The Australian firm Woodside Energy Group announced Tuesday that it had approved a multibillion-dollar investment to develop a large Gulf of Mexico oil field it jointly owns with Mexico’s state-owned oil company Pemex.

Woodside, which has a 60% stake in the Trion oil field, said it would contribute US $4.8 billion to the project. The company said that the forecast total capital expenditure to develop the ultra deepwater field is $7.2 billion.

“The expected returns from the development exceed Woodside’s capital allocation framework targets and deliver enduring shareholder value. First oil is targeted for 2028,” Woodside said in a statement.

“The development is subject to joint venture approval and regulatory approval of the field development plan, expected in the fourth quarter of 2023.”

Woodside, Australia’s largest oil and gas producer, also said that development is expected to deliver “economic and social benefits to Mexico.”

The company said it is “aligned” with Mexico’s ambition to increase oil production and that over US $10 billion in cumulative taxes and royalties would flow into Mexican government coffers. Its investment “is expected to deliver an internal rate of return greater than 16% with a payback period of less than four years,” it said.

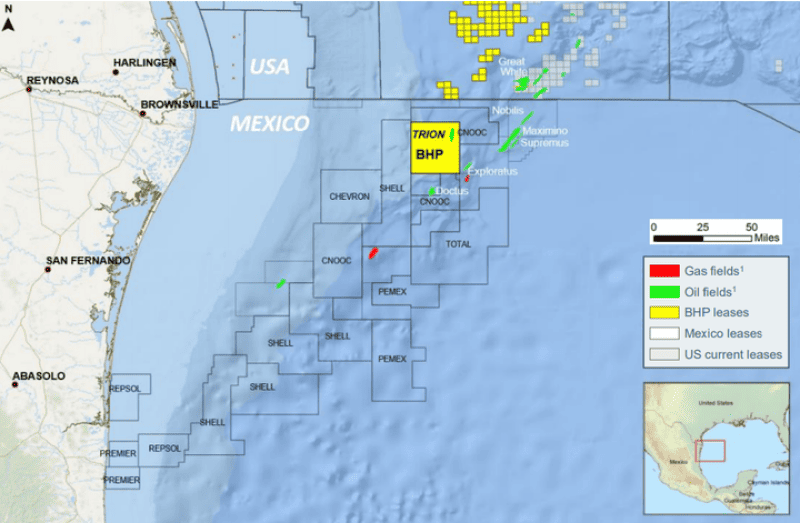

Trion, discovered by Pemex in 2012, contains an estimated 479 million barrels of oil and gas equivalent. It is located at a depth of 2,500 meters about 180 kilometers off the Gulf of Mexico coast and 30 kilometers south of the Mexico-United States maritime border.

“The subsurface has been extensively appraised, with six well penetrations undertaken across the field, informing Woodside’s understanding of this large, high-quality conventional resource,” Woodside said.

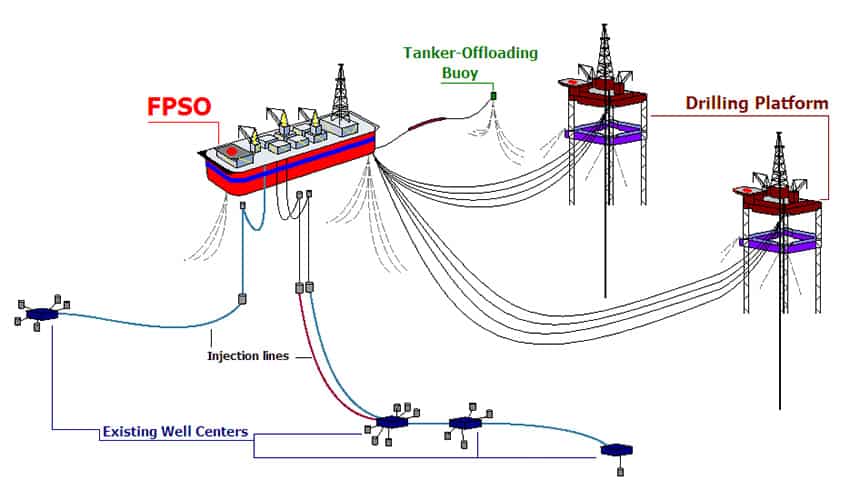

“The resource will be developed through a floating production unit (FPU) with an oil production capacity of 100,000 barrels per day. The FPU will be connected to a floating storage and offloading vessel with a capacity of 950,000 barrels of oil.”

Woodside’s $4.8 billion outlay is the company’s first major investment since its merger last year with the petroleum division of the Melbourne-based company BHP Group, from which it inherited the majority interest in Trion. BHP acquired the 60% stake in Trion in 2017 during former president Enrique Peña Nieto’s administration.

Woodside, which has been a frequent target of criticism from environmental activists, said that its “greenhouse gas emissions reduction targets remain unchanged by the decision to approve investment in Trion.”

CEO Meg O’Neil said that the company has “considered a range of oil demand forecasts and believe Trion can help satisfy the world’s energy requirements.”

“Two-thirds of the Trion resource is expected to be produced within the first 10 years after start-up. We are developing Trion because we believe it will deliver value for Woodside shareholders and benefit for Mexico, including generation of jobs, taxation revenue and social benefit.

“We value the ongoing relationship with Pemex and the support of the Mexican Government and regulators,” she said.

Another major Gulf of Mexico oil field to be jointly developed by Pemex is the Zama field, which is believed to hold some 700 million barrels of oil.

Also participating in the Zama project — in which oil production is not expected before 2026 — are United States company Talos Energy, Germany’s Wintershall DEA, United Kingdom firm Harbour Energy and Mexico’s Grupo Carso, the latter of which announced it was on track to acquire nearly a 49.9% stake in Talos México.