After foreign direct investment hit a record high earlier this year, Mexican authorities celebrated. Additional data now shows that a growing portion of those funds are new investment, rather than established companies reinvesting profits — a promising sign for Mexico’s economy.

The “new” investment component of Mexico’s record first quarter FDI increased by an encouraging 165% compared to the first three months of last year, the Economy Ministry (SE) reported.

Economy Minister Marcelo Ebrard reported last Thursday that FDI in Mexico totaled a record high US $21.4 billion in the first quarter of the year, an annual increase of over 5%, but he didn’t provide details such as where the money came from and which sectors in Mexico the investment went to.

Ebrard didn’t reveal how much of the first quarter FDI was new investment either, only saying that the increase in foreign investment meant that Mexico received “more reinvestment and more capital … through all avenues.”

The SE and the Bank of Mexico (Banxico) subsequently published additional data on first quarter FDI.

New investment data is widely considered to be an important gauge on how well Mexico is doing in capitalizing on what has been described as a “once-in-a-lifetime” opportunity to attract foreign investment amid the nearshoring trend as it shows how much fresh capital foreign companies — including ones with no previous presence in Mexico — are bringing into the country.

In 2024, new foreign direct investment totaled $3.17 billion, accounting for just 8.6% of total FDI in Mexico, down from 13% in 2023.

Reinvestment of profits by foreign companies with an existing presence in Mexico contributed $28.71 billion to FDI in Mexico in 2024, accounting for 77.9% of the total.

The remainder of the record high $36.87 billion in FDI last year — 13.5% — came from loans and payments between companies of the same corporate group.

New investment more than doubled compared to Q1 2024, but was still a small percentage of total FDI

Banxico data shows that FDI in Mexico totaled $21.37 billion in the first quarter of 2025, up from $20.13 billion in the same period of last year.

A total of $1.58 billion in new investment flowed into the country between January and March, representing an increase of 165% compared to the first quarter of 2024.

Thus, new investment accounted for 7.4% of total FDI in Mexico in the first quarter of 2025. While this percentage is more than double the 3% contribution new investment made to FDI in the first quarter of last year, it is still low — and below the new investment proportion of FDI across 2024.

Alfredo Coutiño, director for Latin America at Moody’s Analytics, noted that even with the 165% year-over-year increase, new investment still only makes up a small proportion of total FDI.

“The arrival of new FDI continues to be very poor,” he said.

For its part, the Economy Ministry focused on what it called a “significant recovery in new investment” in the first quarter of the year.

“In an international context that presents challenges to attract investment, economic stability, a good business environment, competitive advantages and the legal certainty that trade and investment agreements provide have allowed Mexico to remain as one of the preferred investment destinations at an international level,” the SE said.

Much of the first quarter FDI in Mexico was made and/or planned before the full extent of United States President Donald Trump’s early-second-term protectionist agenda was known.

It remains to be seen what impact Trump’s on-again, off-again tariffs will have on FDI in Mexico in the second quarter of the year and across 2025.

Lion’s share of Q1 FDI was reinvestment of profits

Of the $21.37 billion in FDI in Mexico in the first quarter, $16.64 billion — 77.9% of the total — was reinvestment of profits by foreign companies with an existing presence in Mexico. This investment, which declined 15% on a year-over-year basis, indicates that companies that already have experience operating in Mexico have sufficient confidence to continue investing in the country, despite the various challenges they face.

At $3.14 billion, loans and payments between companies represented 14.7% of total first quarter FDI in Mexico. This component of FDI increased a whopping 3,086% increase compared to the first quarter of 2024.

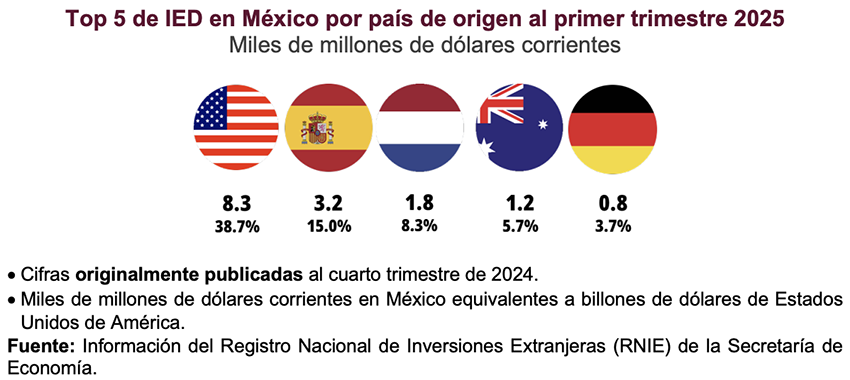

US remained the top foreign investor in Mexico

The Economy Ministry reported that 38.7% of first quarter FDI in Mexico — around $8.3 billion — came from the United States. The United States’ percentage of FDI and its total investment amount are down from 52% and $10.61 billion in the first quarter of 2024.

The next biggest sources of foreign investment in Mexico in the first three months of the year were:

- Spain: $3.2 billion, representing 15% of the total.

- Netherlands: $1.8 billion, representing 8.3% of the total.

- Australia: $1.2 billion, representing 5.7% of the total.

- Germany: $800 million, representing 3.7% of the total.

The SE said that 42.4% of total first quarter FDI came from the United States and Canada, “showing the strength of economic relations in the USMCA region, and the interdependence of trilateral economic growth.”

More than 80% of FDI went to just 5 states

The Economy Ministry reported that 83.9% of first quarter FDI went to just five federal entities, of which Mexico City received the highest proportion.

- Mexico City received $11.8 billion, representing 55% of Mexico’s first quarter FDI total.

- Nuevo León received $2.7 billion, representing 13% of the total.

- México state received $1.9 billion, representing 9% of the total.

- Baja California received $900 million, representing 4% of the total.

- Guanajuato received $700 million, representing 3% of the total.

More than 40% of FDI went to the manufacturing sector

The SE reported that Mexico’s vast manufacturing sector received $9.2 billion in FDI in the first quarter of the year. That figure represents 43% of total FDI in Mexico between January and March. The dollar amount is 8.2% higher compared to the first quarter of 2024, while the manufacturing sector’s share of total FDI was one percentage point higher than a year earlier.

The SE said that “automotive sector trends” — “specifically” those related to “electric transport,” as well as electronics and electricity generation trends, could lead to “greater” investment in Mexico moving forward. It noted that those sectors are “supported” by the federal government’s “Plan México” economic initiative.

After manufacturing, the sectors that received the most FDI in the first quarter of 2025 were:

- Financial services: $5.2 billion, representing 24% of the total.

- Mining: $2.2 billion, representing 10% of the total.

- Commercial (including retail): $1.3 billion, representing 6% of the total.

- Construction: $700 million, representing 3% of the total.

Mexico News Daily

Great data! Thanks for staying on top of this

The future prosperity of Mexico is of great interest. I want to see it prosper & develop..

Mexico in my home, & what happens here means a lot to me.

Consequently keep detailed articles with solid data coming.

The benefits of foreign investments go to foreigners no Mexico. Mexican labor and resources are exploited and then the profits are sent to foreign owners.

There’s really nothing wrong with profits returning to the country and owners of the company of origin. That so much money is spent in capital expenditures in Mexico, in wages to her people, the basic economic components are wonderful for the just country. Profits are a small percent of the total where all have the opportunity to benefit