What share of Chinese investment in North America did Mexico receive between 2016 and 2023? Five percent? Ten percent? Twenty percent?

Not even close, according to Mexico’s Economy Minister Marcelo Ebrard.

He told reporters on Tuesday that in the eight-year period from 2016 to 2023, Mexico received just four-tenths of a percent (0.4%) of the total Chinese investment in North America.

The United States received 68.1% of that total while Canada got 31.5%, Ebrard said.

The economy minister’s data was based on numbers he presented showing that foreign direct investment (FDI) by Chinese companies in North America was just under US $395.4 billion in that period.

Mexico got $1.68 billion of that amount. The United States received $269 billion of it, and Canada got $124.64 billion, according to Ebrard’s data.

Ebrard pointed out that this means that Chinese investment in the U.S. was 160 times higher than economic inflows to Mexico over the past eight years.

His press conference on Tuesday came after Alberta Premier Danielle Smith was critical of Mexico for “inviting China to engage in investment in Mexico,” and Ontario Premier Doug Ford accused Mexico of becoming “a backdoor for Chinese cars, auto parts and other products into Canadian and American markets.”

Chinese investment in the U.S. was 160 times higher than economic inflows to Mexico.

Both premiers believe that Canada should look at entering into a bilateral trade agreement with the United States rather than seeking an extension of the USMCA, the current trilateral trade deal that includes Mexico.

Ebrard called on the Canadian leaders to “review the data” on Chinese investment in North America.

“What are they talking about?” he said.

“… We have to avoid getting confused, I already sent them the data,” Ebrard said.

The economy minister said there are other officials, lawmakers and business leaders in both the United States and Canada who are questioning Chinese investment in Mexico without foundation.

He highlighted that some of those people have accused China of using Mexico as a “springboard” to get Chinese products into other parts of the North American market, namely the U.S. and Canada.

United States President-elect Donald Trump said last month that he would “seek strong new protections against transshipment” in a renegotiated USMCA “so that China and other countries cannot smuggle their products and auto parts into the United States tax-free through Mexico to the detriment of our workers and our supply chains.”

Premier Ford said last week that “if Mexico won’t fight transshipment by, at the very least, matching Canadian and American tariffs on Chinese imports, they shouldn’t have a seat at the [North American trade] table.”

Ebrard said he will dispatch some letters – to exactly whom he did not say – to refute accusations that Mexico is a transshipment hub for Chinese goods. He expressed confidence that trade-related points of contention between Mexico, the United States and Canada will be resolved during the USMCA review process, which will formally commence in 2026.

Ebrard said that the Mexican government does not believe it will be in a position of weakness when the USMCA review takes place, or during the early days of the second Trump administration.

“We’ve been preparing for the first meeting with Trump for months,” he said the same day that the incoming U.S. president announced that billionaire businessman Howard Lutnick was his pick for U.S. secretary of commerce and that he would “lead our tariff and trade agenda.”

“Our negotiating power is relevant,” said Ebrard, who regularly emphasizes that Mexico and the United States are each other’s largest trading partners.

“Any action that places the [Mexico-U.S.] relationship at risk results in impacts on thousands of companies,” he said, noting that many major U.S. firms have a presence in Mexico.

The economy minister also said that Mexico’s trade and investment relationship with China won’t be an impediment to a successful USCMA review.

Indeed, Mexico is taking steps to reduce its reliance on imports from China, and could increase tariffs on Chinese products, such as electric vehicles, to match the duties imposed by its northern neighbors.

Ebrard said last month that Mexico would “mobilize all legitimate interests in favor of North America” amid the ongoing United States-China trade war that could escalate once Trump is back in the White House.

However, he said last week that Mexico would impose retaliatory tariffs on imports from the United States if the incoming Trump administration slaps tariffs on Mexican exports.

Is Ebrard’s data on Chinese investment accurate?

Ebrard on Tuesday presented Economy Ministry (SE) data on Chinese investment in Mexico over the past eight years, but there are claims that the ministry’s data is not accurate.

As Mexico News Daily reported in late 2023, it appears that not all Chinese money that flows into Mexico is counted as such.

The reason, according to Enrique Dussel Peters, an economist and coordinator of the Center for Chinese-Mexican Studies (Cechimex) at the National Autonomous University, is that some Chinese investment comes into Mexico via United States subsidiaries of Chinese companies.

The foreign direct investment inflow is thus recorded as coming from the United States, when the money came from China.

According to Cechimex, Chinese investment in Mexico between 2001 and late 2022 totaled $17 billion, more than six times higher than the amount recorded by the SE between 1999 and March 2024.

The establishment of joint ventures between Chinese and Mexican companies can also skew Chinese FDI figures in Mexico.

Past Chinese investment in Mexico is one thing, future investment is another

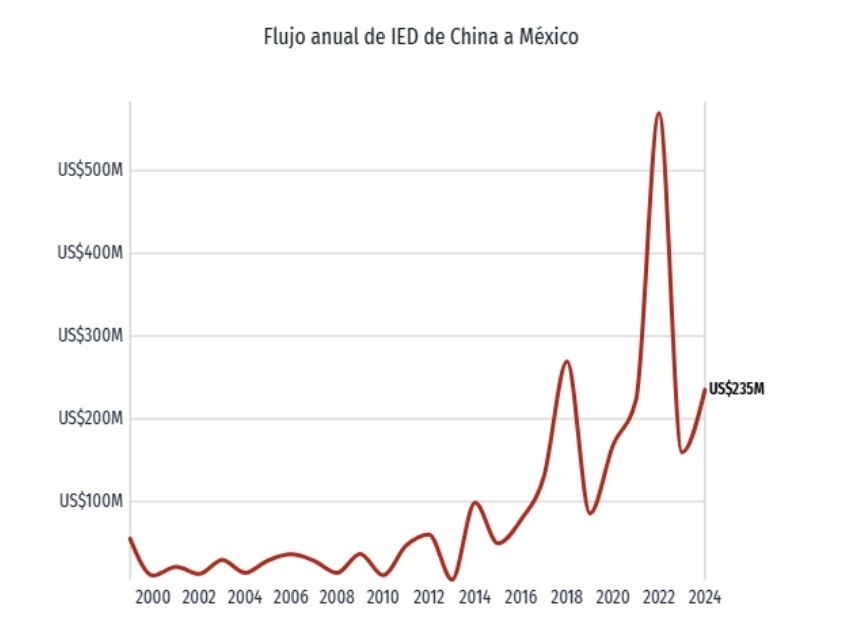

SE data shows that Chinese investment in Mexico has increased significantly in recent years, peaking in 2022 at $569.7 million.

While the increase in Chinese investment that has already flowed into Mexico is a worry for some politicians and officials in the United States and Canada, an even bigger concern is the Chinese money that could come into the country in the coming years.

Trump, for example, is particularly concerned about Chinese automakers opening plants in Mexico, prompting him to first threaten to impose 100% tariffs on cars made here by Chinese companies and later threaten to slap even heftier tariffs on all vehicles manufactured in Mexico.

“Those big monster car manufacturing plants you are building in Mexico right now and you think you are going to … not hire Americans and you’re going to sell the car to us – no. We are going to put a 100% tariff on every car that comes across the lot,” he said in March.

Leading electric vehicle manufacturer BYD and Jaecoo are among the Chinese automakers that have announced plans to open plants in Mexico, but there is no absolute certainty that they will follow through. BYD Americas CEO Stella Li said earlier this year that the company’s plan is to “build the facility for the Mexican market, not for the export market.”

A number of lawmakers in the United States are concerned about national security risks associated with the capacity of Chinese connected vehicles to collect sensitive data. A group of Democratic Party lawmakers wrote to Claudia Sheinbaum just before she was sworn in as president to request that her government take steps to address challenges related to the sale and manufacture in Mexico of vehicles made by Chinese companies and those firms’ potential plans to use Mexico as a base to enter the U.S. market.

If most Chinese companies that have made investment announcements for Mexico – there is a significant number that have done so – do act on their plans, the amount of Chinese money flowing into the country could increase significantly in the near future.

Mexico’s ongoing openness to that investment – the United States has reportedly pressured Mexico to be less welcoming – and the broader trade environment in North America could be factors that influence, or determine, Chinese companies’ willingness to invest here.

Almost a year ago, Mexico and the United States agreed to cooperate on foreign investment screening as a measure to better protect the national security of both countries. That agreement appeared to be motivated to a large degree by a desire to stop problematic Chinese investment in Mexico

From Mexico’s perspective, there are some important questions to consider.

Is Chinese investment a blessing, a curse or both?

Should Mexico continue welcoming all Chinese companies, including automakers, in pursuit of investment-related benefits such as job creation and higher economic growth?

Or should it be very selective in the Chinese investment it accepts in order to avoid upsetting its North American trade partners?

These are open questions.

With reports from El Economista, La Jornada and Milenio