employment in Mexico may have acted as driving forces for Mexicans abroad to send more money home.

Juan José Li Ng, senior economist with the bank BBVA, said that lockdown orders and restrictions on movement across the Mexico-United States border were a factor, explaining that many Mexican migrants sent money home electronically instead of delivering it directly to family members in cash.

He agreed that economic stimulus in the United States and a favorable exchange rate were also factors.

The chief of economic statistics at the Center for Latin American Monetary Studies, an association whose members are the region’s central banks, pointed to a recent employment recovery for Mexican workers in the United States.

“From May to November 2020, the level of employment of Mexican immigrants increased … by 1.13 million, 20.1% higher in relation to the level observed in April 2020,” Jesús Cervantes said.

Goldman Sachs’ Ramos said the strong remittances flows have helped boost both Mexico’s current account and private consumption, especially by members of low-income families, who are the primary recipients of money sent from abroad and tend to spend all or most of what they receive.

Alejandro Saldaña, chief economist at the financial company Ve Por Más, said that total remittances in 2020 may have exceeded $40 billion – the Bank of México will publish December data next month – and predicted that levels will remain high this year.

“It’s a positive element for some Mexican households that benefit from this additional income,” he said.

Marco Arias, an economic analyst at the Monex financial group, said the predicted $40 billion in remittances last year would represent 3.8% of Mexico’s GDP.

“We estimate that remittances in December amounted to $3.61 billion, with which the accumulated amount would go past $40 billion. This figure would mean a participation of 3.8% in the gross domestic product, which … [would be] a significant change given that their contribution is usually less than 3%,” he said.

Arias predicted that remittances would reach $43.5 billion in 2021, an increase of about 8% over last year’s projected total.

Li Ng agreed that total remittances in 2020 could represent 3.8% of GDP, which he said would be a record high and 0.9% above the 2019 level.

The BBVA economist noted in a report that about 12 million Mexican migrants live in the United States, and that 6.6 million of them have either U.S. citizenship or permanent residency.

Many of the remainder crossed into the United States without passing through official migration checkpoints. Such migrants commonly work in low-paid, cash-in-hand jobs but nevertheless send a significant portion of their salary home using money transfer services such as Western Union.

Source: El Financiero (sp)