On Monday, the Mexican peso lost its winning streak against the US dollar, in part due to the impasse in the U.S. Congress between Democrats and Republicans regarding the pandemic stimulus bill. The price of the dollar had risen slightly to 21.62 pesos at Citibanamex windows with the start of operations this week.

Predictions about the fate of the Mexican economy following the election are not optimistic either.

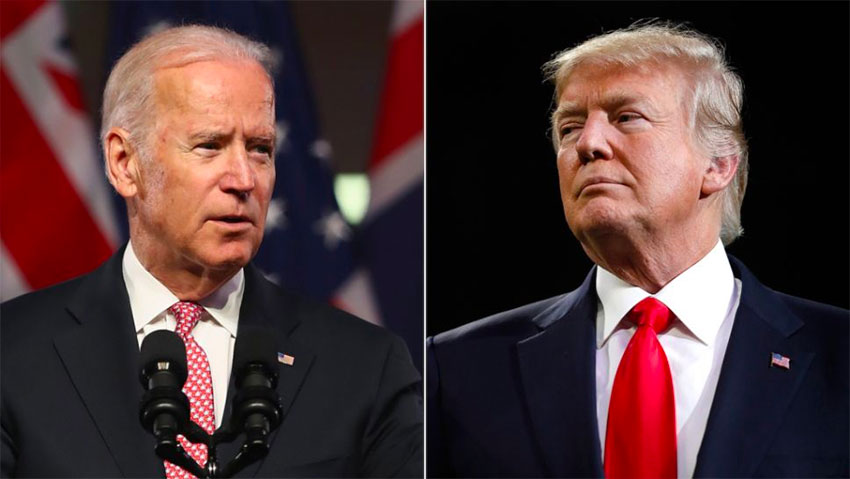

With Joe Biden polling ahead on most counts, the forecasted political stability following a victory for the Democrat challenger in November had contributed to the gradual rise of the peso in recent weeks. Other indicators of stability in the United States also have led to a healthier peso, including the improving condition of Republican incumbent President Trump after contracting Covid-19.

The trend linking greater political stability in the United States with a stronger peso and higher investor confidence can be traced back to the 2016 election.

However, the long-term effects of the election’s outcome on the Mexican economy are less clear, given both the political tumult in the United States, the scarcity of plans released by either candidate for relations with Mexico, and structural issues that continue to exist under Mexican President López Obrador’s administration.

A Biden presidency would signify a return to an “institutionalized” U.S.-Mexico bilateral relationship, said Duncan Wood, president of the Mexico Institute of the Wilson Center. Even though relations were good the past three years under Trump, Wood said, they were at the mercy of the U.S. president’s unpredictable mood swings.

“In bilateral politics and after so many trips to Mexico, Joe Biden wants to have a relationship of respect, dignity and collaboration on issues,” including tackling corruption and promoting transparency, said Roberta S. Jacobson, former U.S. ambassador to Mexico and senior advisor at the Albright Stonebridge Group.

Jacobson stepped down from her post at the State Department in 2018 amid heightening tensions between the U.S. and Mexico, caused in part by Trump’s pressure on then-president Enrique Peña Nieto to fund construction of the border wall.

Biden has also signalled support and a willingness not to politicize the U.S.-Mexico-Canada Agreement (USMCA), which entered into force on July 1. “What I’ve seen change is that the vast majority of the labor movement supported it,” Biden said in December. Even if he wanted to, he could not change the treaty’s terms during his presidency, since they can only be negotiated or modified every five years.

Some experts doubt whether Biden’s presidency would lead to better economic outcomes for Mexico. Gabriela Siller, director of economic and financial analysis at Banco BASE, warned that if Biden changed the existing pandemic stimulus packages, he “could slow down” the economic recovery in the United States and Mexico as a result. He could “hinder the entry of Mexican products” if he enforces pandemic-related sanitary restrictions for imported products, Siller added.

Moreover, Democratic vice presidential nominee Senator Kamala Harris has already shown opposition to the USMCA and could threaten its continuity if she gets elected into the White House.

Even though Trump’s reelection would pose risks to the Mexican economy as well, they would be lesser as they are “the order of the day,” said Siller.

Some analysts argue that the president has made strides in boosting Mexico’s economic growth during his first term. Larry Rubin, representative of the Republican Party in Mexico, said Trump has effectively modernized the North American Free Trade Agreement (NAFTA) through spearheading the passage of the USMCA. Within five years, the treaty will triple Mexico’s bilateral trade with the United States, which is currently estimated at US $600 billion.

Rubin added that USMCA-generated jobs in U.S. companies “will be established in Mexico,” echoing a similar event when NAFTA came into force in 1994.

Despite Trump’s protectionist trade policies, the participation of the U.S. market in Mexico’s GDP increased, said Ignacio Martínez, coordinator of the Laboratory of Commerce, Economy and Business (LACEN) of the National Autonomous University of México (UNAM). “The share of Mexican exports that are directed to the U.S. represent 36.37% of Mexico’s GDP,” under his administration “while with Obama they represented 31.12%,” Martínez added.

Yet with Trump’s unpredictability, another four years of his presidency opens up the possibility of more bargaining on trade through the use of non-trade issues as chips, he said. As this has happened with migration, “we will be seeing how this issue continues to be used, now in relation to organized crime or drug trafficking,” he said.

Uncertainty following the highly anticipated, polarized election would inevitably bring negative effects for Mexico, said Julio Alejandro Millán, president of economic consulting firm Consultores Internacionales. Regardless of whether Trump or Biden wins, “the economic effects are still difficult to estimate, and this uncertainty often has negative effects on investors’ decisions, which is not good news for Mexico’s economic growth.”

Luis Rubio, president of the Mexican Council of International Affairs (COMEXI) and México Evalúa, a think tank, told Mexico News Daily that there are “structural” issues on the Mexican side of the border that prevent growth in foreign investment and trade.

Progress regarding economic and security reforms — such as leveling the development disparities between northern and southern Mexico and improving the rule of law — has been “going backward” under the López Obrador administration.

And with exports as one of the country’s most important economic drivers, Rubio said the government is “not doing anything to attract” multinational companies during the U.S.-China trade war that has many U.S. manufacturers leaving China in search of new spots for their supply chains.

Columnist Antonio Rosas-Landa writes that López Obrador has also “put at risk” billions of dollars of foreign investment by U.S. companies in the production of wind and solar generation in favor of “outdated nationalism,” which would go against policies by Biden, who would prioritize supporting greater renewable energy on his foreign policy agenda.

Rodrigo Aguilar, international analyst and founder of The Northamerica Project, said that despite the projected success of the USMCA, “free trade policies between Mexico and the U.S. are “a necessary condition, but it is not enough for economic growth.“

So far, the U.S. presidential candidates have made few mentions of Mexico on the campaign trail. President López Obredor made it clear recently in a morning conference that he prefers it this way: “The candidates have been very respectful in their opinions about Mexico — nothing like the last election.”

Mexico News Daily