President Andrés Manuel López Obrador on Friday described the Bank of Mexico’s decision to cut its benchmark interest rate as a “daring” move and expressed satisfaction that the Mexican peso didn’t depreciate as a result.

The central bank announced on Thursday that its board had voted to reduce the key interest rate by 25 basis points to 11% from a record-high 11.25%. It was the bank’s first interest rate cut in more than three years.

López Obrador described the 25-basis-point cut as “very small,” but nevertheless called the decision to reduce rates “daring” because the United States Federal Reserve has kept its benchmark rate unchanged at 5.25%-5.5% since last July.

“It was daring move because they don’t want to move rates in the United States,” he told reporters at his morning press conference.

The Bank of Mexico (Banxico) board holds its regular monetary policy meetings shortly after those of the Fed and has often followed the lead of the U.S. central bank.

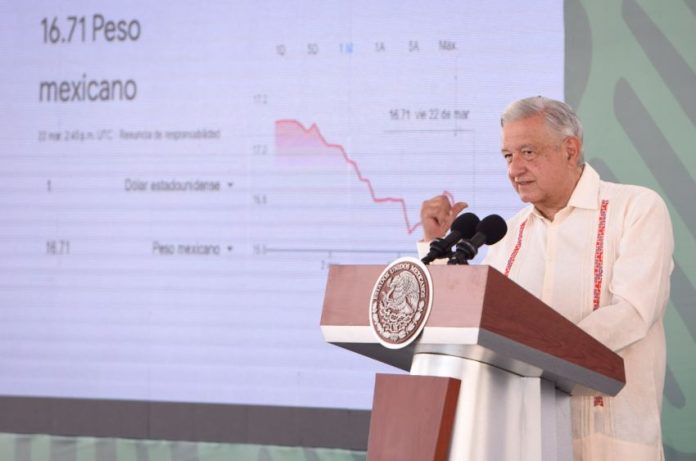

López Obrador said that the rate cut in Mexico “could” have caused a depreciation of the peso against the US dollar, but — with the USD:MXN exchange rate projected onto a screen behind him — happily declared that “nothing happened.”

“Nothing. It didn’t move,” he said, displaying a rate of 16.71 pesos to the greenback.

The peso has benefited from the wide difference between the official interest rates in Mexico and the United States, and many analysts predicted that the currency would weaken if that margin decreased as a result of an interest rate cut by Banxico.

López Obrador asserted that the reduction in interest rates would spur investment in Mexico, saying that while the size of the cut was only small it would still encourage business people to invest.

“And it also helps us, all Mexicans, … because 70% of the debt contracted by Mexico is in pesos,” he said, explaining that repayments would decline as a result of the interest rate cut.

“So it was a good decision [to cut rates],” López Obrador said.

“It didn’t affect [the peso], there’s no need to buy dollars. … The peso is strong, very strong [and so is] the economy in general,” he said.

Mexico News Daily